Silicon Valley Bank Results Presentation Deck

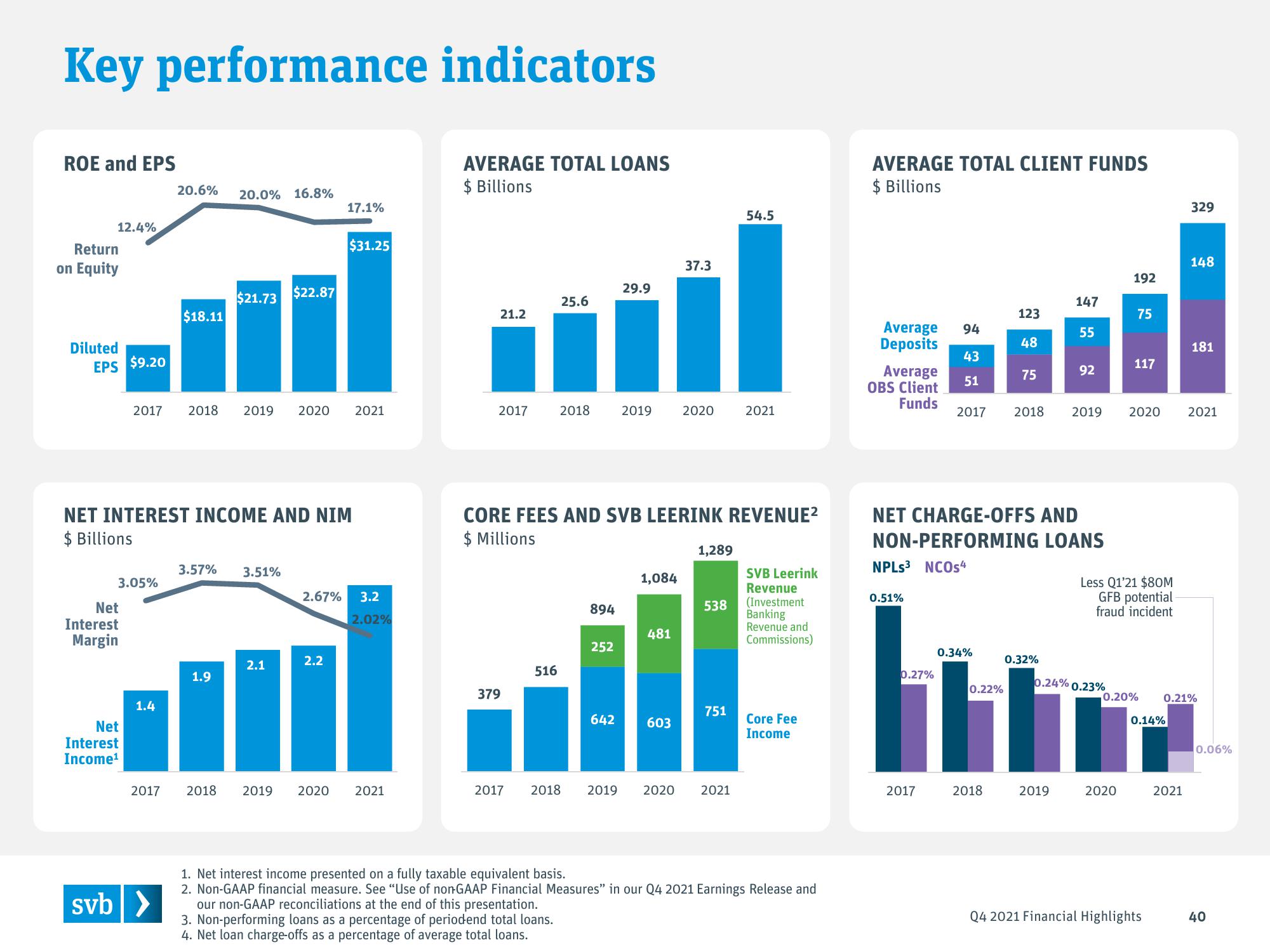

Key performance indicators

ROE and EPS

12.4%

Return

on Equity

Diluted

EPS $9.20

3.05%

Net

Interest

Margin

Net

Interest

Income¹

1.4

20.6%

2017

$18.11

svb >

NET INTEREST INCOME AND NIM

$ Billions

2017 2018 2019 2020 2021

20.0% 16.8%

3.57%

$21.73

1.9

3.51%

$22.87

2.1

2018 2019

17.1%

$31.25

2.2

2.67% 3.2

2.02%

2020 2021

AVERAGE TOTAL LOANS

$ Billions

21.2

2017

379

2017

25.6

516

2018

894

252

29.9

CORE FEES AND SVB LEERINK REVENUE²

$ Millions

642

2019

1,084

481

37.3

603

2020

1,289

538

751

54.5

2018 2019 2020 2021

2021

SVB Leerink

Revenue

(Investment

Banking

Revenue and

Commissions)

Core Fee

Income

1. Net interest income presented on a fully taxable equivalent basis.

2. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2021 Earnings Release and

our non-GAAP reconciliations at the end of this presentation.

3. Non-performing loans as a percentage of periodend total loans.

4. Net loan charge-offs as a percentage of average total loans.

AVERAGE TOTAL CLIENT FUNDS

$ Billions

Average

Deposits

Average

OBS Client

Funds

0.51%

0.27%

94

43

51

2017

0.34%

123

48

NET CHARGE-OFFS AND

NON-PERFORMING LOANS

NPLS3 NCOs4

0.22%

75

2018

147

0.32%

55

92

2019

2017 2018 2019 2020 2021

0.24% 0.23%

192

75

117

Less Q1'21 $80M

GFB potential

fraud incident

2020

-0.20%

0.14%

Q4 2021 Financial Highlights

329

148

2021

181

0.21%

0.06%

40View entire presentation