Silicon Valley Bank Results Presentation Deck

Active capital management to support extraordinary growth

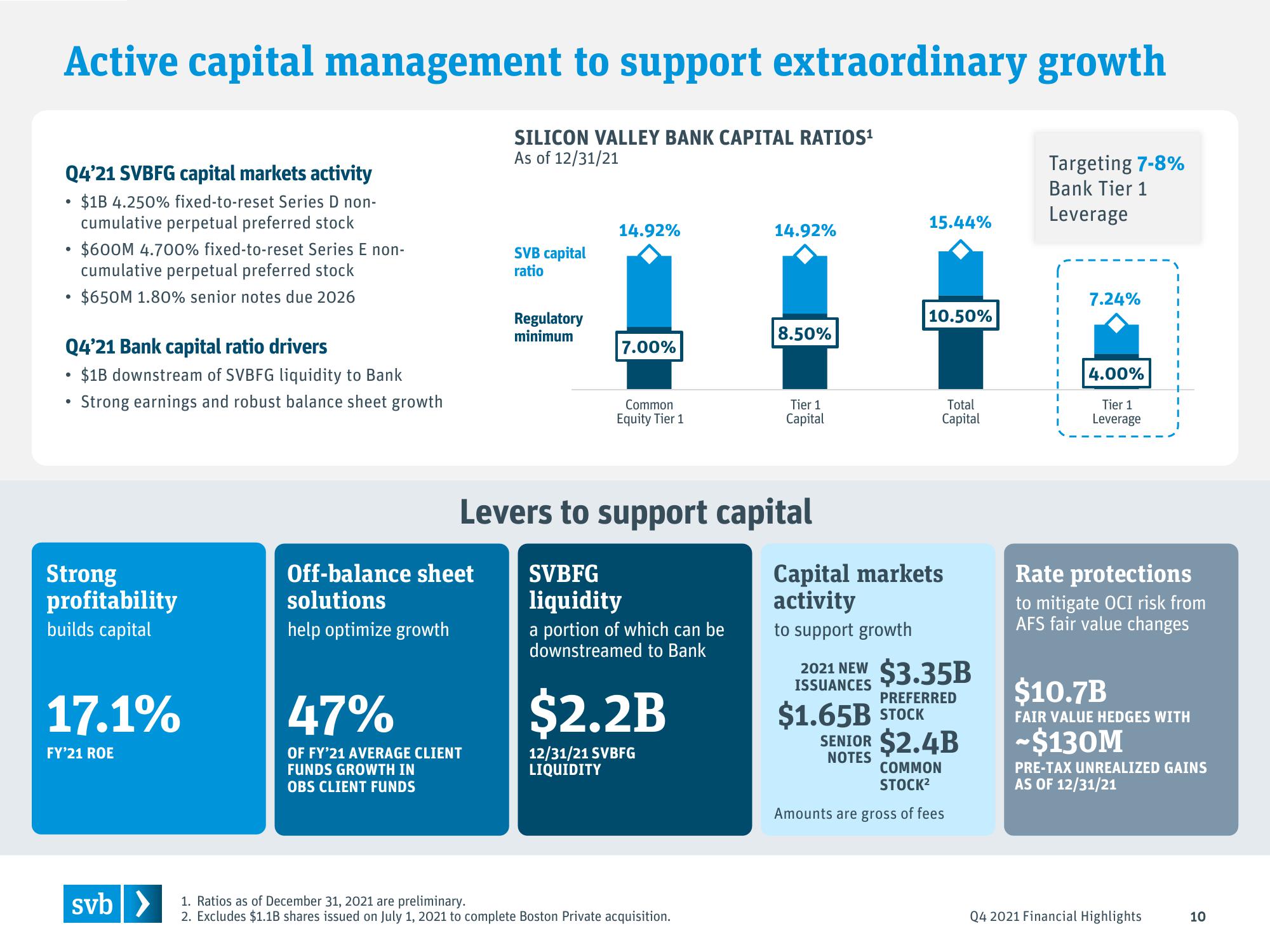

SILICON VALLEY BANK CAPITAL RATIOS¹

As of 12/31/21

Q4'21 SVBFG capital markets activity

$1B 4.250% fixed-to-reset Series D non-

cumulative perpetual preferred stock

•

●

●

Q4'21 Bank capital ratio drivers

$1B downstream of SVBFG liquidity to Bank

Strong earnings and robust balance sheet growth

●

$600M 4.700% fixed-to-reset Series E non-

cumulative perpetual preferred stock

$650M 1.80% senior notes due 2026

●

Strong

profitability

builds capital

17.1%

FY'21 ROE

svb >

Off-balance sheet

solutions

help optimize growth

SVB capital

ratio

47%

OF FY'21 AVERAGE CLIENT

FUNDS GROWTH IN

OBS CLIENT FUNDS

Regulatory

minimum

14.92%

7.00%

Common

Equity Tier 1

Levers to support capital

SVBFG

liquidity

a portion of which can be

downstreamed to Bank

$2.2B

12/31/21 SVBFG

LIQUIDITY

14.92%

1. Ratios as of December 31, 2021 are preliminary.

2. Excludes $1.1B shares issued on July 1, 2021 to complete Boston Private acquisition.

8.50%

Tier 1

Capital

15.44%

10.50%

Total

Capital

Capital markets

activity

to support growth

$1.65B STOCK

2021 NEW $3.35B

ISSUANCES

PREFERRED

SENIOR $2.4B

NOTES

COMMON

STOCK²

Amounts are gross of fees

Targeting 7-8%

Bank Tier 1

Leverage

7.24%

4.00%

Tier 1

Leverage

I

Rate protections

to mitigate OCI risk from

AFS fair value changes

$10.7B

FAIR VALUE HEDGES WITH

-$130M

PRE-TAX UNREALIZED GAINS

AS OF 12/31/21

Q4 2021 Financial Highlights

10View entire presentation