Silicon Valley Bank Mergers and Acquisitions Presentation Deck

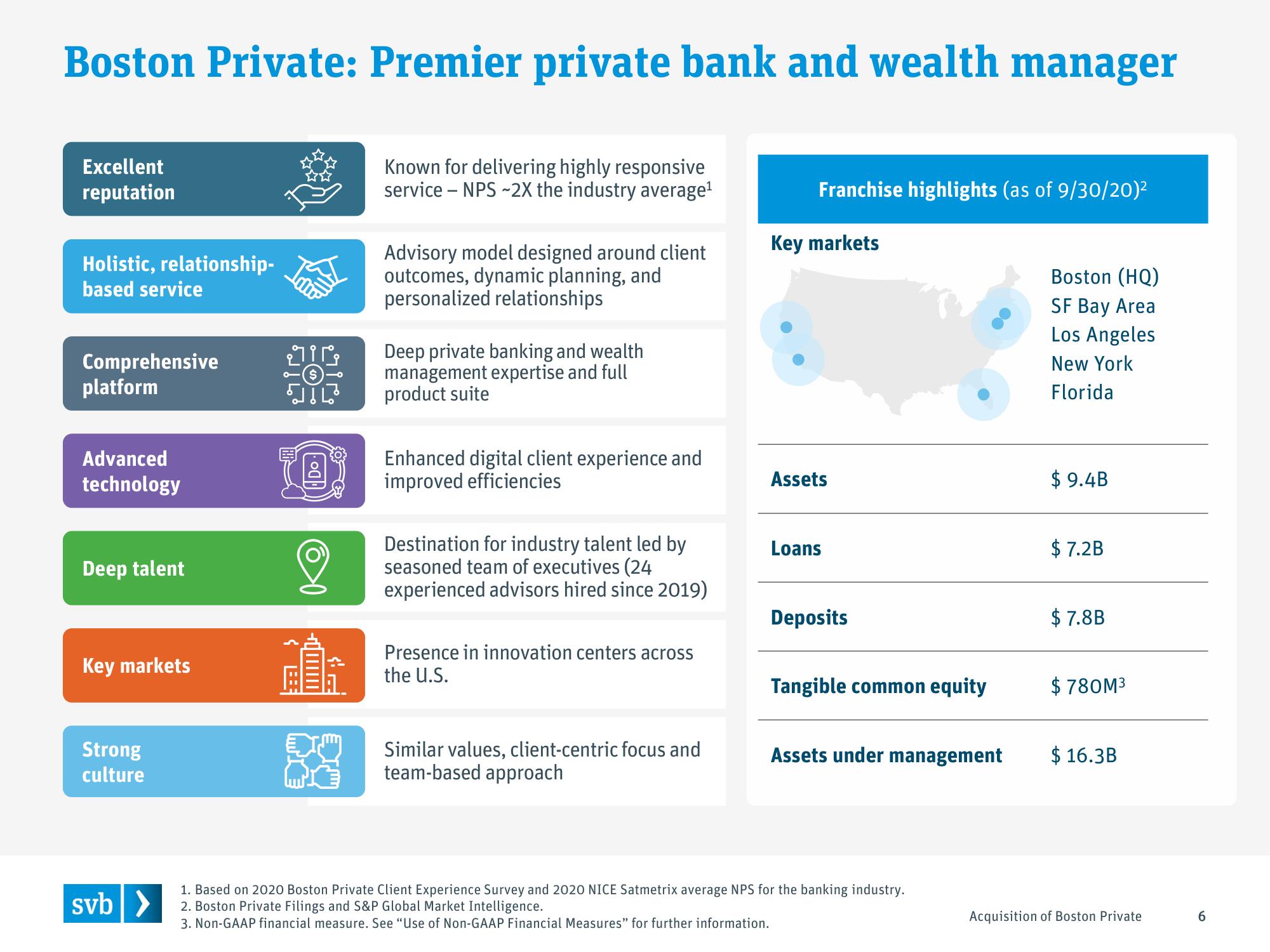

Boston Private: Premier private bank and wealth manager

Excellent

reputation

Known for delivering highly responsive

service - NPS-2X the industry average¹

Holistic, relationship-

based service

Comprehensive

platform

Advanced

technology

Deep talent

Key markets

Strong

culture

svb>

E

Do.

Advisory model designed around client

outcomes, dynamic planning, and

personalized relationships

Deep private banking and wealth

management expertise and full

product suite

Enhanced digital client experience and

improved efficiencies

Destination for industry talent led by

seasoned team of executives (24

experienced advisors hired since 2019)

Presence in innovation centers across

the U.S.

Similar values, client-centric focus and

team-based approach

Franchise highlights (as of 9/30/20)²

Key markets

Assets

Loans

Deposits

Tangible common equity

Assets under management

1. Based on 2020 Boston Private Client Experience Survey and 2020 NICE Satmetrix average NPS for the banking industry.

2. Boston Private Filings and S&P Global Market Intelligence.

3. Non-GAAP financial measure. See "Use of Non-GAAP Financial Measures" for further information.

Boston (HQ)

SF Bay Area

Los Angeles

New York

Florida

$9.4B

$7.2B

$7.8B

$ 780M³

$16.3B

Acquisition of Boston Private

6View entire presentation