Apollo Global Management Investor Presentation Deck

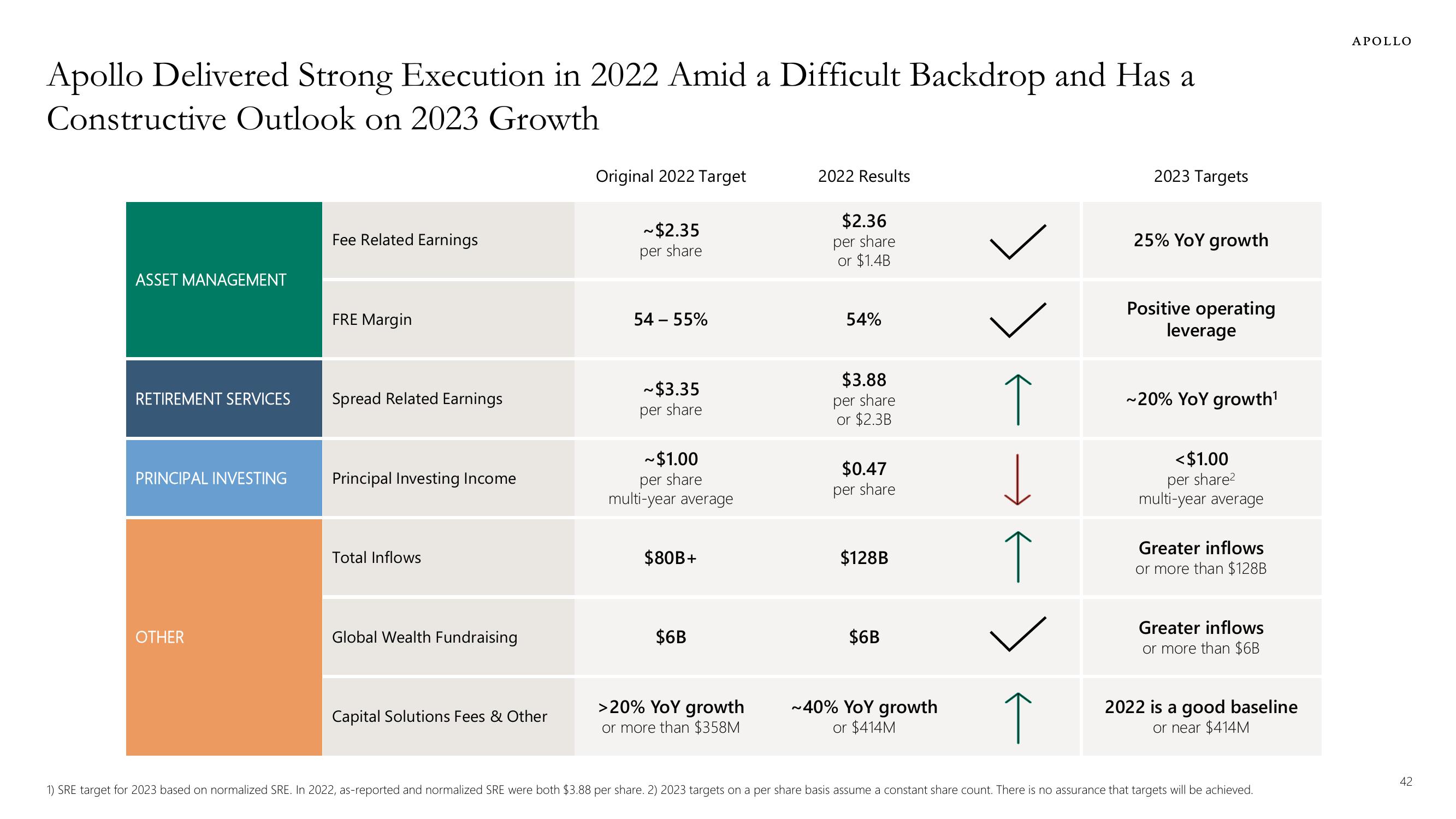

Apollo Delivered Strong Execution in 2022 Amid a Difficult Backdrop and Has a

Constructive Outlook on 2023 Growth

ASSET MANAGEMENT

RETIREMENT SERVICES

PRINCIPAL INVESTING

OTHER

Fee Related Earnings

FRE Margin

Spread Related Earnings

Principal Investing Income

Total Inflows

Global Wealth Fundraising

Capital Solutions Fees & Other

Original 2022 Target

~$2.35

per share

54 - 55%

~$3.35

per share

~$1.00

per share

multi-year average

$80B+

$6B

>20% YoY growth

or more than $358M

2022 Results

$2.36

per share

or $1.4B

54%

$3.88

per share

or $2.3B

$0.47

per share

$128B

$6B

~40% YoY growth

or $414M

↑

-←

↑

2023 Targets

25% YoY growth

Positive operating

leverage

~20% YoY growth¹

<$1.00

per share²

multi-year average

Greater inflows

or more than $128B

Greater inflows

or more than $6B

2022 is a good baseline

or near $414M

1) SRE target for 2023 based on normalized SRE. In 2022, as-reported and normalized SRE were both $3.88 per share. 2) 2023 targets on a per share basis assume a constant share count. There is no assurance that targets will be achieved.

APOLLO

42View entire presentation