Silicon Valley Bank Results Presentation Deck

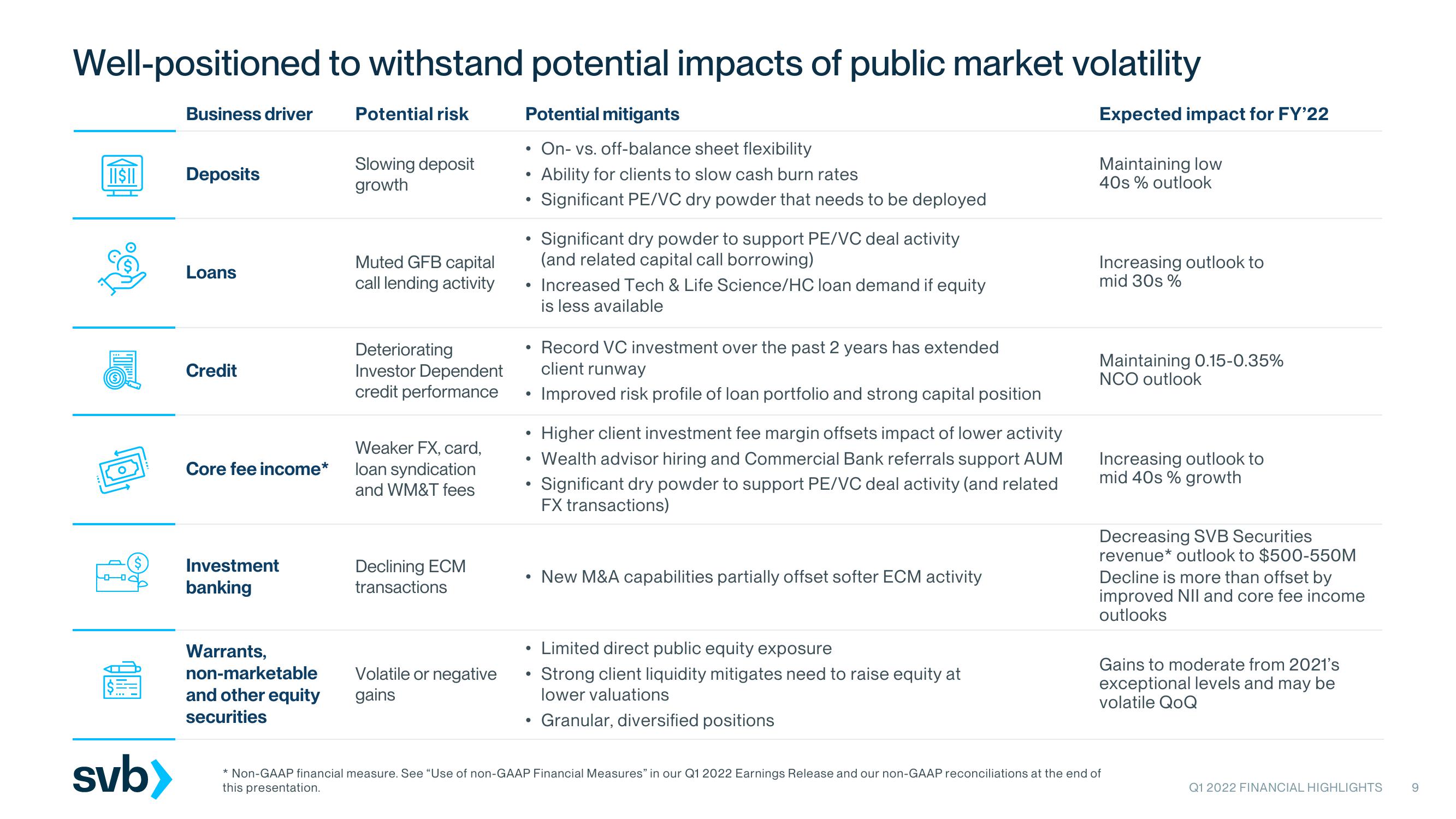

Well-positioned to withstand potential impacts of public market volatility

Potential risk

||$||

$

2

svb>

Business driver

Deposits

Loans

Credit

Core fee income*

Investment

banking

Warrants,

non-marketable

and other equity

securities

Slowing deposit

growth

Muted GFB capital

call lending activity

Deteriorating

Investor Dependent

credit performance

Weaker FX, card,

loan syndication

and WM&T fees

Declining ECM

transactions

Volatile or negative

gains

Potential mitigants

On- vs. off-balance sheet flexibility

Ability for clients to slow cash burn rates

Significant PE/VC dry powder that needs to be deployed

●

●

●

●

●

●

●

●

●

●

●

●

Significant dry powder to support PE/VC deal activity

(and related capital call borrowing)

Increased Tech & Life Science/HC loan demand if equity

is less available

Record VC investment over the past 2 years has extended

client runway

Improved risk profile of loan portfolio and strong capital position

Higher client investment fee margin offsets impact of lower activity

Wealth advisor hiring and Commercial Bank referrals support AUM

Significant dry powder to support PE/VC deal activity (and related

FX transactions)

New M&A capabilities partially offset softer ECM activity

Limited direct public equity exposure

Strong client liquidity mitigates need to raise equity at

lower valuations

Granular, diversified positions

Expected impact for FY'22

Maintaining low

40s % outlook

Increasing outlook to

mid 30s %

Maintaining 0.15-0.35%

NCO outlook

Increasing outlook to

mid 40s % growth

Decreasing SVB Securities

revenue* outlook to $500-550M

Decline is more than offset by

improved NII and core fee income

outlooks

Gains to moderate from 2021's

exceptional levels and may be

volatile QoQ

* Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q1 2022 Earnings Release and our non-GAAP reconciliations at the end of

this presentation.

Q1 2022 FINANCIAL HIGHLIGHTS

9View entire presentation