Silicon Valley Bank Results Presentation Deck

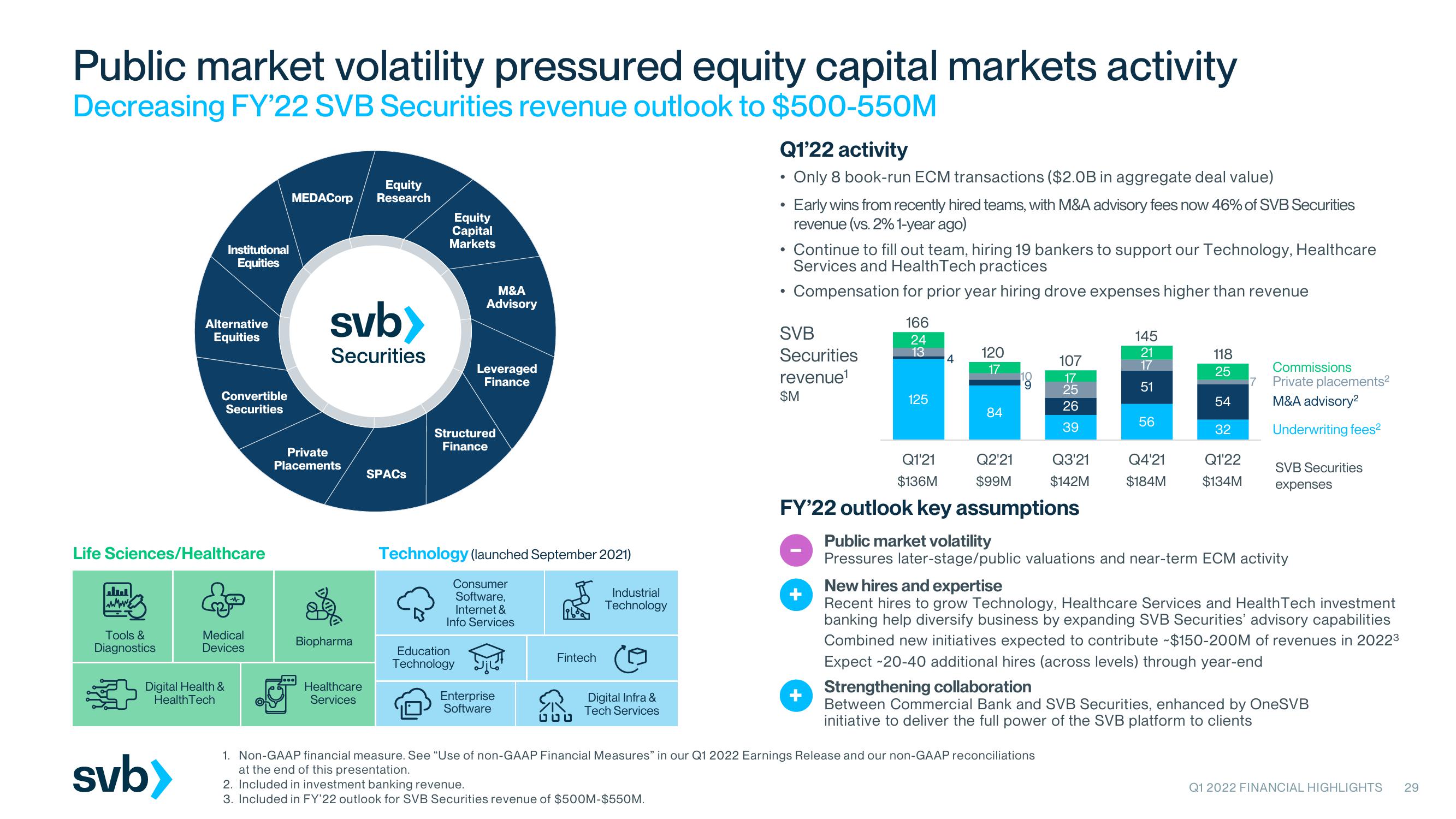

Public market volatility pressured equity capital markets activity

Decreasing FY'22 SVB Securities revenue outlook to $500-550M

IMME

Tools &

Diagnostics

Institutional

Equities

Alternative

Equities

Life Sciences/Healthcare

svb>

Convertible

Securities

Digital Health &

Health Tech

Medical

Devices

Equity

MEDACorp Research

svb>

Securities

Private

Placements

Biopharma

Healthcare

Services

SPACS

Equity

Capital

Markets

M&A

Advisory

Leveraged

Finance

Structured

Finance

Technology (launched September 2021)

Education

Technology

Consumer

Software,

Internet &

Info Services

Enterprise

Software

Levering

Fintech

Industrial

Technology

Digital Infra &

Tech Services

Q1'22 activity

Only 8 book-run ECM transactions ($2.0B in aggregate deal value)

●

Early wins from recently hired teams, with M&A advisory fees now 46% of SVB Securities

revenue (vs. 2% 1-year ago)

• Continue to fill out team, hiring 19 bankers to support our Technology, Healthcare

Services and Health Tech practices

Compensation for prior year hiring drove expenses higher than revenue

●

SVB

Securities

revenue¹

$M

166

24

13

125

4

120

17

84

19

Q2'21

$99M

Q1'21

$136M

FY'22 outlook key assumptions

107

17

25

26

39

Q3'21

$142M

145

21

17

51

1. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q1 2022 Earnings Release and our non-GAAP reconciliations

at the end of this presentation.

2. Included in investment banking revenue.

3. Included in FY'22 outlook for SVB Securities revenue of $500M-$550M.

56

Q4'21

$184M

118

25

54

32

Q1'22

$134M

7

Commissions

Private placements²

M&A advisory²

Underwriting fees²

SVB Securities

expenses

Public market volatility

Pressures later-stage/public valuations and near-term ECM activity

New hires and expertise

Recent hires to grow Technology, Healthcare Services and Health Tech investment

banking help diversify business by expanding SVB Securities' advisory capabilities

Combined new initiatives expected to contribute -$150-200M of revenues in 2022³

Expect -20-40 additional hires (across levels) through year-end

Strengthening collaboration

Between Commercial Bank and SVB Securities, enhanced by OneSVB

initiative to deliver the full power of the SVB platform to clients

Q1 2022 FINANCIAL HIGHLIGHTS 29View entire presentation