Silicon Valley Bank Results Presentation Deck

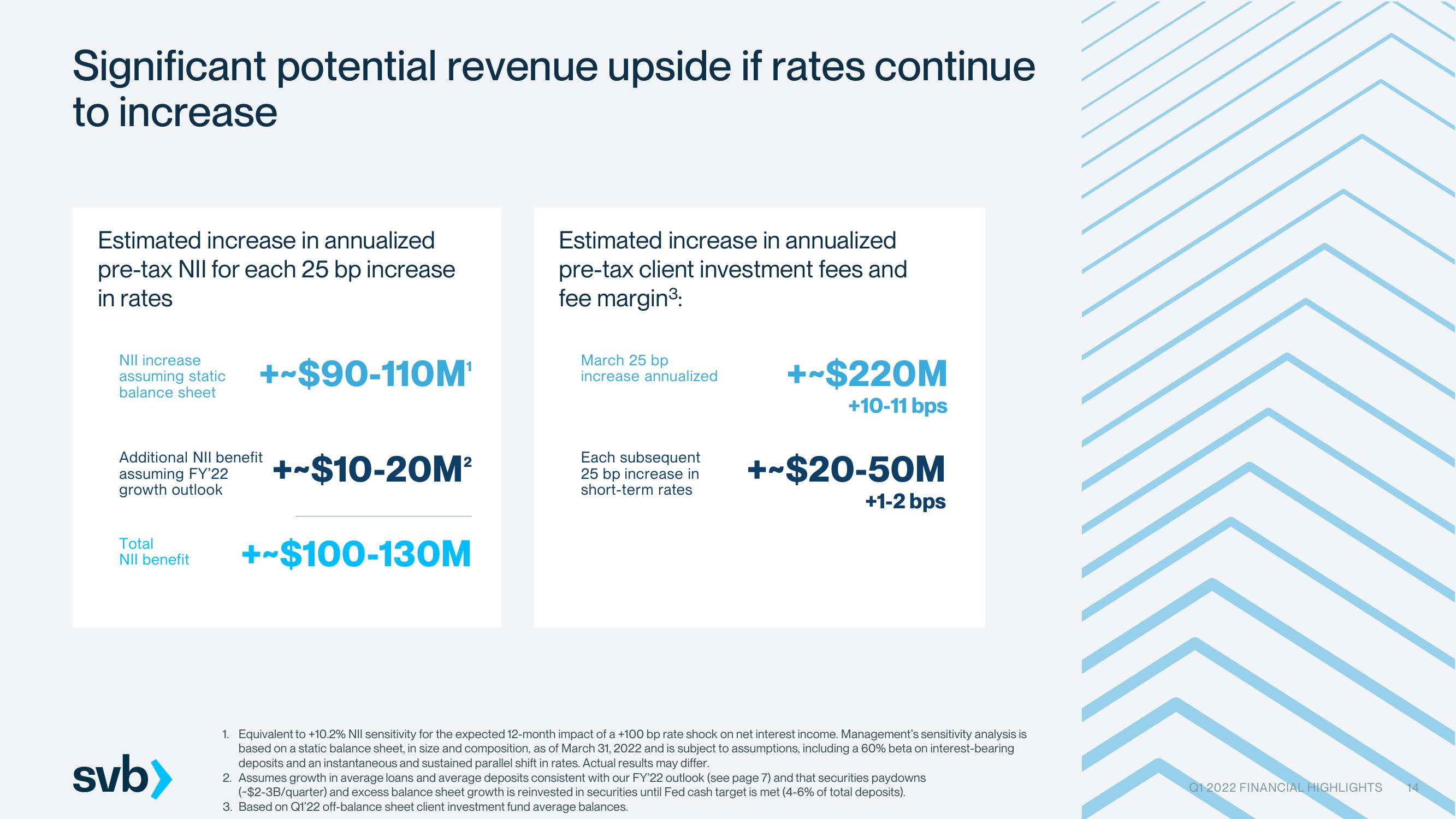

Significant potential revenue upside if rates continue

to increase

Estimated increase in annualized

pre-tax NII for each 25 bp increase

in rates

NII increase

assuming static

balance sheet

Additional NII benefit

assuming FY'22

growth outlook

Total

NII benefit

+~$90-110M¹

svb>

-~$10-20M²

~$100-130M

Estimated increase in annualized

pre-tax client investment fees and

fee margin³:

March 25 bp

increase annualized

Each subsequent

25 bp increase in

short-term rates

+~$220M

+10-11 bps

+~$20-50M

+1-2 bps

1. Equivalent to +10.2% NII sensitivity for the expected 12-month impact of a +100 bp rate shock on net interest income. Management's sensitivity analysis is

based on a static balance sheet, in size and composition, as of March 31, 2022 and is subject to assumptions, including a 60% beta on interest-bearing

deposits and an instantaneous and sustained parallel shift in rates. Actual results may differ.

2. Assumes growth in average loans and average deposits consistent with our FY'22 outlook (see page 7) and that securities paydowns

(-$2-3B/quarter) and excess balance sheet growth is reinvested in securities until Fed cash target is met (4-6% of total deposits).

3. Based on Q1'22 off-balance sheet client investment fund average balances.

Q1 2022 FINANCIAL HIGHLIGHTS

14View entire presentation