Silicon Valley Bank Results Presentation Deck

Acquisition

transaction

svb >

Financial Group

Silicon Valley Bank

Global commercial banking

svb >

Silicon Valley Bank

SVBLEERINK

SVB Leerink

Investment banking

for healthcare and life

science companies

svb >

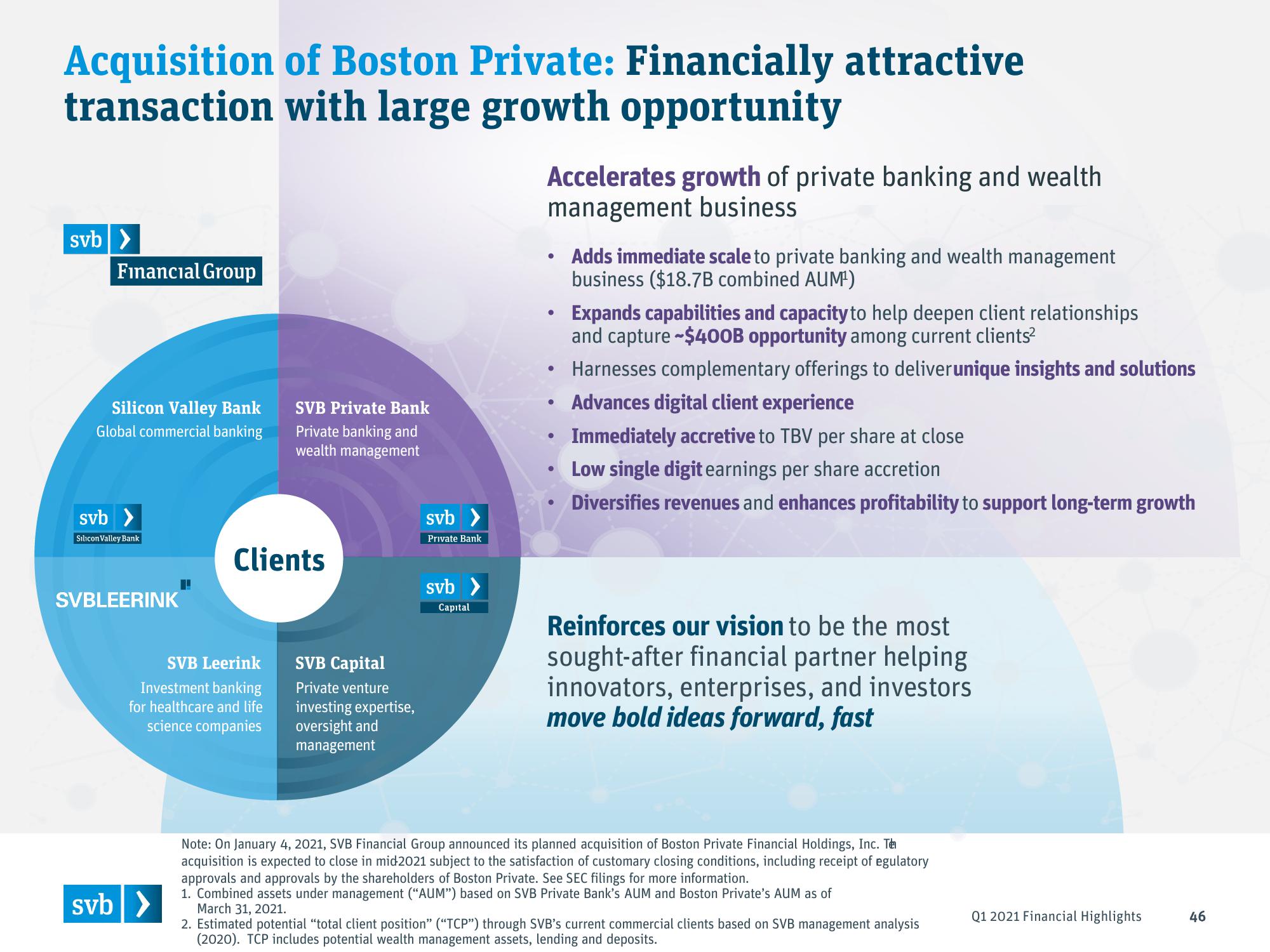

of Boston Private: Financially attractive

with large growth opportunity

SVB Private Bank

Private banking and

wealth management

Clients

SVB Capital

Private venture

investing expertise,

oversight and

management

svb>

Private Bank

svb>

Capital

Accelerates growth of private banking and wealth

management business

●

Adds immediate scale to private banking and wealth management

business ($18.7B combined AUM¹)

Expands capabilities and capacity to help deepen client relationships

and capture ~$400B opportunity among current clients²

Harnesses complementary offerings to deliverunique insights and solutions

Advances digital client experience

Immediately accretive to TBV per share at close

Low single digit earnings per share accretion

Diversifies revenues and enhances profitability to support long-term growth

Reinforces our vision to be the most

sought-after financial partner helping

innovators, enterprises, and investors

move bold ideas forward, fast

Note: On January 4, 2021, SVB Financial Group announced its planned acquisition of Boston Private Financial Holdings, Inc. Te

acquisition is expected to close in mid2021 subject to the satisfaction of customary closing conditions, including receipt of egulatory

approvals and approvals by the shareholders of Boston Private. See SEC filings for more information.

1. Combined assets under management ("AUM") based on SVB Private Bank's AUM and Boston Private's AUM as of

March 31, 2021.

2. Estimated potential "total client position" ("TCP") through SVB's current commercial clients based on SVB management analysis

(2020). TCP includes potential wealth management assets, lending and deposits.

Q1 2021 Financial Highlights

46View entire presentation