FL Entertaiment SPAC

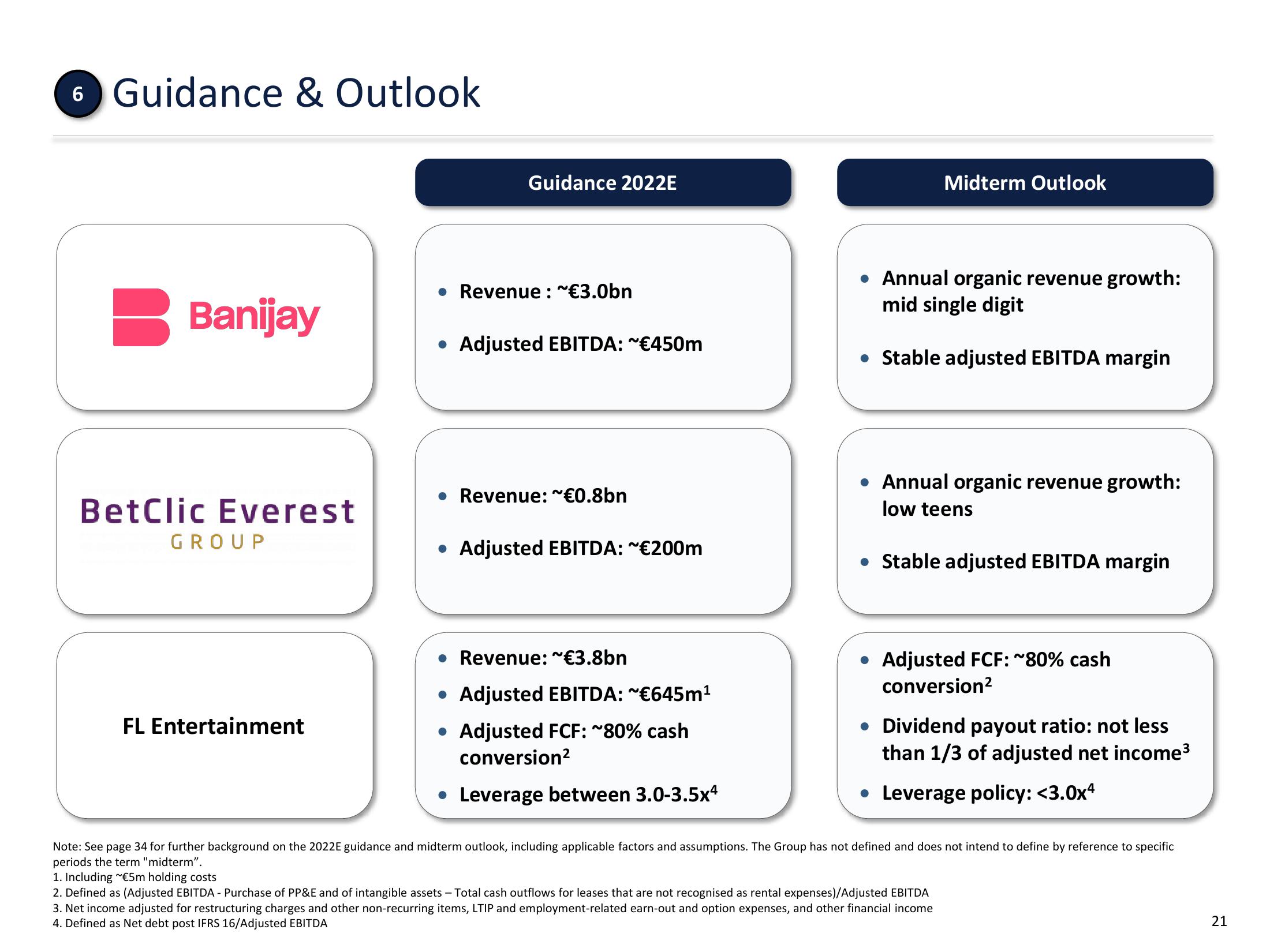

6 Guidance & Outlook

B Banijay

BetClic Everest

GROUP

FL Entertainment

Guidance 2022E

• Revenue : ~€3.0bn

Adjusted EBITDA: ~€450m

Revenue: ~€0.8bn

• Adjusted EBITDA: ~€200m

• Revenue: ~€3.8bn

• Adjusted EBITDA: ~€645m¹

• Adjusted FCF: ~80% cash

conversion²

Leverage between 3.0-3.5x4

Midterm Outlook

Annual organic revenue growth:

mid single digit

Stable adjusted EBITDA margin

Annual organic revenue growth:

low teens

Stable adjusted EBITDA margin

Adjusted FCF: ~80% cash

conversion²

Dividend payout ratio: not less

than 1/3 of adjusted net income³

Leverage policy: <3.0x4

Note: See page 34 for further background on the 2022E guidance and midterm outlook, including applicable factors and assumptions. The Group has not defined and does not intend to define by reference to specific

periods the term "midterm".

1. Including ~€5m holding costs

2. Defined as (Adjusted EBITDA - Purchase of PP&E and of intangible assets - Total cash outflows for leases that are not recognised as rental expenses)/Adjusted EBITDA

3. Net income adjusted for restructuring charges and other non-recurring items, LTIP and employment-related earn-out and option expenses, and other financial income

4. Defined as Net debt post IFRS 16/Adjusted EBITDA

21View entire presentation