Silicon Valley Bank Results Presentation Deck

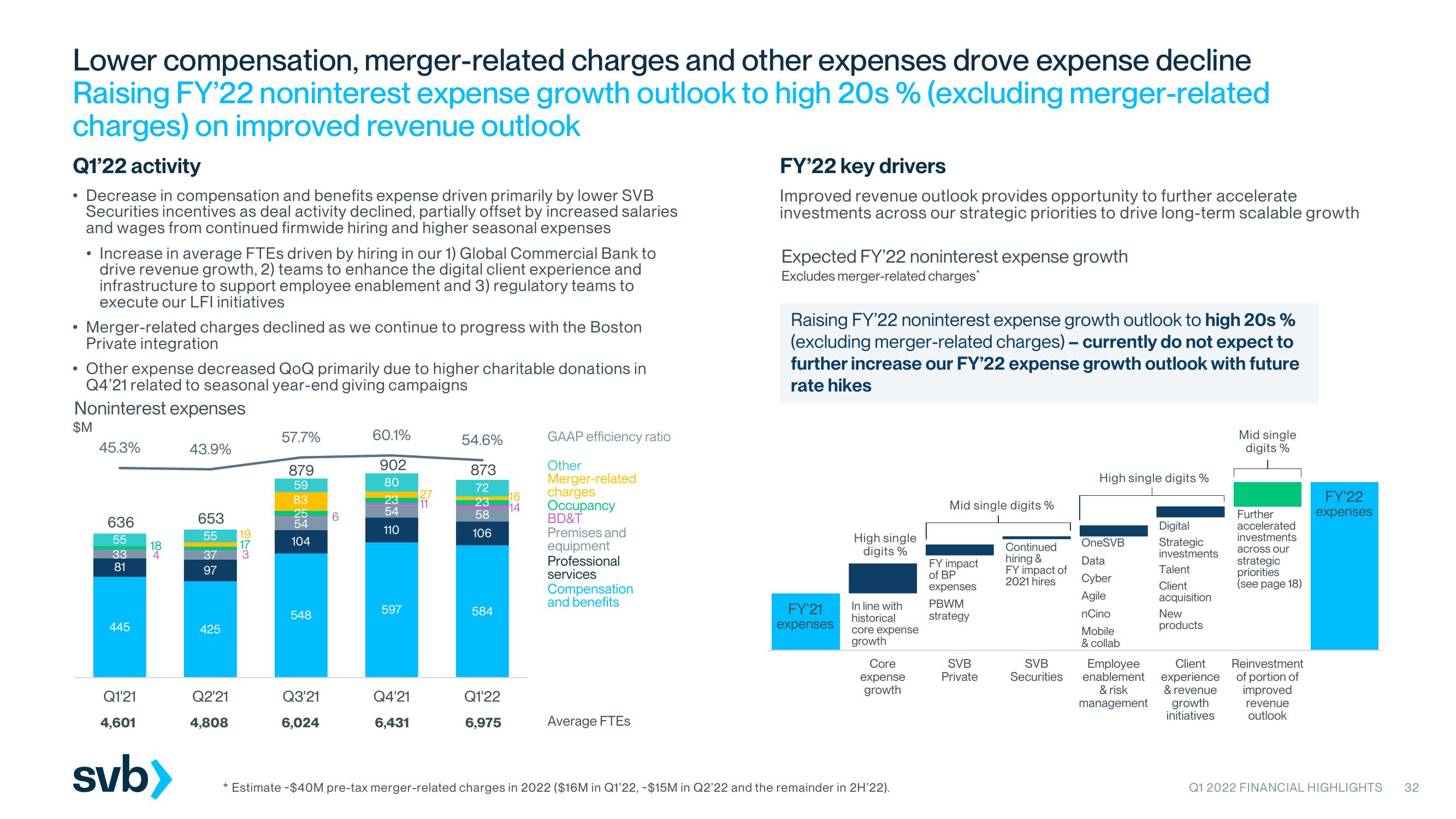

Lower compensation, merger-related charges and other expenses drove expense decline

Raising FY'22 noninterest expense growth outlook to high 20s % (excluding merger-related

charges) on improved revenue outlook

Q1'22 activity

Decrease in compensation and benefits expense driven primarily by lower SVB

Securities incentives as deal activity declined, partially offset by increased salaries

and wages from continued firmwide hiring and higher seasonal expenses

●

Increase in average FTES driven by hiring in our 1) Global Commercial Bank to

drive revenue growth, 2) teams to enhance the digital client experience and

infrastructure to support employee enablement and 3) regulatory teams to

execute our LFI initiatives

Merger-related charges declined as we continue to progress with the Boston

Private integration

Other expense decreased QoQ primarily due to higher charitable donations in

Q4'21 related to seasonal year-end giving campaigns

Noninterest expenses

●

●

●

$M

45.3%

636

55

33

81

445

Q1'21

4,601

18

4

svb>

43.9%

653

55

37

97

425

Q2'21

4,808

973

57.7%

879

59

83

25

54

104

548

Q3'21

6,024

6

60.1%

902

80

23

54

110

597

Q4'21

6,431

27

11

54.6%

873

72

23

58

106

584

Q1'22

6,975

16

64

14

GAAP efficiency ratio

Other

Merger-related

charges

Occupancy

BD&T

Premises and

equipment

Professional

services

Compensation

and benefits

Average FTES

FY'22 key drivers

Improved revenue outlook provides opportunity to further accelerate

investments across our strategic priorities to drive long-term scalable growth

Expected FY'22 noninterest expense growth

Excludes merger-related charges*

Raising FY'22 noninterest expense growth outlook to high 20s%

(excluding merger-related charges) - currently do not expect to

further increase our FY'22 expense growth outlook with future

rate hikes

FY'21

expenses

High single

digits %

In line with

historical

core expense

growth

Core

expense

growth

* Estimate - $40M pre-tax merger-related charges in 2022 ($16M in Q1'22, -$15M in Q2'22 and the remainder in 2H'22).

Mid single digits %

FY impact

of BP

expenses

PBWM

strategy

SVB

Private

Continued

hiring &

FY impact of

2021 hires

SVB

Securities

High single digits %

OneSVB

Data

Cyber

Agile

nCino

Mobile

& collab

Digital

Strategic

investments

Talent

Client

acquisition

New

products

Employee Client

enablement experience

& risk & revenue

management growth

initiatives

Mid single

digits %

Further

accelerated

investments

across our

strategic

priorities

(see page 18)

Reinvestment

of portion of

improved

revenue

outlook

FY'22

expenses

Q1 2022 FINANCIAL HIGHLIGHTS 32View entire presentation