Silicon Valley Bank Results Presentation Deck

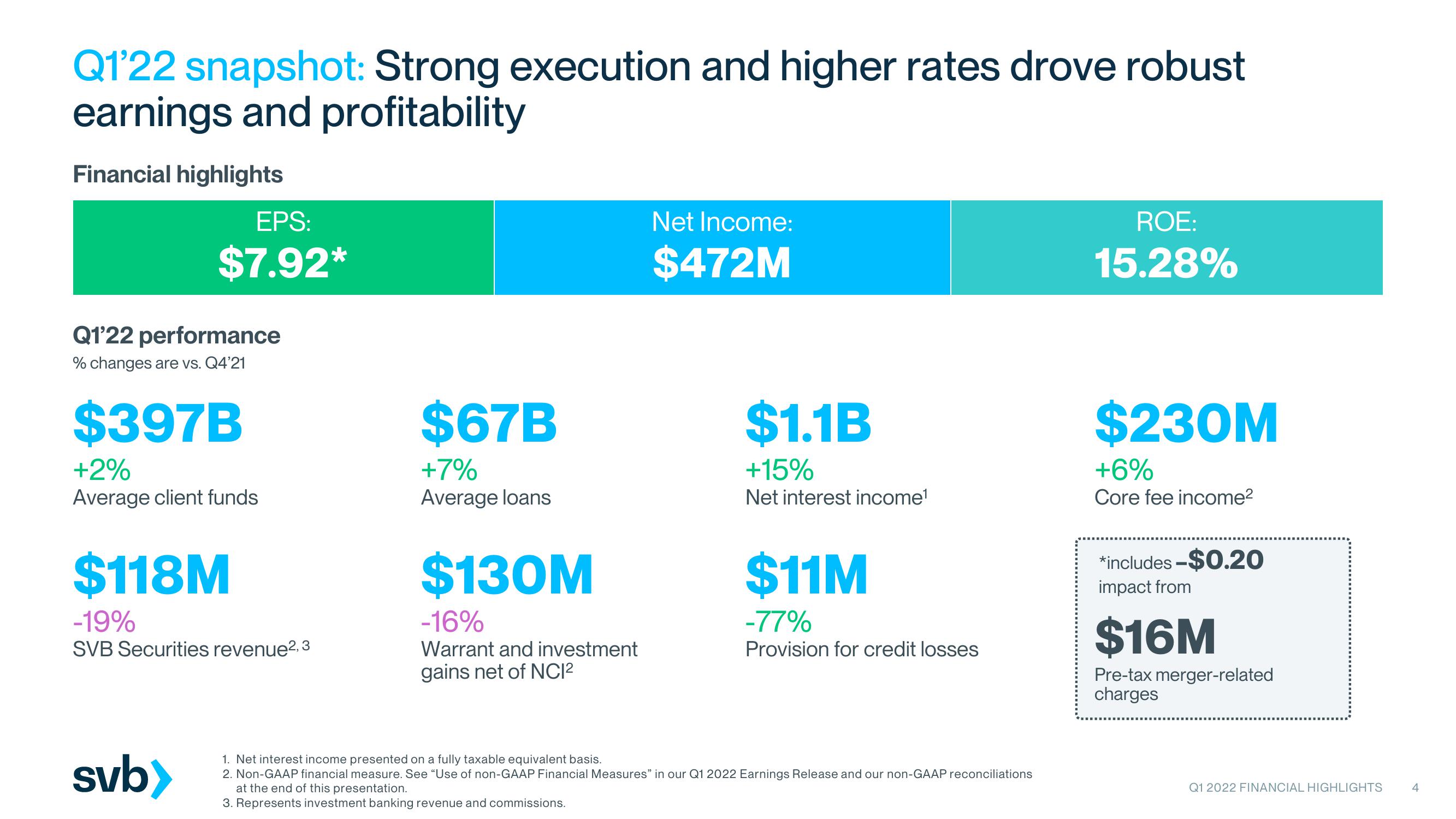

Q1'22 snapshot: Strong execution and higher rates drove robust

earnings and profitability

Financial highlights

EPS:

$7.92*

Q1'22 performance

% changes are vs. Q4'21

$397B

+2%

Average client funds

$118M

-19%

SVB Securities revenue², 3

svb>

$67B

+7%

Average loans

$130M

-16%

Warrant and investment

gains net of NC1²

Net Income:

$472M

$1.1B

+15%

Net interest income¹

$11M

-77%

Provision for credit losses

1. Net interest income presented on a fully taxable equivalent basis.

2. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q1 2022 Earnings Release and our non-GAAP reconciliations

at the end of this presentation.

3. Represents investment banking revenue and commissions.

ROE:

15.28%

$230M

+6%

Core fee income²

*includes - $0.20

impact from

$16M

Pre-tax merger-related

charges

Q1 2022 FINANCIAL HIGHLIGHTS

4View entire presentation