Silicon Valley Bank Results Presentation Deck

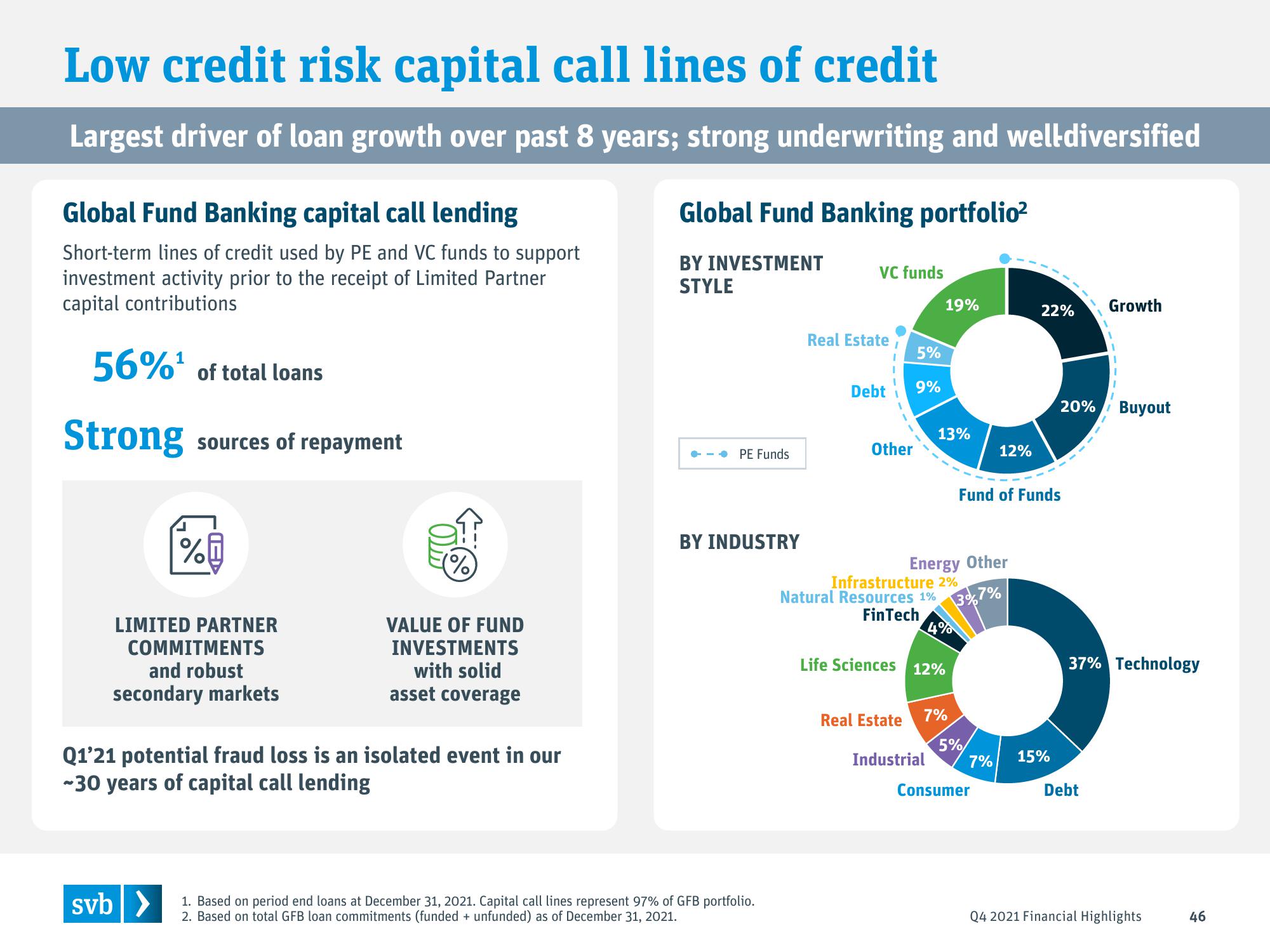

Low credit risk capital call lines of credit

Largest driver of loan growth over past 8 years; strong underwriting and well diversified

Global Fund Banking capital call lending

Short-term lines of credit used by PE and VC funds to support

investment activity prior to the receipt of Limited Partner

capital contributions

56% of total loans

Strong

sources of repayment

%

LIMITED PARTNER

COMMITMENTS

and robust

secondary markets

svb >

(%)

VALUE OF FUND

INVESTMENTS

with solid

asset coverage

Q1'21 potential fraud loss is an isolated event in our

-30 years of capital call lending

Global Fund Banking portfolio²

BY INVESTMENT

STYLE

PE Funds

BY INDUSTRY

1. Based on period end loans at December 31, 2021. Capital call lines represent 97% of GFB portfolio.

2. Based on total GFB loan commitments (funded + unfunded) as of December 31, 2021.

VC funds

Real Estate

Debt

Other

5%

9%

19%

13%

Industrial

Real Estate 7%

Energy Other

Infrastructure 2%

Natural Resources 1%

3% 7%

FinTech

4%

Life Sciences 12%

5%

12%

Fund of Funds

7%

Consumer

22% Growth

20% Buyout

15%

37% Technology

Debt

Q4 2021 Financial Highlights

46View entire presentation