Silicon Valley Bank Results Presentation Deck

Accelerated securities purchases as significant deposit inflows continued

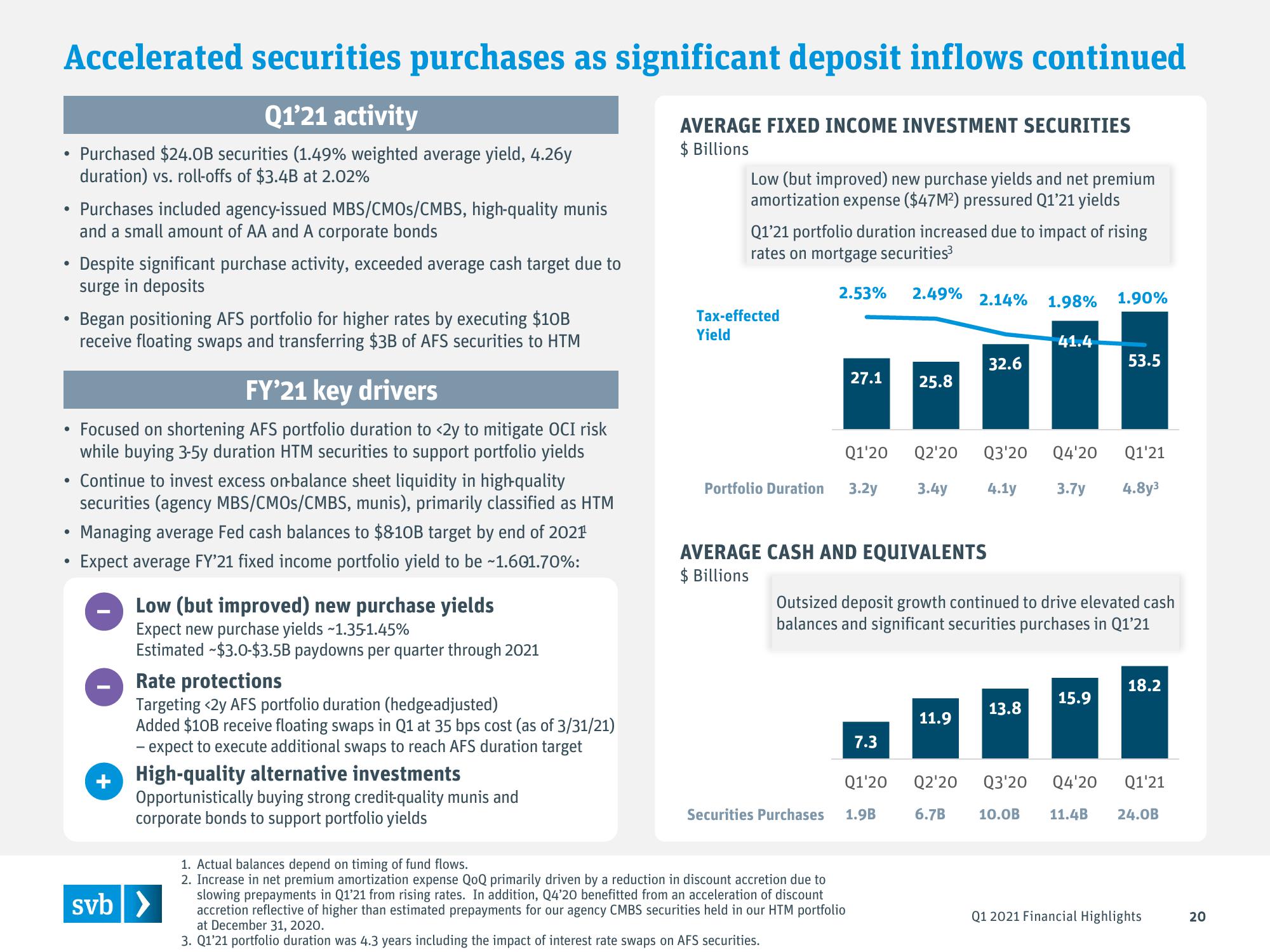

Q1'21 activity

Purchased $24.OB securities (1.49% weighted average yield, 4.26y

duration) vs. roll-offs of $3.4B at 2.02%

●

.

Purchases included agency-issued MBS/CMOS/CMBS, high-quality munis

and a small amount of AA and A corporate bonds

●

Despite significant purchase activity, exceeded average cash target due to

surge in deposits

Began positioning AFS portfolio for higher rates by executing $10B

receive floating swaps and transferring $3B of AFS securities to HTM

FY'21 key drivers

Focused on shortening AFS portfolio duration to <2y to mitigate OCI risk

while buying 3-5y duration HTM securities to support portfolio yields

Continue to invest excess on-balance sheet liquidity in high-quality

securities (agency MBS/CMOS/CMBS, munis), primarily classified as HTM

• Managing average Fed cash balances to $810B target by end of 2021

Expect average FY'21 fixed income portfolio yield to be ~1.601.70%:

+

Low (but improved) new purchase yields

Expect new purchase yields ~1.35-1.45%

Estimated $3.0-$3.5B paydowns per quarter through 2021

Rate protections

Targeting <2y AFS portfolio duration (hedgeadjusted)

Added $10B receive floating swaps in Q1 at 35 bps cost (as of 3/31/21)

- expect to execute additional swaps to reach AFS duration target

High-quality alternative investments

Opportunistically buying strong credit-quality munis and

corporate bonds to support portfolio yields

svb >

AVERAGE FIXED INCOME INVESTMENT SECURITIES

$ Billions

Low (but improved) new purchase yields and net premium

amortization expense ($47M²) pressured Q1'21 yields

Q1'21 portfolio duration increased due to impact of rising

rates on mortgage securities³

2.53% 2.49% 2.14% 1.98% 1.90%

Tax-effected

Yield

27.1 25.8

Portfolio Duration 3.2y

Q1'20 Q2'20 Q3'20

3.4y

AVERAGE CASH AND EQUIVALENTS

$ Billions

Securities Purchases

1. Actual balances depend on timing of fund flows.

2. Increase in net premium amortization expense QoQ primarily driven by a reduction in discount accretion due to

slowing prepayments in Q1'21 from rising rates. In addition, Q4'20 benefitted from an acceleration of discount

accretion reflective of higher than estimated prepayments for our agency CMBS securities held in our HTM portfolio

at December 31, 2020.

3. Q1'21 portfolio duration was 4.3 years including the impact of interest rate swaps on AFS securities.

7.3

Q1'20

1.9B

32.6

Outsized deposit growth continued to drive elevated cash

balances and significant securities purchases in Q1'21

11.9

41.4

Q4'20 Q1'21

4.1y 3.7y 4.8y³

13.8

53.5

15.9

18.2

Q2'20 Q3'20 Q4'20 Q1'21

6.7B

10.0B 11.4B

24.0B

Q1 2021 Financial Highlights

20View entire presentation