Silicon Valley Bank Results Presentation Deck

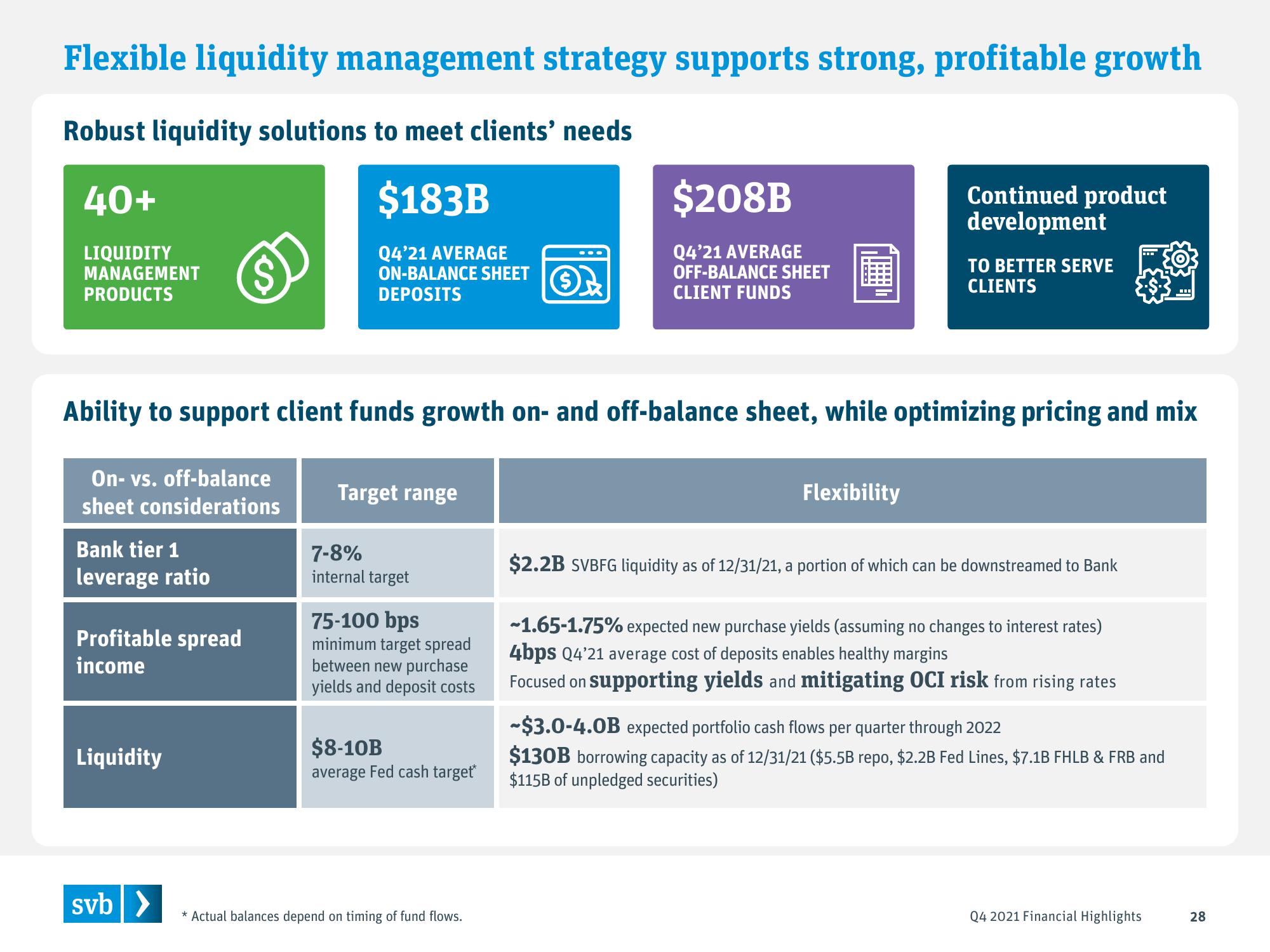

Flexible liquidity management strategy supports strong, profitable growth

Robust liquidity solutions to meet clients' needs

$183B

Q4'21 AVERAGE

ON-BALANCE SHEET

DEPOSITS

40+

LIQUIDITY

MANAGEMENT

PRODUCTS

On- vs. off-balance

sheet considerations

Bank tier 1

leverage ratio

Profitable spread

income

Ability to support client funds growth on- and off-balance sheet, while optimizing pricing and mix

Liquidity

svb >

Target range

7-8%

internal target

75-100 bps

minimum target spread

between new purchase

yields and deposit costs

$8-10B

average Fed cash target*

3

* Actual balances depend on timing of fund flows.

$208B

Q4'21 AVERAGE

OFF-BALANCE SHEET

CLIENT FUNDS

Continued product

development

Flexibility

TO BETTER SERVE

CLIENTS

$2.2B SVBFG liquidity as of 12/31/21, a portion of which can be downstreamed to Bank

-1.65-1.75% expected new purchase yields (assuming no changes to interest rates)

4bps Q4'21 average cost of deposits enables healthy margins

Focused on supporting yields and mitigating OCI risk from rising rates

-$3.0-4.0B expected portfolio cash flows per quarter through 2022

$130B borrowing capacity as of 12/31/21 ($5.5B repo, $2.2B Fed Lines, $7.1B FHLB & FRB and

$115B of unpledged securities)

Q4 2021 Financial Highlights

28View entire presentation