Silicon Valley Bank Results Presentation Deck

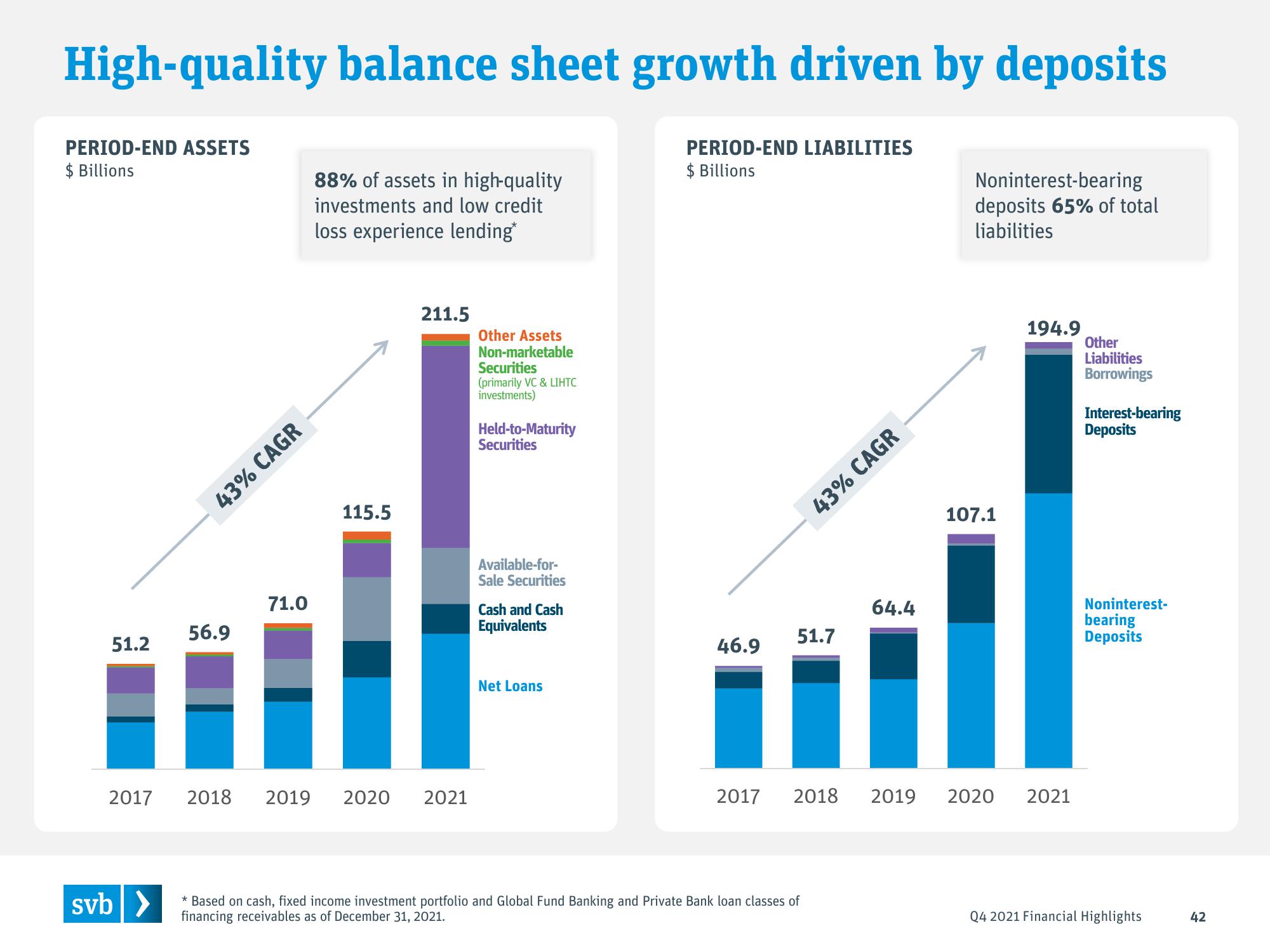

High-quality balance sheet growth driven by deposits

PERIOD-END ASSETS

$ Billions

PERIOD-END LIABILITIES

$ Billions

51.2

2017

svb >

43% CAGR

56.9

88% of assets in high-quality

investments and low credit

loss experience lending*

71.0

115.5

211.5

2018 2019 2020 2021

Other Assets

Non-marketable

Securities

(primarily VC & LIHTC

investments)

Held-to-Maturity

Securities

Available-for-

Sale Securities

Cash and Cash

Equivalents

Net Loans

46.9

2017

43% CAGR

51.7

2018

* Based on cash, fixed income investment portfolio and Global Fund Banking and Private Bank loan classes of

financing receivables as of December 31, 2021.

64.4

Noninterest-bearing

deposits 65% of total

liabilities

107.1

194.9

2019 2020 2021

Other

Liabilities

Borrowings

Interest-bearing

Deposits

Noninterest-

bearing

Deposits

Q4 2021 Financial Highlights

42View entire presentation