Silicon Valley Bank Results Presentation Deck

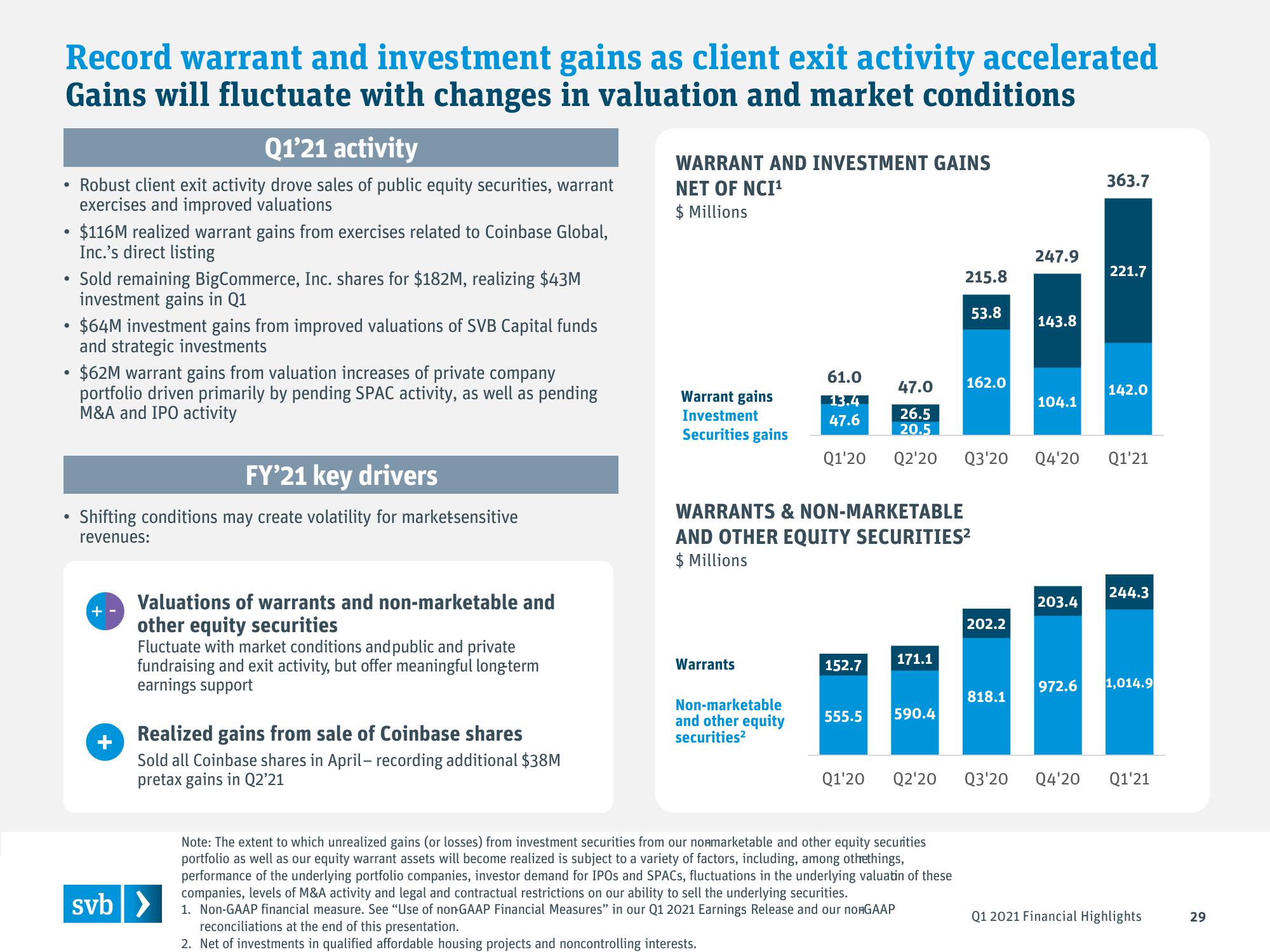

Record warrant and investment gains as client exit activity accelerated

Gains will fluctuate with changes in valuation and market conditions

●

●

• $116M realized warrant gains from exercises related to Coinbase Global,

Inc.'s direct listing

●

Q1'21 activity

Robust client exit activity drove sales of public equity securities, warrant

exercises and improved valuations

●

Sold remaining BigCommerce, Inc. shares for $182M, realizing $43M

investment gains in Q1

●

• $64M investment gains from improved valuations of SVB Capital funds

and strategic investments

$62M warrant gains from valuation increases of private company

portfolio driven primarily by pending SPAC activity, as well as pending

M&A and IPO activity

FY'21 key drivers

Shifting conditions may create volatility for marketsensitive

revenues:

+

+

Valuations of warrants and non-marketable and

other equity securities

Fluctuate with market conditions and public and private

fundraising and exit activity, but offer meaningful long-term

earnings support

Realized gains from sale of Coinbase shares

Sold all Coinbase shares in April- recording additional $38M

pretax gains in Q2'21

svb>

WARRANT AND INVESTMENT GAINS

NET OF NCI¹

$ Millions

Warrant gains

Investment

Securities gains

Warrants

61.0

13.4

47.6

Non-marketable

and other equity

securities²

Q1'20

152.7

WARRANTS & NON-MARKETABLE

AND OTHER EQUITY SECURITIES²

$ Millions

47.0 162.0

26.5

20.5

Q2'20

171.1

555.5 590.4

215.8

Q1'20 Q2'20

53.8

Note: The extent to which unrealized gains (or losses) from investment securities from our nonmarketable and other equity securities

portfolio as well as our equity warrant assets will become realized is subject to a variety of factors, including, among othethings,

performance of the underlying portfolio companies, investor demand for IPOs and SPACs, fluctuations in the underlying valuatin of these

companies, levels of M&A activity and legal and contractual restrictions on our ability to sell the underlying securities.

1. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q1 2021 Earnings Release and our noRGAAP

reconciliations at the end of this presentation.

2. Net of investments in qualified affordable housing projects and noncontrolling interests.

202.2

247.9

818.1

143.8

104.1

Q3'20 Q4'20 Q1'21

363.7

203.4

221.7

142.0

244.3

972.6 1,014.9

Q3'20 Q4'20 Q1'21

Q1 2021 Financial Highlights

29View entire presentation