Sotheby's Investor Briefing

.

• 91%, or $636mm, of Sotheby's cash is held by foreign

subsidiaries¹

-

OFFSHORE FUNDING & CASH BALANCES

H

Over half of Sotheby's business is generated outside the United

States

Key Considerations Regarding Repatriation

Ongoing international funding needs and investment opportunities

• U.S. capital requirements

Cash tax payment and impact to effective tax rate on repatriated

cash, after considering the benefit of claiming available foreign tax

credits

Impact of current / future tax regulations

40

$585mm subject to additional taxes if repatriated¹

Many multi-national companies are also facing similar

considerations regarding foreign cash

¹ As of June 30, 2013.

2 Based on location of sales for fiscal year 2012.

Sotheby's

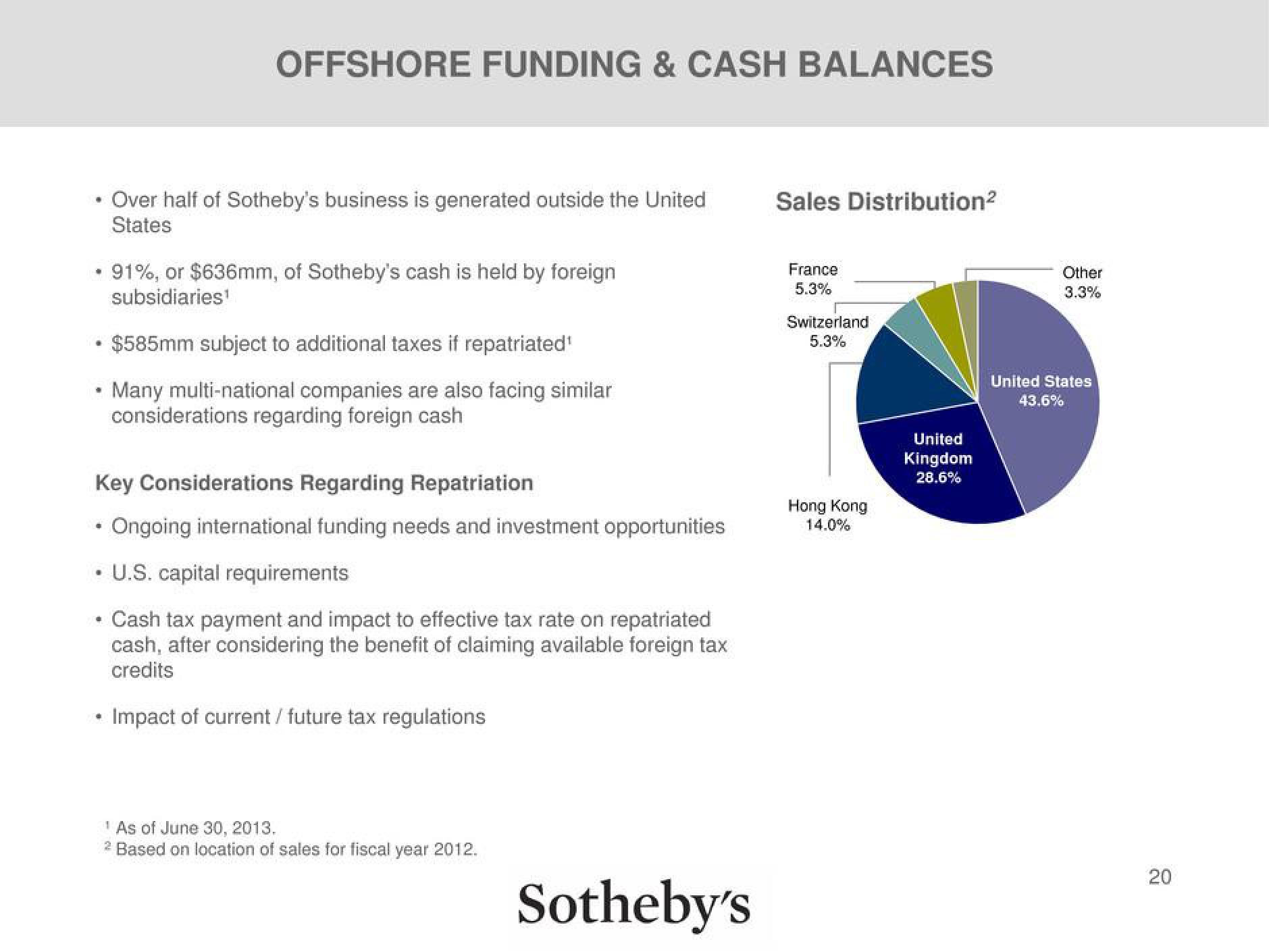

Sales Distribution²

France

5.3%

Switzerland

5.3%

Hong Kong

14.0%

United

Kingdom

28.6%

Other

3.3%

United States

43.6%

20View entire presentation