Silicon Valley Bank Results Presentation Deck

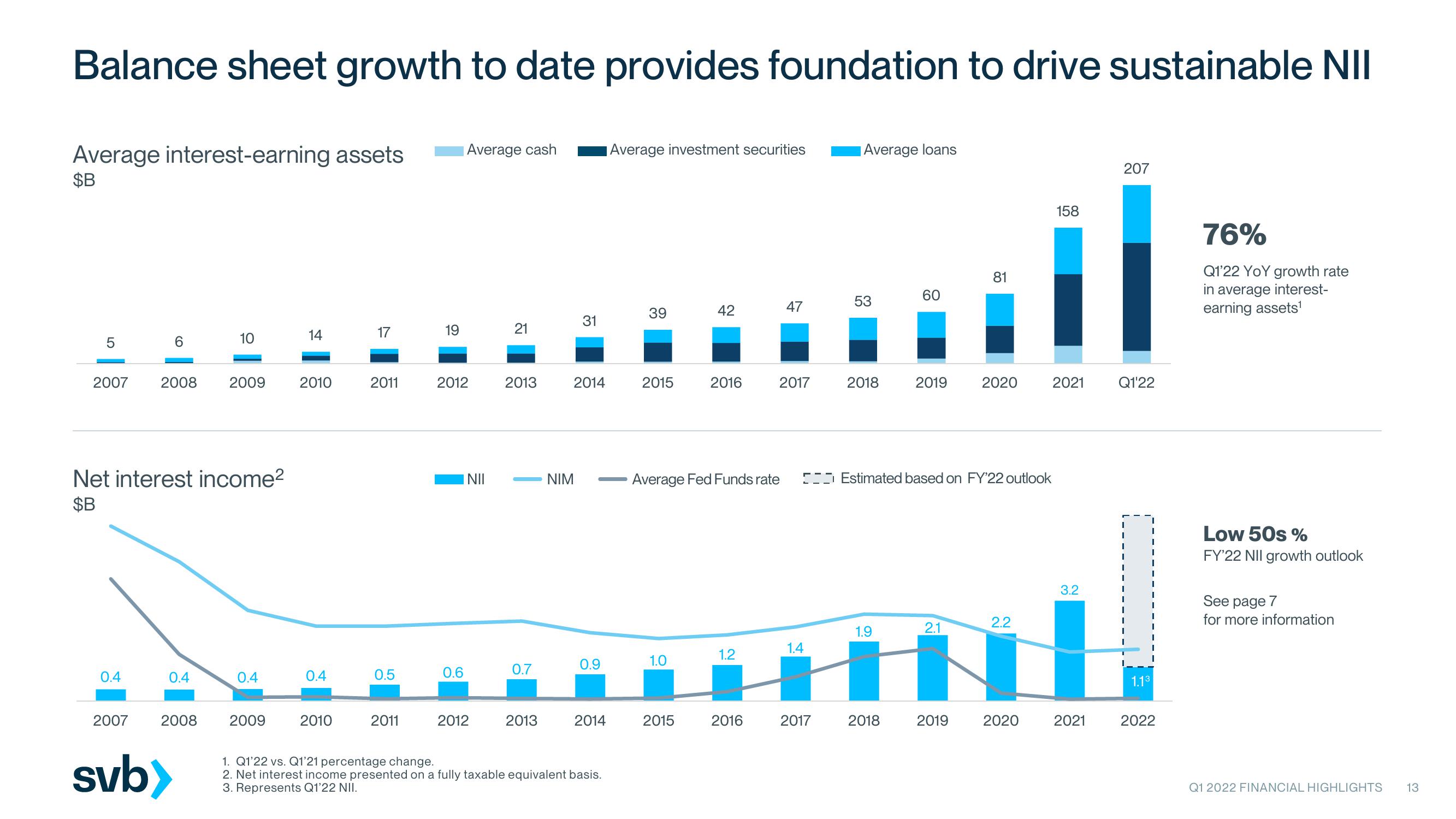

Balance sheet growth to date provides foundation to drive sustainable NII

Average interest-earning assets Average cash

$B

5

2007 2008 2009

0.4

6

Net interest income²

$B

2007

0.4

10

2008

svb>

0.4

2009

14

2010

0.4

2010

17

2011

0.5

2011

19

2012

0.6

NII

2012

21

2013

0.7

2013

NIM

31

2014

0.9

2014

1. Q1'22 vs. Q1'21 percentage change.

2. Net interest income presented on a fully taxable equivalent basis.

3. Represents Q1'22 NII.

Average investment securities

39

2015

1.0

42

2015

2016

Average Fed Funds rate

1.2

2016

47

2017

1.4

2017

Average loans

53

2018

60

1.9

2019

2018

Estimated based on FY'22 outlook

2.1

IN

2019

81

2020

2.2

2020

158

2021

3.2

2021

207

Q1'22

1.13

2022

76%

Q1'22 YoY growth rate

in average interest-

earning assets¹

Low 50s%

FY'22 NII growth outlook

See page 7

for more information

Q1 2022 FINANCIAL HIGHLIGHTS

13View entire presentation