Silicon Valley Bank Results Presentation Deck

Moderating market-related gains and potential volatility

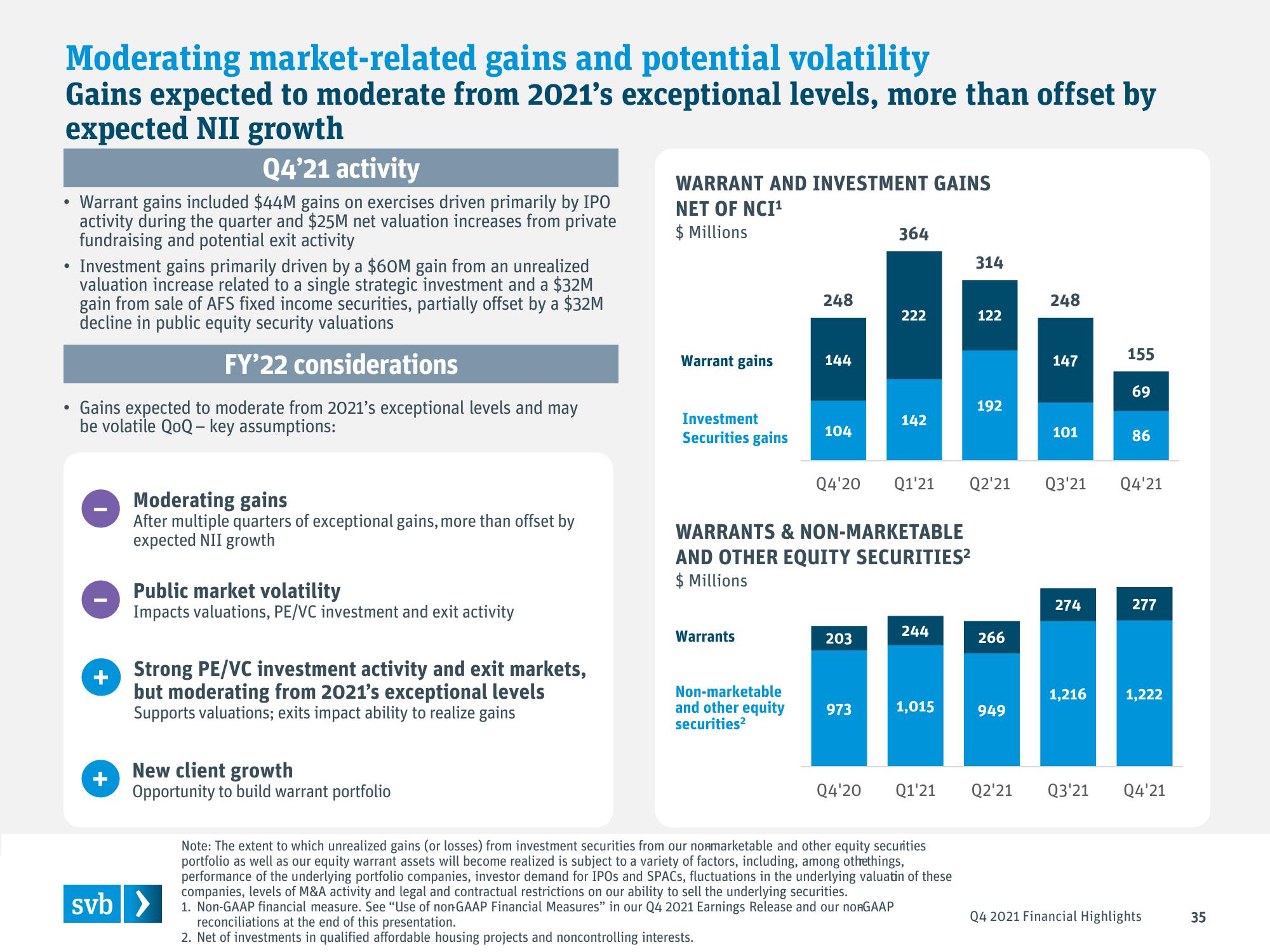

Gains expected to moderate from 2021's exceptional levels, more than offset by

expected NII growth

Q4'21 activity

●

●

Warrant gains included $44M gains on exercises driven primarily by IPO

activity during the quarter and $25M net valuation increases from private

fundraising and potential exit activity

Investment gains primarily driven by a $60M gain from an unrealized

valuation increase related to a single strategic investment and a $32M

gain from sale of AFS fixed income securities, partially offset by a $32M

decline in public equity security valuations

FY'22 considerations

Gains expected to moderate from 2021's exceptional levels and may

be volatile QoQ-key assumptions:

Moderating gains

After multiple quarters of exceptional gains, more than offset by

expected NII growth

+

Public market volatility

Impacts valuations, PE/VC investment and exit activity

+Strong PE/VC investment activity and exit markets,

but moderating from 2021's exceptional levels

Supports valuations; exits impact ability to realize gains

New client growth

Opportunity to build warrant portfolio

svb >

WARRANT AND INVESTMENT GAINS

NET OF NCI¹

$ Millions

Warrant gains

Investment

Securities gains

Warrants

248

Non-marketable

and other equity

securities²

144

104

Q4'20

203

364

973

222

WARRANTS & NON-MARKETABLE

AND OTHER EQUITY SECURITIES²

$ Millions

142

Q1'21

244

1,015

314

Note: The extent to which unrealized gains (or losses) from investment securities from our nomarketable and other equity securities

portfolio as well as our equity warrant assets will become realized is subject to a variety of factors, including, among othethings,

performance of the underlying portfolio companies, investor demand for IPOs and SPACs, fluctuations in the underlying valuatin of these

companies, levels of M&A activity and legal and contractual restrictions on our ability to sell the underlying securities.

1. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2021 Earnings Release and our nonGAAP

reconciliations at the end of this presentation.

2. Net of investments in qualified affordable housing projects and noncontrolling interests.

122

192

Q2'21

266

949

248

147

101

274

155

1,216

69

Q3'21 Q4'21

86

277

1,222

Q4'20 Q1'21 Q2'21 Q3'21 Q4'21

Q4 2021 Financial Highlights

35View entire presentation