Crocs Investor Presentation Deck

NON-GAAP RECONCILIATION (cont'd)

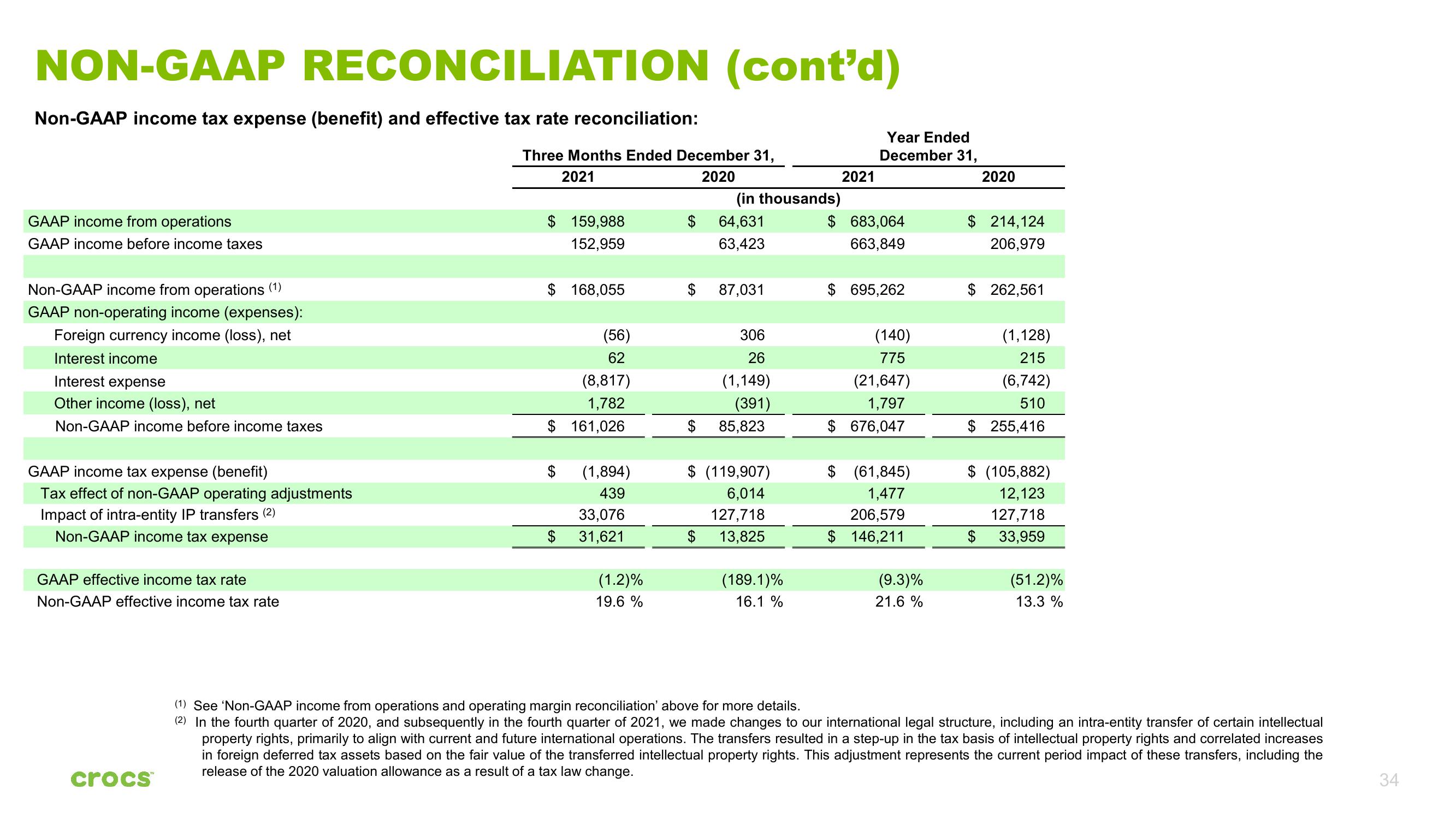

Non-GAAP income tax expense (benefit) and effective tax rate reconciliation:

GAAP income from operations

GAAP income before income taxes

Non-GAAP income from operations (1)

GAAP non-operating income (expenses):

Foreign currency income (loss), net

Interest income

Interest expense

Other income (loss), net

Non-GAAP income before income taxes

GAAP income tax expense (benefit)

Tax effect of non-GAAP operating adjustments

Impact of intra-entity IP transfers (2)

Non-GAAP income tax expense

GAAP effective income tax rate

Non-GAAP effective income tax rate

crocs™

Three Months Ended December 31,

2021

2020

$ 159,988

152,959

$ 168,055

(56)

62

(8,817)

1,782

$ 161,026

$

$

(1,894)

439

33,076

31,621

(1.2)%

19.6 %

$

$

(in thousands)

64,631

63,423

87,031

306

26

(1,149)

(391)

$ 85,823

$ (119,907)

6,014

127,718

$ 13,825

(189.1)%

16.1 %

$

2021

Year Ended

December 31,

683,064

663,849

$ 695,262

(140)

775

(21,647)

1,797

$ 676,047

$ (61,845)

1,477

206,579

$ 146,211

(9.3)%

21.6%

2020

$ 214,124

206,979

$ 262,561

(1,128)

215

(6,742)

510

$ 255,416

$ (105,882)

12,123

127,718

33,959

$

(51.2)%

13.3%

(1) See 'Non-GAAP income from operations and operating margin reconciliation' above for more details.

(2) In the fourth quarter of 2020, and subsequently in the fourth quarter of 2021, we made changes to our international legal structure, including an intra-entity transfer of certain intellectual

property rights, primarily to align with current and future international operations. The transfers resulted in a step-up in the tax basis of intellectual property rights and correlated increases

in foreign deferred tax assets based on the fair value of the transferred intellectual property rights. This adjustment represents the current period impact of these transfers, including the

release of the 2020 valuation allowance as a result of a tax law change.

34View entire presentation