Silicon Valley Bank Results Presentation Deck

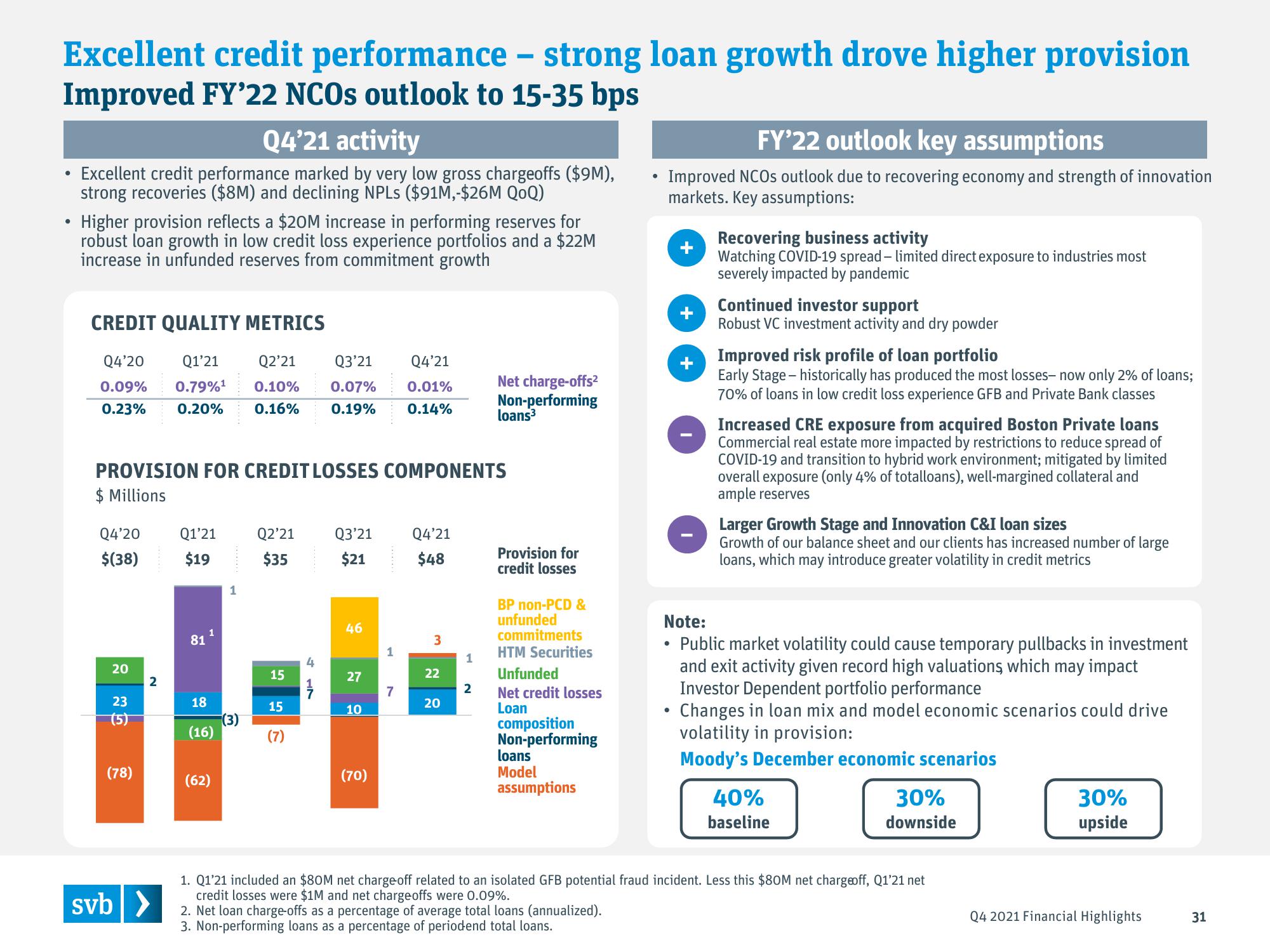

Excellent credit performance - strong loan growth drove higher provision

Improved FY'22 NCOs outlook to 15-35 bps

●

Q4'21 activity

Excellent credit performance marked by very low gross chargeoffs ($9M),

strong recoveries ($8M) and declining NPLs ($91M,-$26M QoQ)

Higher provision reflects a $20M increase in performing reserves for

robust loan growth in low credit loss experience portfolios and a $22M

increase in unfunded reserves from commitment growth

CREDIT QUALITY METRICS

Q4'20

Q1'21

0.09%

0.79%¹

0.23% 0.20%

Q4'20 Q1'21

$(38)

$19

20

PROVISION FOR CREDIT LOSSES COMPONENTS

$ Millions

23

(5)

(78)

2

svb >

81

1

18

(16)

(62)

1

Q2'21

0.10%

0.16%

(3)

Q2'21

$35

15

15

Q4'21

Q3'21

0.07%

0.01%

0.19% 0.14%

4

1

Q3'21

$21

46

27

10

(70)

1

7

Q4'21

$48

3

22

20

1

Net charge-offs²

Non-performing

loans³

2

Provision for

credit losses

BP non-PCD &

unfunded

commitments

HTM Securities

Unfunded

Net credit losses

Loan

composition

Non-performing

loans

Model

assumptions

●

2. Net loan charge-offs as a percentage of average total loans (annualized).

3. Non-performing loans as a percentage of periodend total loans.

FY'22 outlook key assumptions

Improved NCOs outlook due to recovering economy and strength of innovation

markets. Key assumptions:

+

●

+

+

Recovering business activity

Watching COVID-19 spread-limited direct exposure to industries most

severely impacted by pandemic

Continued investor support

Robust VC investment activity and dry powder

Improved risk profile of loan portfolio

Early Stage - historically has produced the most losses- now only 2% of loans;

70% of loans in low credit loss experience GFB and Private Bank classes

Increased CRE exposure from acquired Boston Private loans

Commercial real estate more impacted by restrictions to reduce spread of

COVID-19 and transition to hybrid work environment; mitigated by limited

overall exposure (only 4% of totalloans), well-margined collateral and

ample reserves

Larger Growth Stage and Innovation C&I loan sizes

Growth of our balance sheet and our clients has increased number of large

loans, which may introduce greater volatility in credit metrics

Note:

Public market volatility could cause temporary pullbacks in investment

and exit activity given record high valuations which may impact

Investor Dependent portfolio performance

Changes in loan mix and model economic scenarios could drive

volatility in provision:

Moody's December economic scenarios

40%

baseline

30%

downside

1. Q1'21 included an $80M net charge off related to an isolated GFB potential fraud incident. Less this $80M net chargeoff, Q1'21 net

credit losses were $1M and net chargeoffs were 0.09%.

30%

upside

Q4 2021 Financial Highlights

31View entire presentation