Silicon Valley Bank Results Presentation Deck

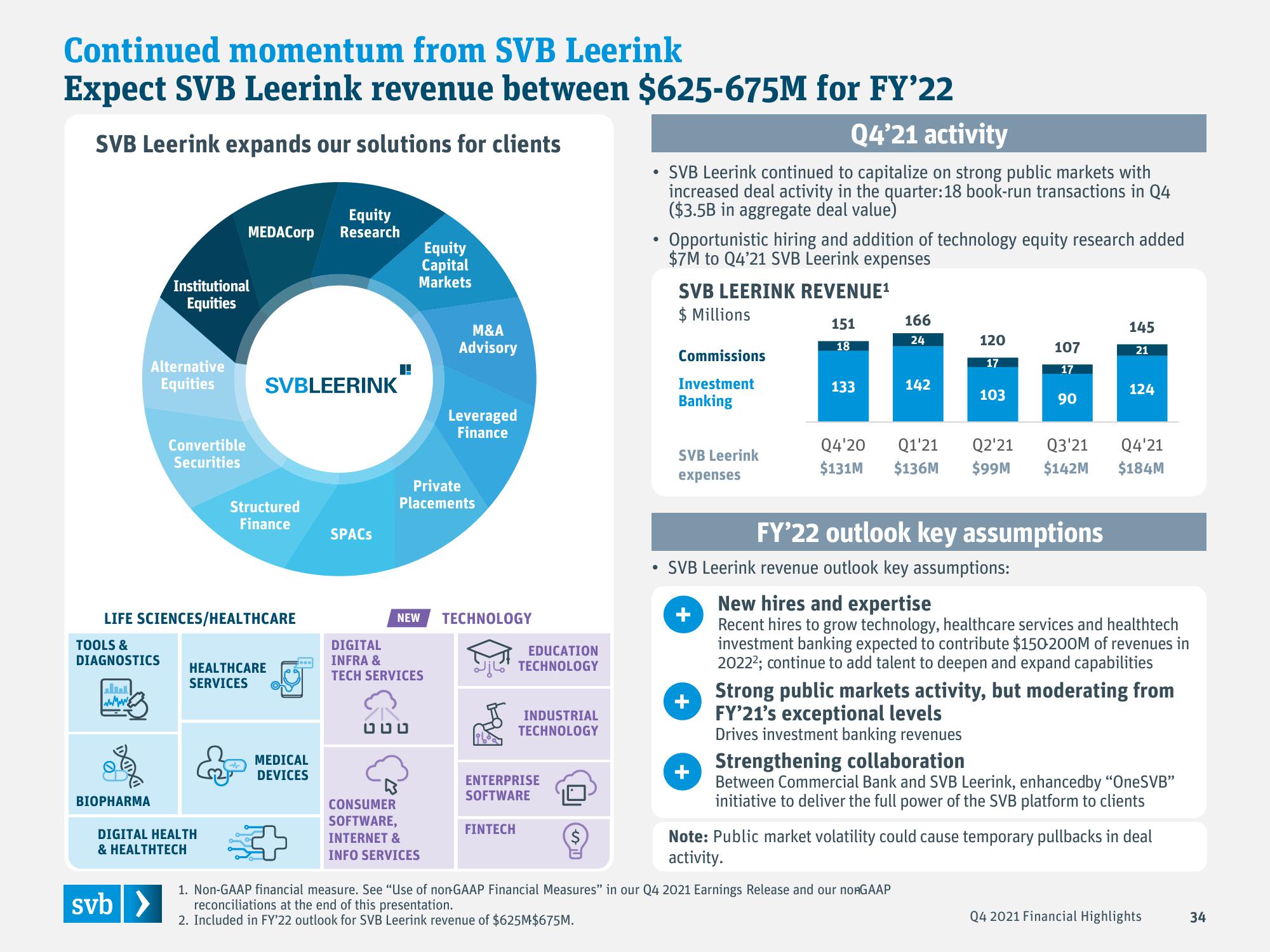

Continued momentum from SVB Leerink

Expect SVB Leerink revenue between $625-675M for FY'22

SVB Leerink expands our solutions for clients

Alternative

Equities

TOOLS &

DIAGNOSTICS

www

BIOPHARMA

Institutional

Equities

Convertible

Securities

LIFE SCIENCES/HEALTHCARE

svb >

Equity

MEDACorp Research

DIGITAL HEALTH

& HEALTHTECH

SVBLEERINK

Structured

Finance

HEALTHCARE

SERVICES

MEDICAL

DEVICES

SPACS

Equity

Capital

Markets

Private

Placements

DIGITAL

INFRA &

TECH SERVICES

បបប

M&A

Advisory

NEW TECHNOLOGY

Leveraged

Finance

CONSUMER

SOFTWARE,

INTERNET &

INFO SERVICES

EDUCATION

TECHNOLOGY مازل

FINTECH

INDUSTRIAL

TECHNOLOGY

ENTERPRISE

SOFTWARE

Q4'21 activity

• SVB Leerink continued to capitalize on strong public markets with

increased deal activity in the quarter: 18 book-run transactions in Q4

($3.5B in aggregate deal value)

●

Opportunistic hiring and addition of technology equity research added

$7M to Q4'21 SVB Leerink expenses

SVB LEERINK REVENUE¹

$ Millions

Commissions

Investment

Banking

SVB Leerink

expenses

151

18

133

166

24

142

120

17

103

107

17

SVB Leerink revenue outlook key assumptions:

90

FY'22 outlook key assumptions

1. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2021 Earnings Release and our noRGAAP

reconciliations at the end of this presentation.

2. Included in FY'22 outlook for SVB Leerink revenue of $625M$675M.

Q4'20 Q1'21 Q2'21 Q3'21 Q4'21

$131M $136M $99M $142M $184M

145

21

124

New hires and expertise

Recent hires to grow technology, healthcare services and healthtech

investment banking expected to contribute $150-200M of revenues in

2022²; continue to add talent to deepen and expand capabilities

Strong public markets activity, but moderating from

FY'21's exceptional levels

Drives investment banking revenues

Strengthening collaboration

Between Commercial Bank and SVB Leerink, enhancedby "OneSVB"

initiative to deliver the full power of the SVB platform to clients

Note: Public market volatility could cause temporary pullbacks in deal

activity.

Q4 2021 Financial Highlights

34View entire presentation