Lazard Investor Presentation Deck

INVESTOR PRESENTATION

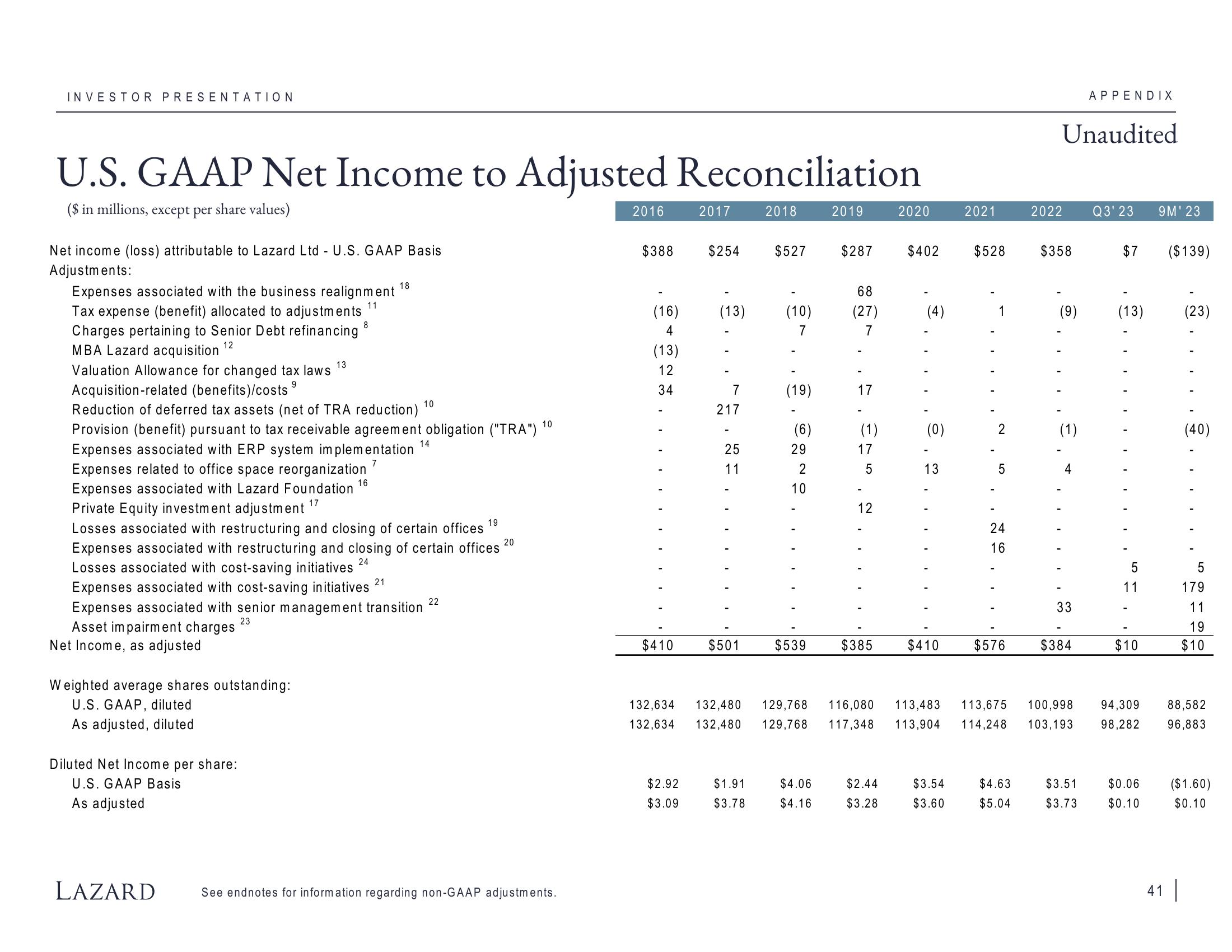

U.S. GAAP Net Income to Adjusted Reconciliation

($ in millions, except per:

2018

share values)

Net income (loss) attributable to Lazard Ltd - U.S. GAAP Basis

Adjustments:

18

Expenses associated with the business realignment ¹8

11

Tax expense (benefit) allocated to adjustments

Charges pertaining to Senior Debt refinancing

MBA Lazard acquisition

12

Weighted average shares outstanding:

U.S. GAAP, diluted

As adjusted, diluted

Valuation Allowance for changed tax laws

Acquisition-related (benefits)/costs 9

Reduction of deferred tax assets (net of TRA reduction)

Provision (benefit) pursuant to tax receivable agreement obligation ("TRA")

Expenses associated with ERP system implementation

Expenses related to office space reorganization

Expenses associated with Lazard Foundation

17

Private Equity investment adjustment

Losses associated with restructuring and closing of certain offices

Expenses associated with restructuring and closing of certain offices 20

Losses associated with cost-saving initiatives

24

Expenses associated with cost-saving initiatives

Expenses associated with senior management transition

Asset impairment charges

23

Net Income, as adjusted

Diluted Net Income per share:

U.S. GAAP Basis

As adjusted

LAZARD

13

8

16

21

10

14

22

19

10

See endnotes for information regarding non-GAAP adjustments.

2016

$388

(16)

4

(13)

12

34

2017

$254

$2.92

$3.09

(13)

7

217

25

11

132,634 132,480

132,634 132,480

$527

$1.91

$3.78

(10)

7

(19)

(6)

$410 $501 $539

29

2

10

2019

$4.06

$4.16

$287

68

(27)

7

17

(1)

17

5

12

2020

$402

$2.44

$3.28

(4)

(0)

13

$385 $410

2021

$3.54

$3.60

$528

1

2

5

24

16

$576

$4.63

$5.04

Unaudited

2022 Q3' 23

$358

(9)

(1)

4

33

APPENDIX

$384

129,768 116,080 113,483 113,675 100,998 94,309

129,768 117,348 113,904 114,248 103,193 98,282

$3.51

$3.73

$7

(13)

5

11

$10

$0.06

$0.10

9M' 23

41

($139)

(23)

(40)

5

179

11

19

$10

88,582

96,883

($1.60)

$0.10View entire presentation