Silicon Valley Bank Results Presentation Deck

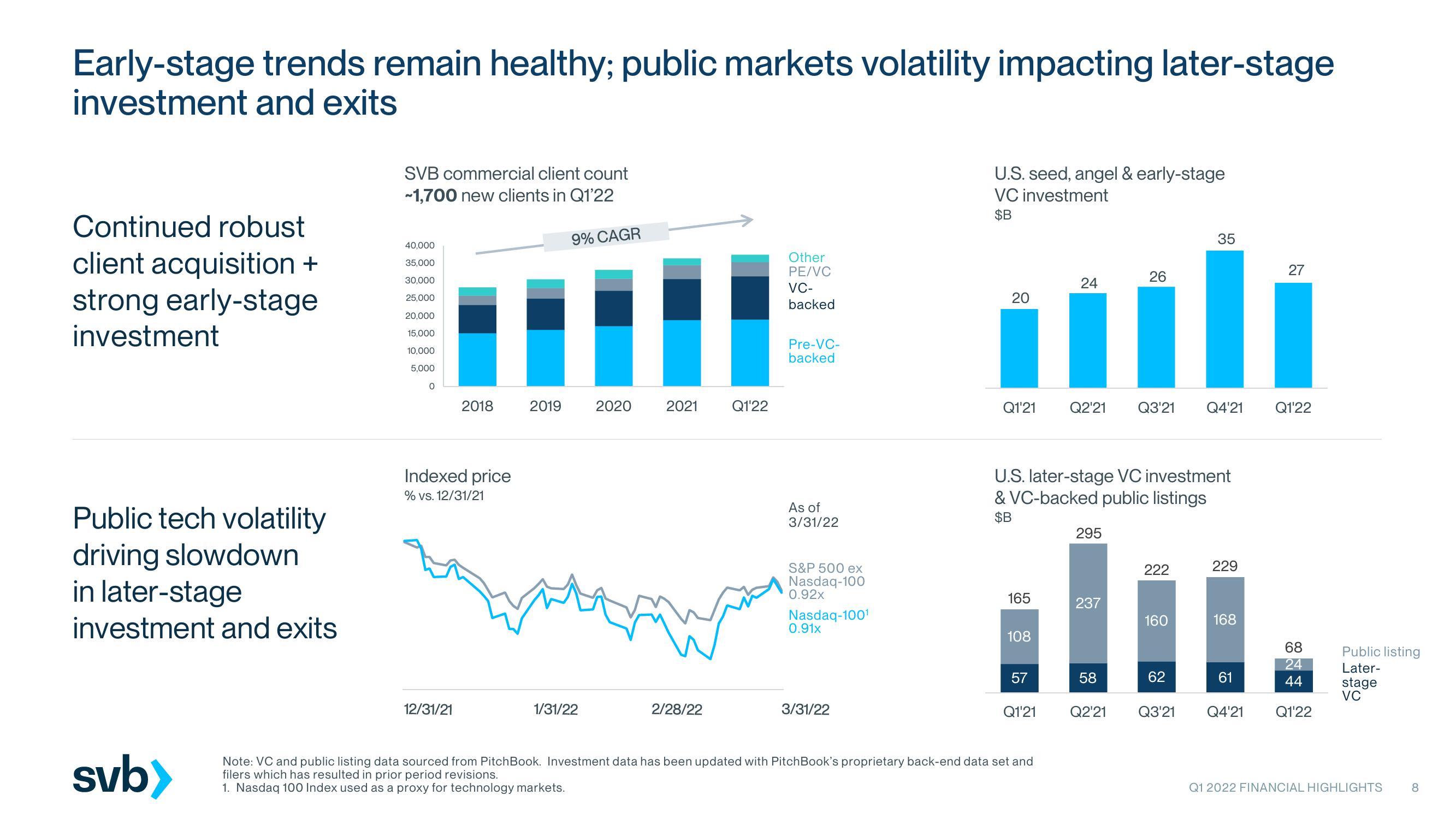

Early-stage trends remain healthy; public markets volatility impacting later-stage

investment and exits

Continued robust

client acquisition +

strong early-stage

investment

Public tech volatility

driving slowdown

in later-stage

investment and exits

svb>

SVB commercial client count

~1,700 new clients in Q1'22

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

0

2018

Indexed pri

% vs. 12/31/21

12/31/21

2019

9% CAGR

1/31/22

2020

2021

2/28/22

Q1'22

Other

PE/VC

VC-

backed

Pre-VC-

backed

As of

3/31/22

S&P 500 ex

Nasdaq-100

0.92x

Nasdaq-100¹

0.91x

3/31/22

U.S. seed, angel & early-stage

VC investment

$B

20

Q1'21

165

108

57

U.S. later-stage VC investment

& VC-backed public listings

$B

Q1'21

24

Note: VC and public listing data sourced from Pitch Book. Investment data has been updated with PitchBook's proprietary back-end data set and

filers which has resulted in prior period revisions.

1. Nasdaq 100 Index used as a proxy for technology markets.

Q2'21 Q3'21 Q4'21

295

237

26

58

Q2'21

222

160

35

62

Q3'21

229

168

27

61

Q1'22

68

24

44

Q4'21 Q1'22

Public listing

Later-

stage

VC

Q1 2022 FINANCIAL HIGHLIGHTS

8View entire presentation