Silicon Valley Bank Results Presentation Deck

Glossary (continued)

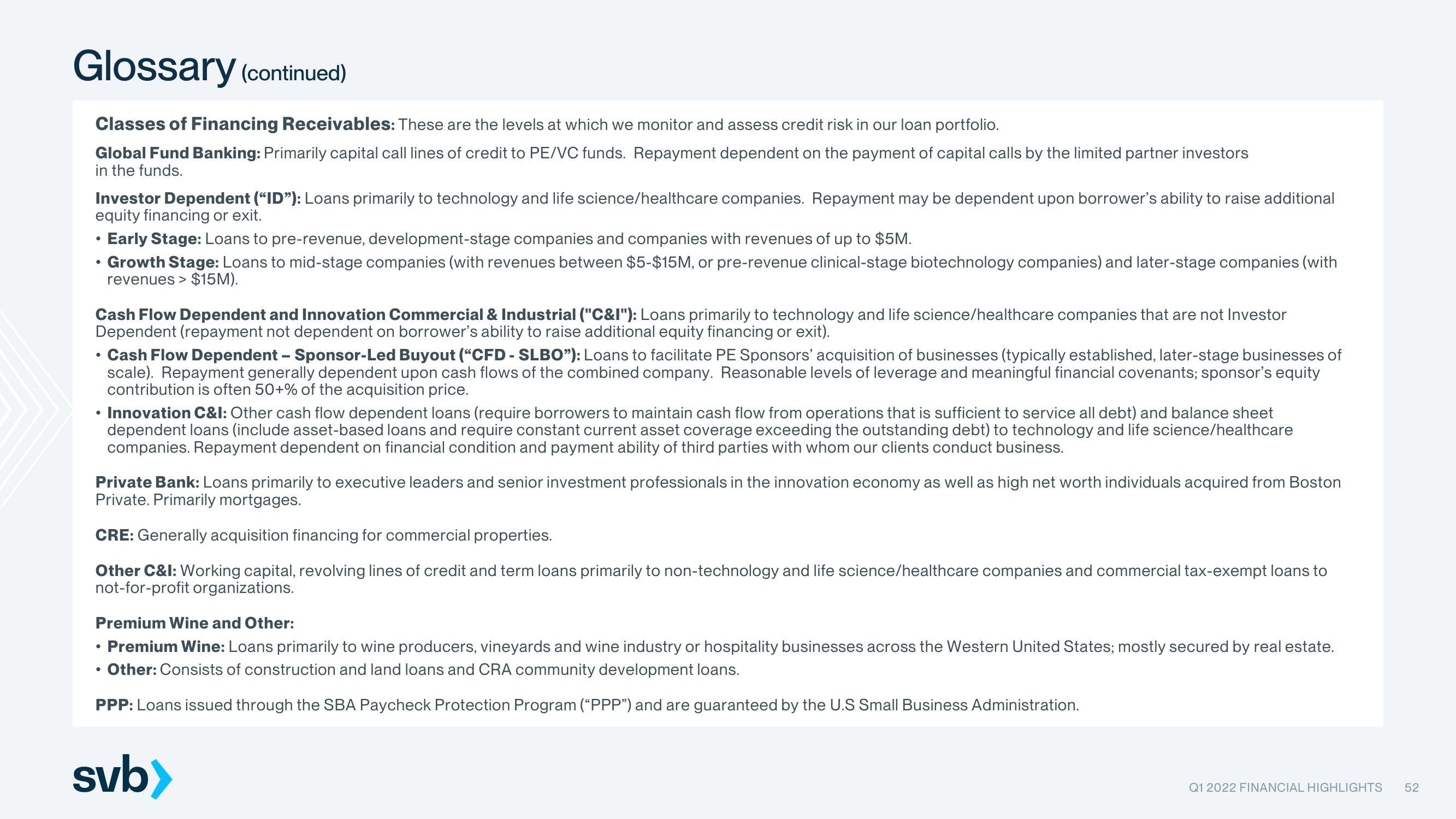

Classes of Financing Receivables: These are the levels at which we monitor and assess credit risk in our loan portfolio.

Global Fund Banking: Primarily capital call lines of credit to PE/VC funds. Repayment dependent on the payment of capital calls by the limited partner investors

in the funds.

Investor Dependent ("ID"): Loans primarily to technology and life science/healthcare companies. Repayment may be dependent upon borrower's ability to raise additional

equity financing or exit.

• Early Stage: Loans to pre-revenue, development-stage companies and companies with revenues of up to $5M.

• Growth Stage: Loans to mid-stage companies (with revenues between $5-$15M, or pre-revenue clinical-stage biotechnology companies) and later-stage companies (with

revenues > $15M).

Cash Flow Dependent and Innovation Commercial & Industrial ("C&I"): Loans primarily to technology and life science/healthcare companies that are not Investor

Dependent (repayment not dependent on borrower's ability to raise additional equity financing or exit).

●

Cash Flow Dependent - Sponsor-Led Buyout ("CFD - SLBO"): Loans to facilitate PE Sponsors' acquisition of businesses (typically established, later-stage businesses of

scale). Repayment generally dependent upon cash flows of the combined company. Reasonable levels of leverage and meaningful financial covenants; sponsor's equity

contribution is often 50+% of the acquisition price.

• Innovation C&I: Other cash flow dependent loans (require borrowers to maintain cash flow from operations that is sufficient to service all debt) and balance sheet

dependent loans (include asset-based loans and require constant current asset coverage exceeding the outstanding debt) to technology and life science/healthcare

companies. Repayment dependent on financial condition and payment ability of third parties with whom our clients conduct business.

Private Bank: Loans primarily to executive leaders and senior investment professionals in the innovation economy as well as high net worth individuals acquired from Boston

Private. Primarily mortgages.

CRE: Generally acquisition financing for commercial properties.

Other C&I: Working capital, revolving lines of credit and term loans primarily to non-technology and life science/healthcare companies and commercial tax-exempt loans to

not-for-profit organizations.

Premium Wine and Other:

Premium Wine: Loans primarily to wine producers, vineyards and wine industry or hospitality businesses across the Western United States; mostly secured by real estate.

Other: Consists of construction and land loans and CRA community development loans.

PPP: Loans issued through the SBA Paycheck Protection Program ("PPP") and are guaranteed by the U.S Small Business Administration.

●

svb)

Q1 2022 FINANCIAL HIGHLIGHTS

52View entire presentation