Silicon Valley Bank Results Presentation Deck

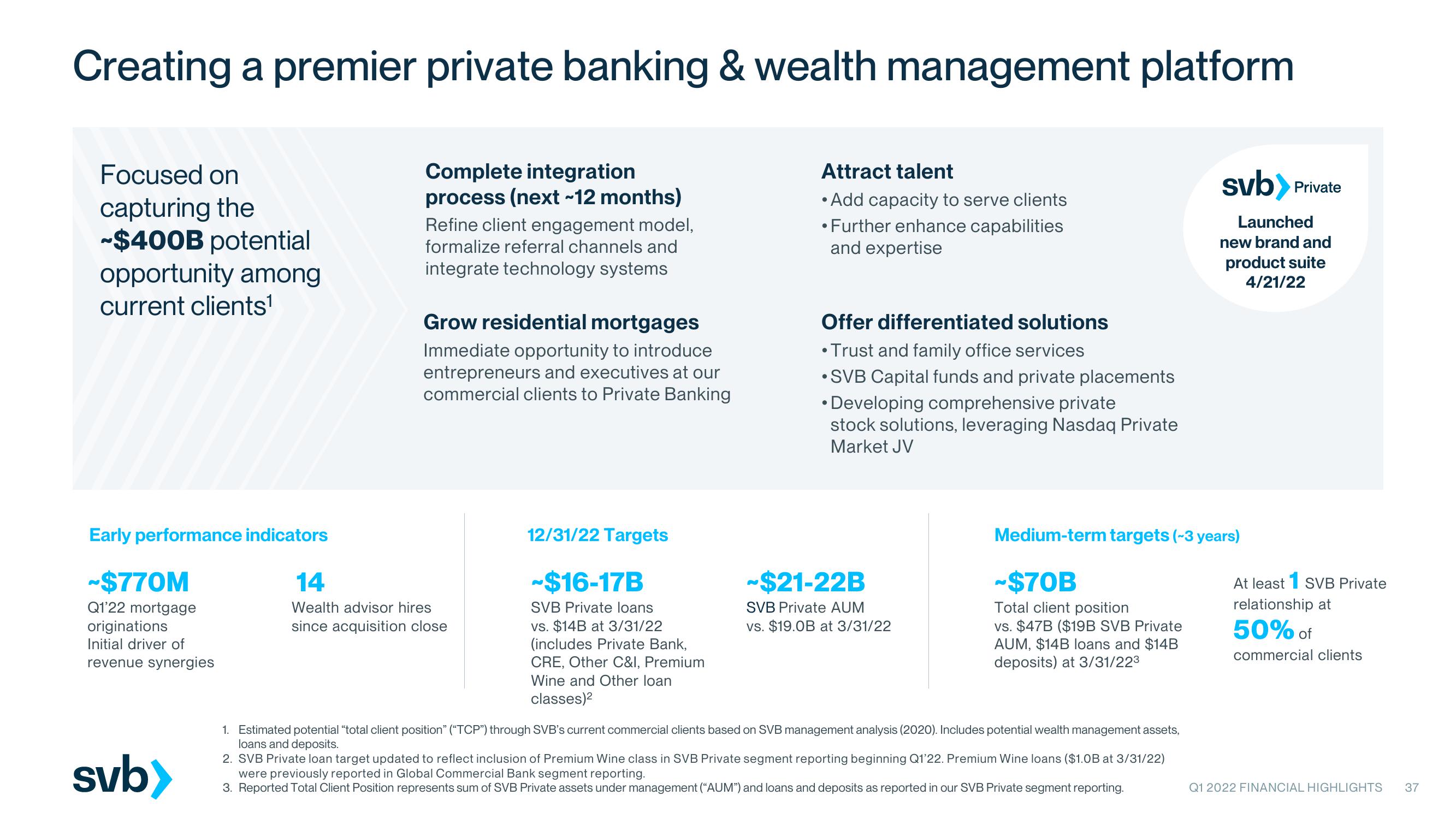

Creating a premier private banking & wealth management platform

Focused on

capturing the

Complete integration

process (next ~12 months)

Refine client engagement model,

formalize referral channels and

integrate technology systems

-$400B potential

opportunity among

current clients¹

Grow residential mortgages

Immediate opportunity to introduce

entrepreneurs and executives at our

commercial clients to Private Banking

Early performance indicators

~$770M

14

Wealth advisor hires

since acquisition close

Q1'22 mortgage

originations

Initial driver of

revenue synergies

svb>

12/31/22 Targets

~$16-17B

SVB Private loans

vs. $14B at 3/31/22

(includes Private Bank,

CRE, Other C&I, Premium

Wine and Other loan

classes)²

Attract talent

Add capacity to serve clients

• Further enhance capabilities

and expertise

Offer differentiated solutions

• Trust and family office services

•SVB Capital funds and private placements

●

• Developing comprehensive private

stock solutions, leveraging Nasdaq Private

Market JV

~$21-22B

SVB Private AUM

vs. $19.0B at 3/31/22

Medium-term targets (~3 years)

~$70B

Total client position

vs. $47B ($19B SVB Private

AUM, $14B loans and $14B

deposits) at 3/31/22³

1. Estimated potential "total client position" ("TCP") through SVB's current commercial clients based on SVB management analysis (2020). Includes potential wealth management assets,

loans and deposits.

svb> Private

Launched

new brand and

product suite

4/21/22

2. SVB Private loan target updated to reflect inclusion of Premium Wine class in SVB Private segment reporting beginning Q1'22. Premium Wine loans ($1.0B at 3/31/22)

were previously reported in Global Commercial Bank segment reporting.

3. Reported Total Client Position represents sum of SVB Private assets under management ("AUM") and loans and deposits as reported in our SVB Private segment reporting.

At least 1 SVB Private

relationship at

50% of

commercial clients

Q1 2022 FINANCIAL HIGHLIGHTS

37View entire presentation