Silicon Valley Bank Results Presentation Deck

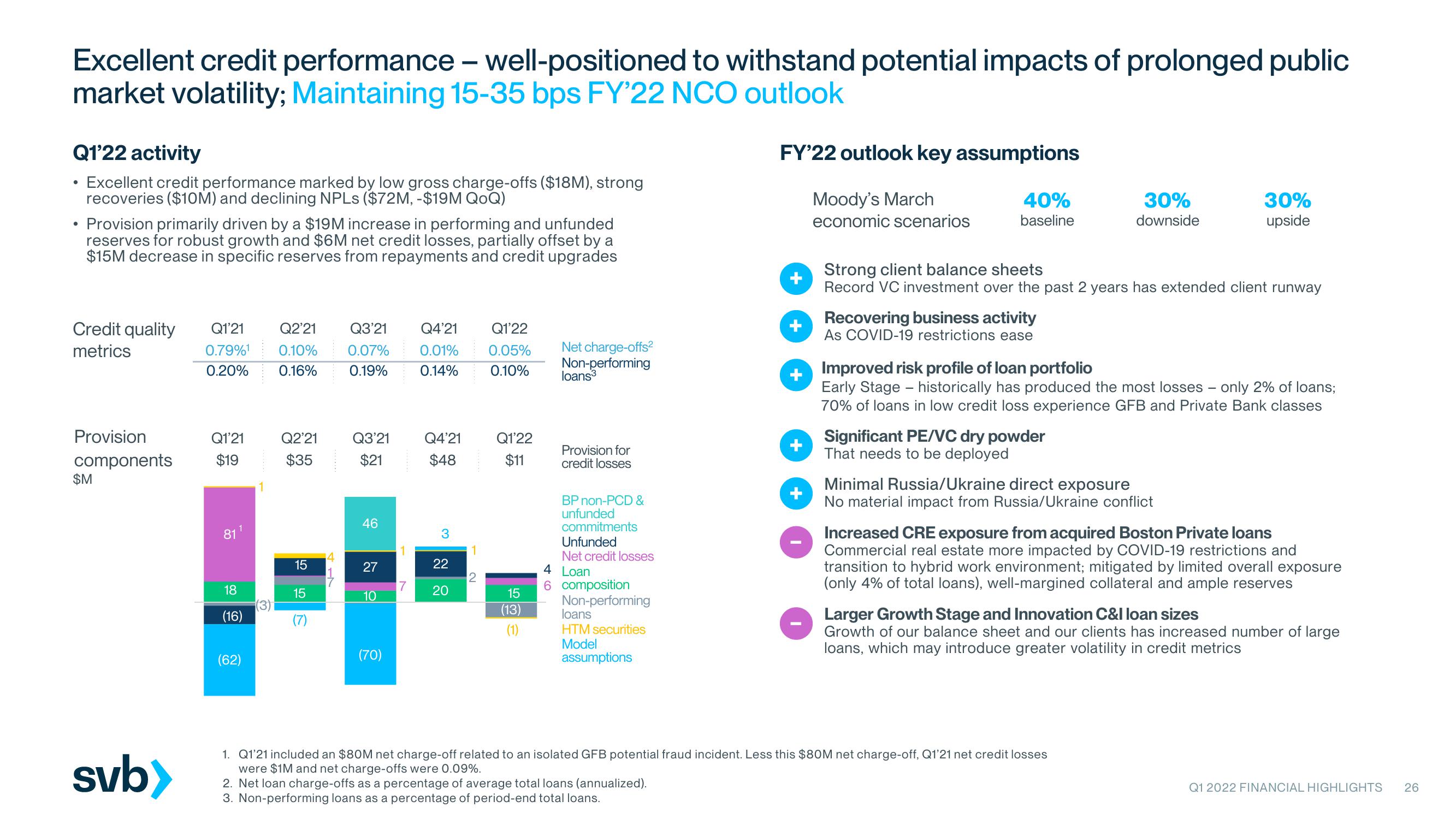

Excellent credit performance - well-positioned to withstand potential impacts of prolonged public

market volatility; Maintaining 15-35 bps FY'22 NCO outlook

FY'22 outlook key assumptions

Q1'22 activity

Excellent credit performance marked by low gross charge-offs ($18M), strong

recoveries ($10M) and declining NPLs ($72M, -$19M QOQ)

●

.

Provision primarily driven by a $19M increase in performing and unfunded

reserves for robust growth and $6M net credit losses, partially offset by a

$15M decrease in specific reserves from repayments and credit upgrades

Credit quality Q1'21

metrics

0.79%¹

0.20%

Provision

components

$M

svb>

Q1'21

$19

811

18

(16)

(62)

(3)

Q2'21

0.10%

0.16%

Q2'21

$35

15

15

(7)

4

0.07%

Q3'21 Q4'21 Q1'22

0.01% 0.05%

0.14% 0.10%

0.19%

Q3'21

$21

46

27

10

(70)

7

Q4'21

$48

3

22

20

2

Q1'22

$11

15

(13)

(1)

Net charge-offs²

Non-performing

loans³

Provision for

credit losses

BP non-PCD &

unfunded

commitments

Unfunded

Net credit losses

Loan

4

6 composition

Non-performing

loans

HTM securities

Model

assumptions

Moody's March

economic scenarios

2. Net loan charge-offs as a percentage of average total loans (annualized).

3. Non-performing loans as a percentage of period-end total loans.

40%

baseline

Recovering business activity

As COVID-19 restrictions ease

Strong client balance sheets

Record VC investment over the past 2 years has extended client runway

30%

downside

Significant PE/VC dry powder

That needs to be deployed

Improved risk profile of loan portfolio

Early Stage - historically has produced the most losses - only 2% of loans;

70% of loans in low credit loss experience GFB and Private Bank classes

30%

upside

Minimal Russia/Ukraine direct exposure

No material impact from Russia/Ukraine conflict

1. Q1'21 included an $80M net charge-off related to an isolated GFB potential fraud incident. Less this $80M net charge-off, Q1'21 net credit losses

were $1M and net charge-offs were 0.09%.

Increased CRE exposure from acquired Boston Private loans

Commercial real estate more impacted by COVID-19 restrictions and

transition to hybrid work environment; mitigated by limited overall exposure

(only 4% of total loans), well-margined collateral and ample reserves

Larger Growth Stage and Innovation C&I loan sizes

Growth of our balance sheet and our clients has increased number of large

loans, which may introduce greater volatility in credit metrics

Q1 2022 FINANCIAL HIGHLIGHTS

26View entire presentation