Silicon Valley Bank Results Presentation Deck

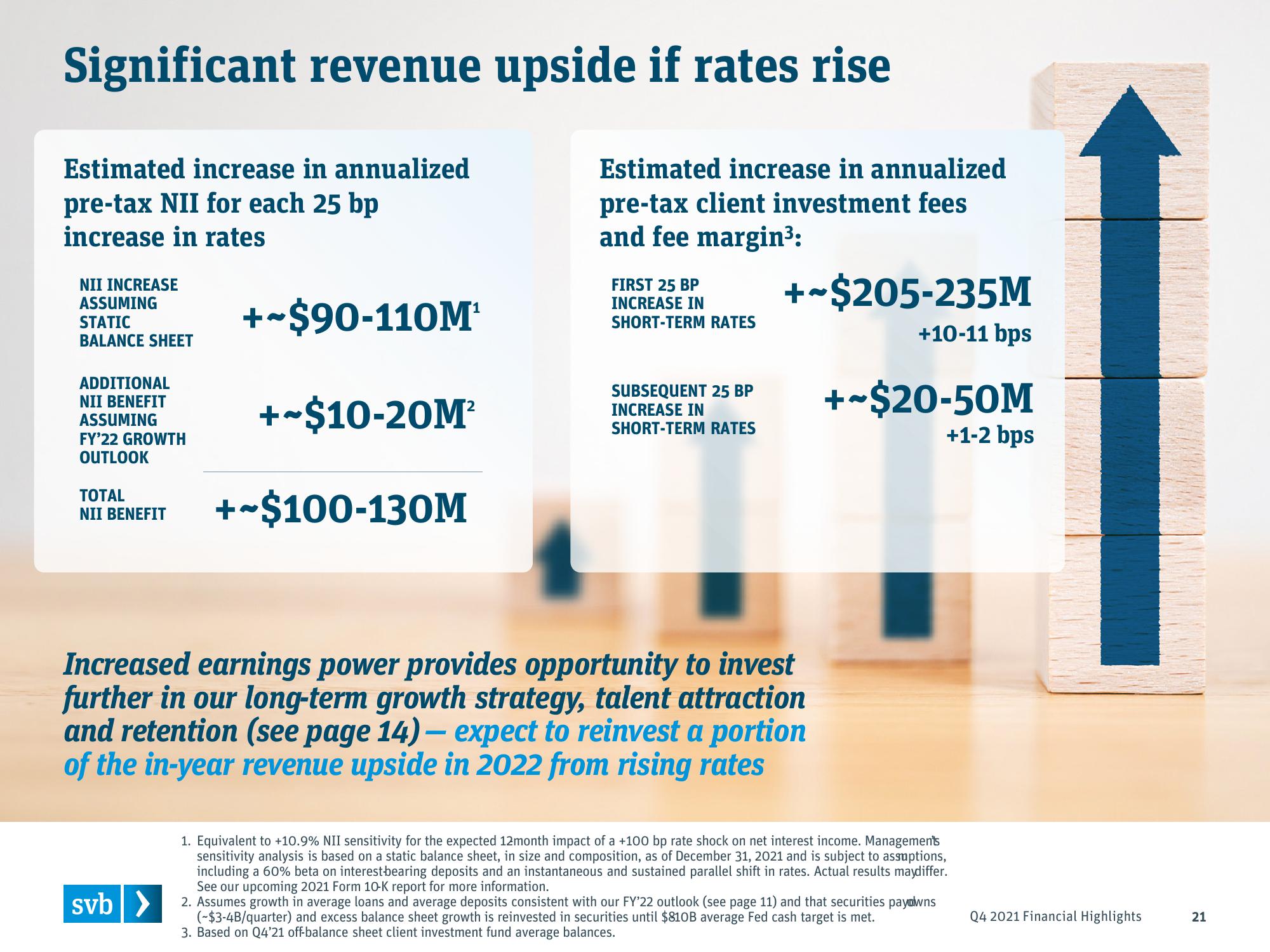

Significant revenue upside if rates rise

Estimated increase in annualized

pre-tax NII for each 25 bp

increase in rates

NII INCREASE

ASSUMING

STATIC

BALANCE SHEET

ADDITIONAL

NII BENEFIT

ASSUMING

FY'22 GROWTH

OUTLOOK

TOTAL

NII BENEFIT

+~$90-110M¹

+~$10-20M²

+~$100-130M

svb >

Estimated increase in annualized

pre-tax client investment fees

and fee margin³:

FIRST 25 BP

INCREASE IN

SHORT-TERM RATES

SUBSEQUENT 25 BP

INCREASE IN

SHORT-TERM RATES

+~$205-235M

+10-11 bps

Increased earnings power provides opportunity to invest

further in our long-term growth strategy, talent attraction

and retention (see page 14) - expect to reinvest a portion

of the in-year revenue upside in 2022 from rising rates

+~$20-50M

+1-2 bps

1. Equivalent to +10.9% NII sensitivity for the expected 12month impact of a +100 bp rate shock on net interest income. Managements

sensitivity analysis is based on a static balance sheet, in size and composition, as of December 31, 2021 and is subject to assuptions,

including a 60% beta on interest-bearing deposits and an instantaneous and sustained parallel shift in rates. Actual results maydiffer.

See our upcoming 2021 Form 10-K report for more information.

2. Assumes growth in average loans and average deposits consistent with our FY'22 outlook (see page 11) and that securities payowns

(-$3-4B/quarter) and excess balance sheet growth is reinvested in securities until $810B average Fed cash target is met.

3. Based on Q4'21 off-balance sheet client investment fund average balances.

Q4 2021 Financial Highlights

21View entire presentation