FL Entertaiment SPAC

6 Transaction structured to align all stakeholders

Highlights

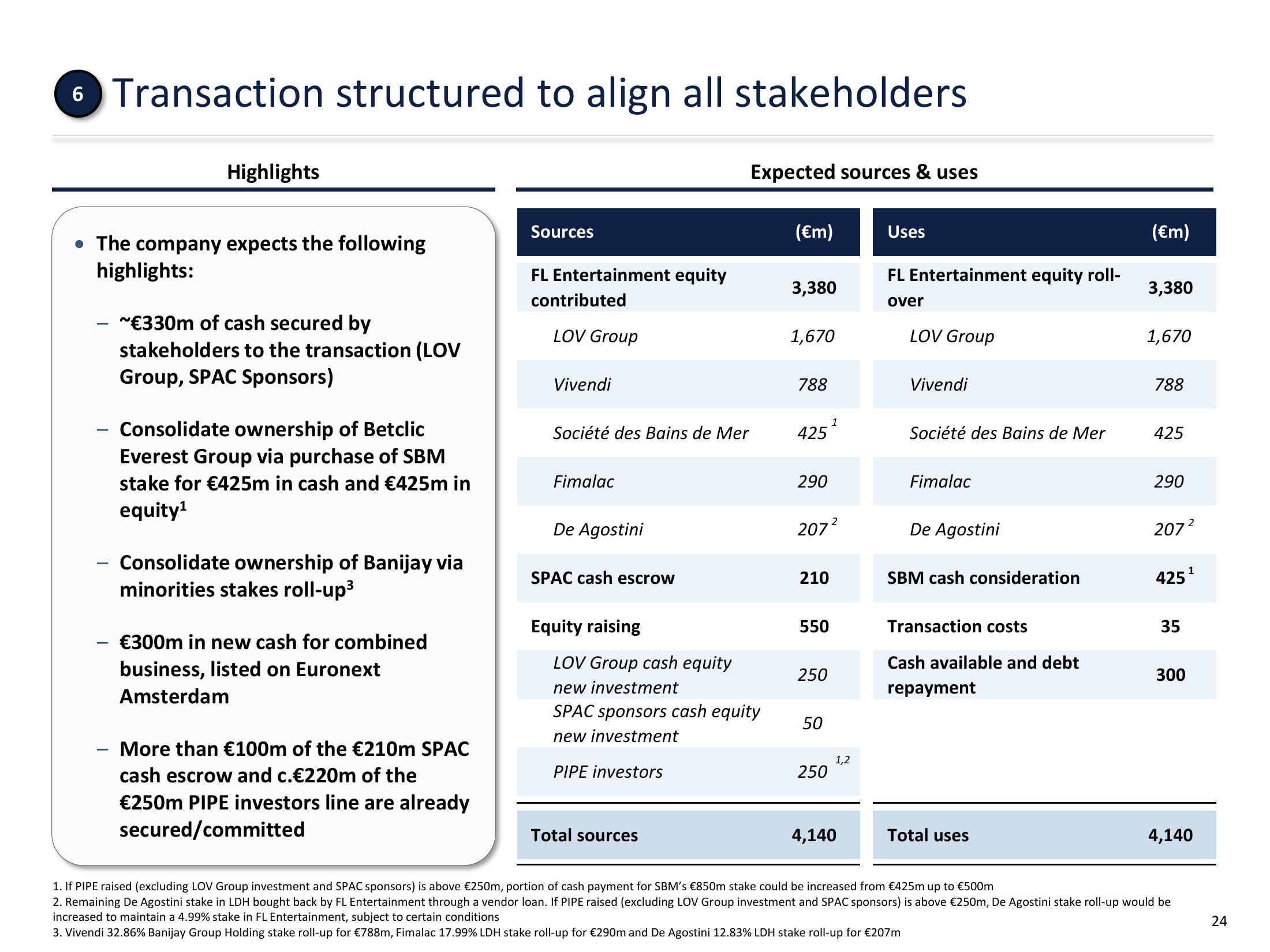

The company expects the following

highlights:

~€330m of cash secured by

stakeholders to the transaction (LOV

Group, SPAC Sponsors)

Consolidate ownership of Betclic

Everest Group via purchase of SBM

stake for €425m in cash and €425m in

equity¹

Consolidate ownership of Banijay via

minorities stakes roll-up³

€300m in new cash for combined

business, listed on Euronext

Amsterdam

More than €100m of the €210m SPAC

cash escrow and c.€220m of the

€250m PIPE investors line are already

secured/committed

Sources

FL Entertainment equity

contributed

LOV Group

Vivendi

Société des Bains de Mer

Fimalac

De Agostini

SPAC cash escrow

Equity raising

Expected sources & uses

LOV Group cash equity

new investment

SPAC sponsors cash equity

new investment

PIPE investors

Total sources

(€m)

3,380

1,670

788

425

290

207²

210

550

250

50

1

250

1,2

4,140

Uses

FL Entertainment equity roll-

over

LOV Group

Vivendi

Société des Bains de Mer

Fimalac

De Agostini

SBM cash consideration

Transaction costs

Cash available and debt

repayment

Total uses

(€m)

3,380

1,670

788

425

290

207²

425¹

35

300

4,140

1. If PIPE raised (excluding LOV Group investment and SPAC sponsors) is above €250m, portion of cash payment for SBM's €850m stake could be increased from €425m up to €500m

2. Remaining De Agostini stake in LDH bought back by FL Entertainment through a vendor loan. If PIPE raised (excluding LOV Group investment and SPAC sponsors) is above €250m, De Agostini stake roll-up would be

increased to maintain a 4.99% stake in FL Entertainment, subject to certain conditions

3. Vivendi 32.86% Banijay Group Holding stake roll-up for €788m, Fimalac 17.99% LDH stake roll-up for €290m and De Agostini 12.83% LDH stake roll-up for €207m

24View entire presentation