Silicon Valley Bank Results Presentation Deck

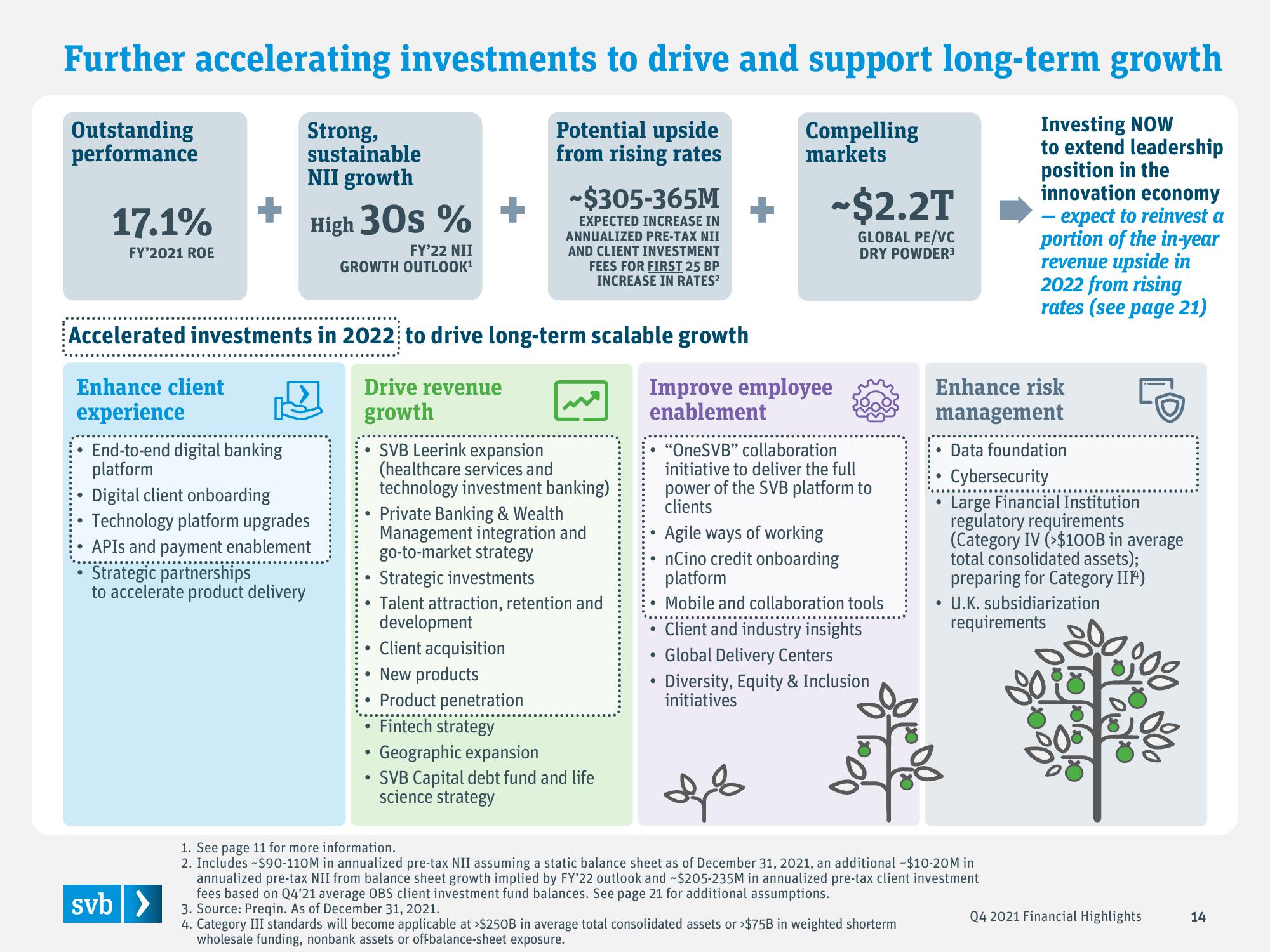

Further accelerating investments to drive and support long-term growth

Outstanding

performance

Potential upside

from rising rates

Investing NOW

to extend leadership

position in the

innovation economy

- expect to reinvest a

portion of the in-year

revenue upside in

2022 from rising

rates (see page 21)

17.1% +

FY'2021 ROE

Strong,

sustainable

NII growth

High 30s %

End-to-end digital banking

platform

Digital client onboarding

Technology platform upgrades

APIs and payment enablement

Strategic partnerships

to accelerate product delivery

svb >

FY'22 NII

GROWTH OUTLOOK¹

+

Accelerated investments in 2022 to drive long-term scalable growth

Enhance client

experience

Drive revenue

growth

SVB Leerink expansion

(healthcare services and

technology investment banking)

Private Banking & Wealth

Management integration and

go-to-market strategy

Strategic investments

Talent attraction, retention and

development

Client acquisition

New products

-$305-365M

EXPECTED INCREASE IN

ANNUALIZED PRE-TAX NII

AND CLIENT INVESTMENT

FEES FOR FIRST 25 BP

INCREASE IN RATES²

Product penetration

• Fintech strategy

• Geographic expansion

• SVB Capital debt fund and life

science strategy

+

Compelling

markets

.

~$2.2T

GLOBAL PE/VC

DRY POWDER³

Improve employee

enablement

"OneSVB" collaboration

initiative to deliver the full

power of the SVB platform to

clients

Agile ways of working

nCino credit onboarding

platform

• Mobile and collaboration tools

Client and industry insights

Global Delivery Centers

• Diversity, Equity & Inclusion

initiatives

Enhance risk

management

%%

4. Category III standards will become applicable at >$250B in average total consolidated assets or ›$75B in weighted shorterm

wholesale funding, nonbank assets or offbalance-sheet exposure.

●

●

ofă

1. See page 11 for more information.

2. Includes $90-110M in annualized pre-tax NII assuming a static balance sheet as of December 31, 2021, an additional ~$10-20M in

annualized pre-tax NII from balance sheet growth implied by FY'22 outlook and ~$205-235M in annualized pre-tax client investment

fees based on Q4'21 average OBS client investment fund balances. See page 21 for additional assumptions.

3. Source: Preqin. As of December 31, 2021.

Data foundation

Cybersecurity

Large Financial Institution

regulatory requirements

(Category IV (>$100B in average

total consolidated assets);

preparing for Category III)

U.K. subsidiarization

requirements

O

108

B

Q4 2021 Financial Highlights

14View entire presentation