Silicon Valley Bank Mergers and Acquisitions Presentation Deck

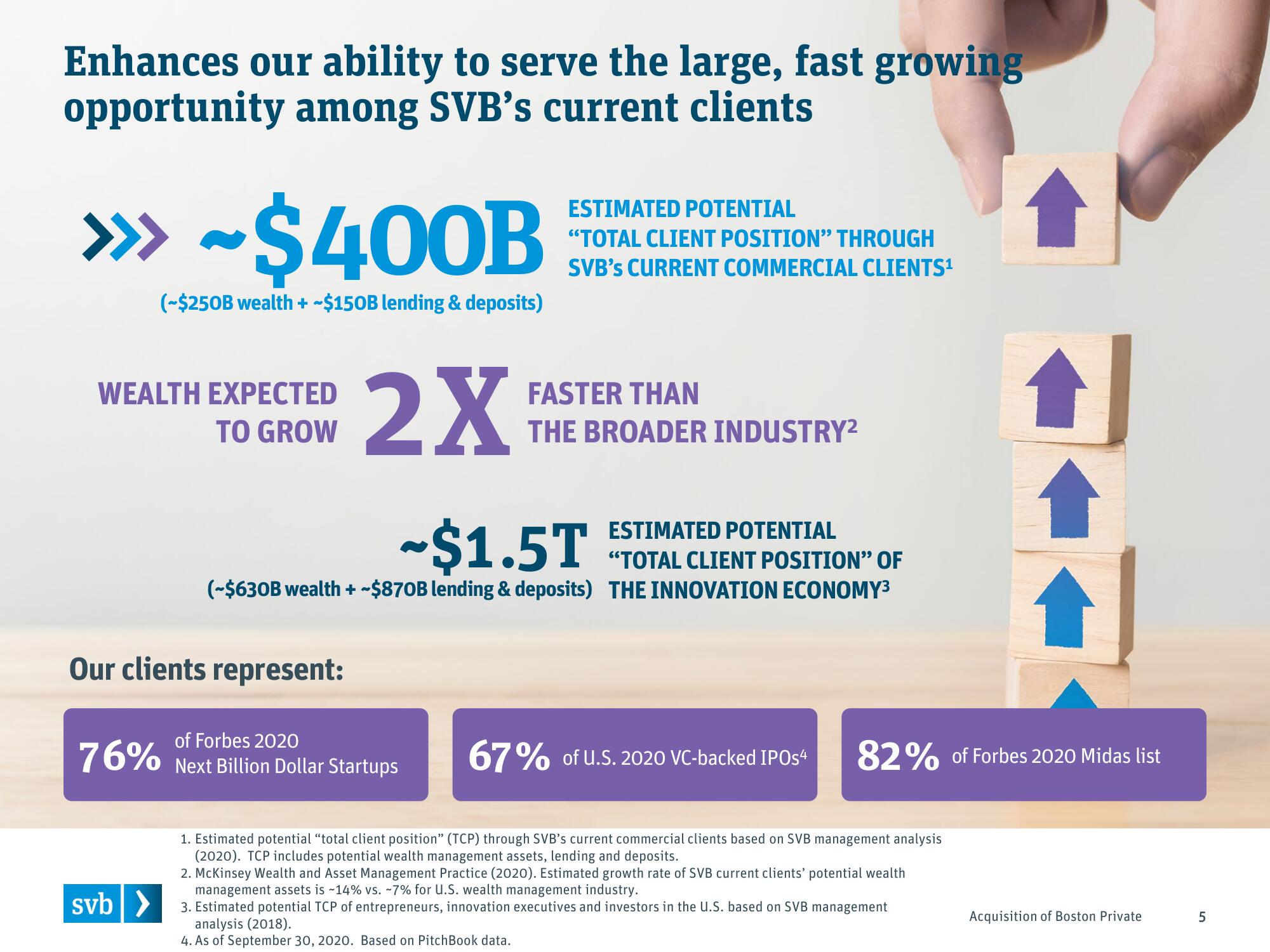

Enhances our ability to serve the large, fast growing

opportunity among SVB's current clients

>>> ~$400B

(~$250B wealth + -$150B lending & deposits)

WEALTH EXPECTED

TO GROW

Our clients represent:

2X

svb >

of Forbes 2020

76% Next Billion Dollar Startups

ESTIMATED POTENTIAL

"TOTAL CLIENT POSITION" THROUGH

SVB's CURRENT COMMERCIAL CLIENTS¹

~$1.5T

ESTIMATED POTENTIAL

"TOTAL CLIENT POSITION" OF

(~$630B wealth + ~$870B lending & deposits) THE INNOVATION ECONOMY³

FASTER THAN

THE BROADER INDUSTRY²

67% of U.S. 2020 VC-backed IPOs4 82% of Forbes 2020 Midas list

1. Estimated potential "total client position" (TCP) through SVB's current commercial clients based on SVB management analysis

(2020). TCP includes potential wealth management assets, lending and deposits.

2. McKinsey Wealth and Asset Management Practice (2020). Estimated growth rate of SVB current clients' potential wealth

management assets is ~14% vs. ~7% for U.S. wealth management industry.

3. Estimated potential TCP of entrepreneurs, innovation executives and investors in the U.S. based on SVB management

analysis (2018).

4. As of September 30, 2020. Based on Pitch Book data.

Acquisition of Boston Private

5View entire presentation