Silicon Valley Bank Results Presentation Deck

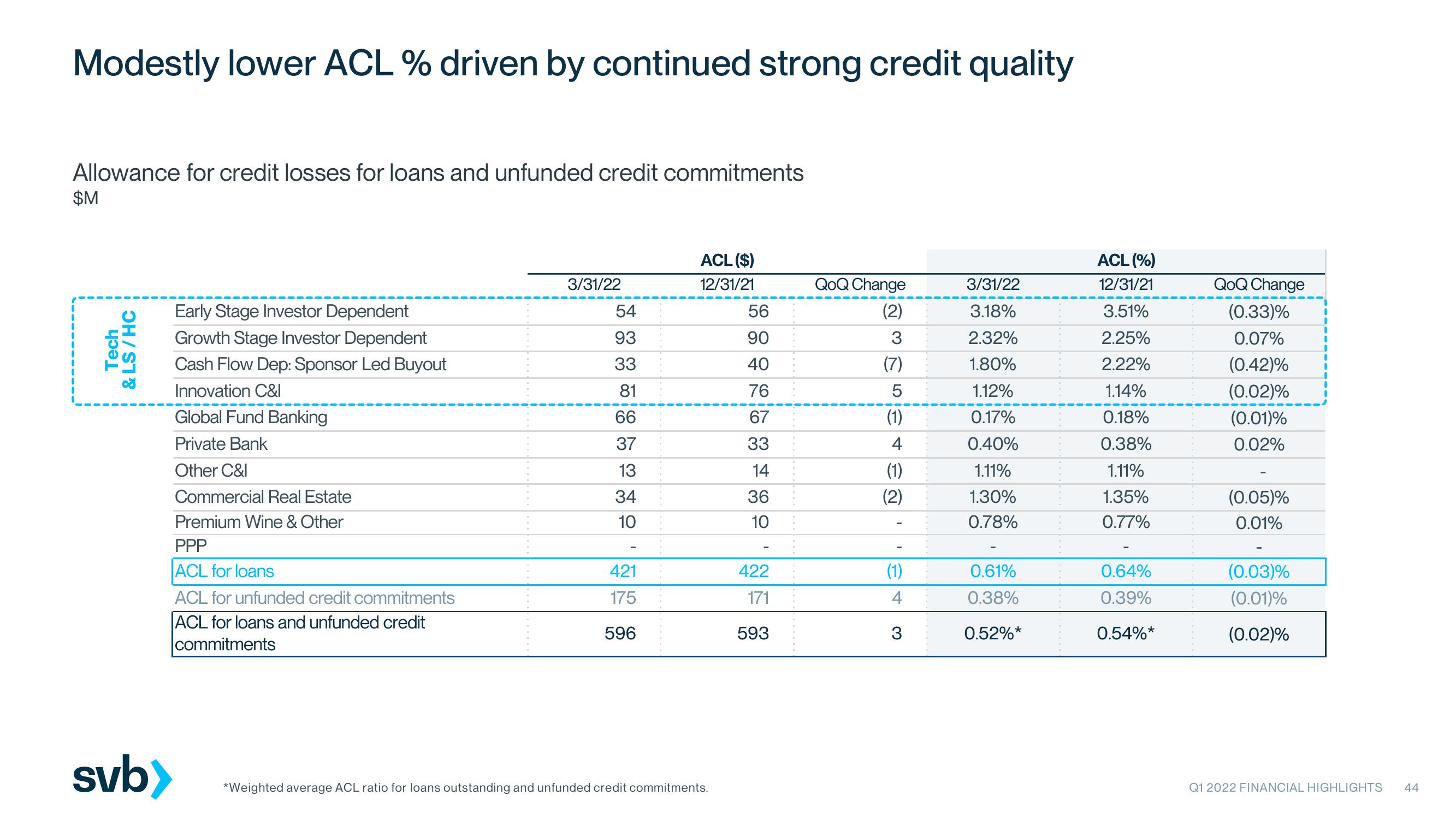

Modestly lower ACL % driven by continued strong credit quality

Allowance for credit losses for loans and unfunded credit commitments

$M

Tech

& LS/HC

svb>

Early Stage Investor Dependent

Growth Stage Investor Dependent

Cash Flow Dep: Sponsor Led Buyout

C&I

Innovation

Global Fund Banking

Private Bank

Other C&I

Commercial Real Estate

Premium Wine & Other

PPP

ACL for loans

ACL for unfunded credit commitments

ACL for loans and unfunded credit

commitments

3/31/22

54

93

33

81

66

37

13

34

10

421

175

596

ACL ($)

12/31/21

*Weighted average ACL ratio for loans outstanding and unfunded credit commitments.

56

90

40

76

67

33

14

36

10

422

171

593

QoQ Change

(2)

3

(7)

5

(1)

4

(1)

(2)

(1)

4

3

3/31/22

3.18%

2.32%

1.80%

1.12%

0.17%

0.40%

1.11%

1.30%

0.78%

0.61%

0.38%

0.52%*

ACL (%)

12/31/21

3.51%

2.25%

2.22%

1.14%

0.18%

0.38%

1.11%

1.35%

0.77%

0.64%

0.39%

0.54%*

QoQ Change

(0.33)%

0.07%

(0.42)%

(0.02)%

(0.01)%

0.02%

(0.05)%

0.01%

(0.03)%

(0.01)%

(0.02)%

Q1 2022 FINANCIAL HIGHLIGHTS

44View entire presentation