Silicon Valley Bank Results Presentation Deck

Overall stable credit trends and improving economic environment

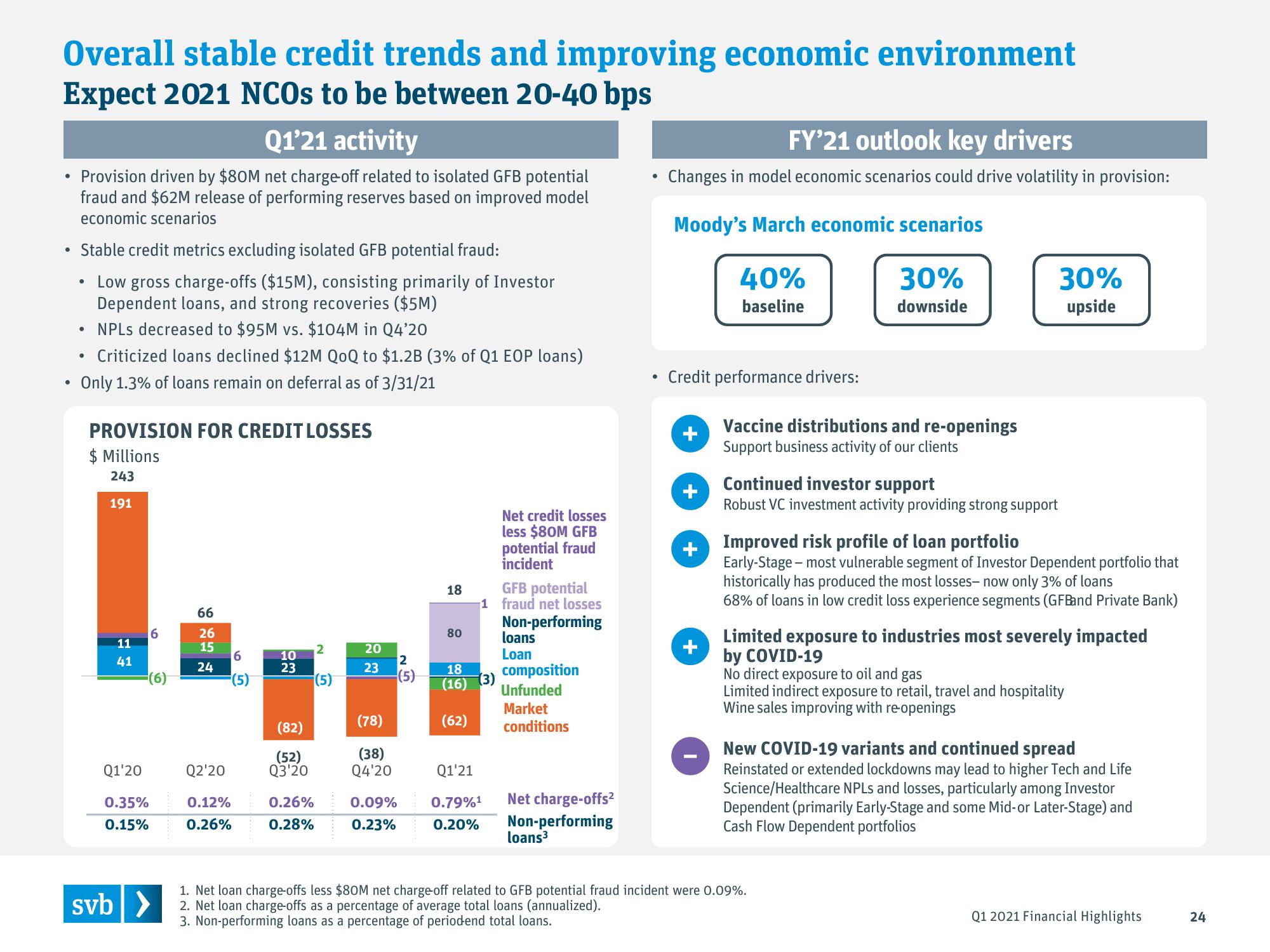

Expect 2021 NCOs to be between 20-40 bps

Q1'21 activity

• Provision driven by $80M net charge-off related to isolated GFB potential

fraud and $62M release of performing reserves based on improved model

economic scenarios

●

Stable credit metrics excluding isolated GFB potential fraud:

• Low gross charge-offs ($15M), consisting primarily of Investor

Dependent loans, and strong recoveries ($5M)

• NPLs decreased to $95M vs. $104M in Q4'20

Criticized loans declined $12M QoQ to $1.2B (3% of Q1 EOP loans)

Only 1.3% of loans remain on deferral as of 3/31/21

PROVISION FOR CREDIT LOSSES

$ Millions

243

191

11

41

Q1'20

0.35%

0.15%

6

(6)

svb>

66

26

15

24

Q2'20

0.12%

0.26%

6

10

23

(82)

(52)

Q3'20

0.26%

0.28%

2

(5)

20

23

(78)

(38)

Q4'20

0.09%

0.23%

2

(5)

18

80

18

(16)

(62)

GFB potential

1 fraud net losses

Non-performing

(3)

Net credit losses

less $80M GFB

potential fraud

incident

Q1'21

0.79%¹

0.20%

loans

Loan

composition

Unfunded

Market

conditions

Net charge-offs²

Non-performing

loans³

FY'21 outlook key drivers

Changes in model economic scenarios could drive volatility in provision:

Moody's March economic scenarios

40%

30%

baseline

downside

Credit performance drivers:

+

+

Vaccine distributions and re-openings

Support business activity of our clients

Continued investor support

Robust VC investment activity providing strong support

30%

upside

Improved risk profile of loan portfolio

Early-Stage - most vulnerable segment of Investor Dependent portfolio that

historically has produced the most losses- now only 3% of loans

68% of loans in low credit loss experience segments (GFBand Private Bank)

Limited exposure to industries most severely impacted

by COVID-19

No direct exposure to oil and gas

Limited indirect exposure to retail, travel and hospitality

Wine sales improving with re-openings

New COVID-19 variants and continued spread

Reinstated or extended lockdowns may lead to higher Tech and Life

Science/Healthcare NPLs and losses, particularly among Investor

Dependent (primarily Early-Stage and some Mid-or Later-Stage) and

Cash Flow Dependent portfolios

1. Net loan charge-offs less $80M net charge-off related to GFB potential fraud incident were 0.09%.

2. Net loan charge-offs as a percentage of average total loans (annualized).

3. Non-performing loans as a percentage of periodend total loans.

Q1 2021 Financial Highlights

24View entire presentation