Silicon Valley Bank Results Presentation Deck

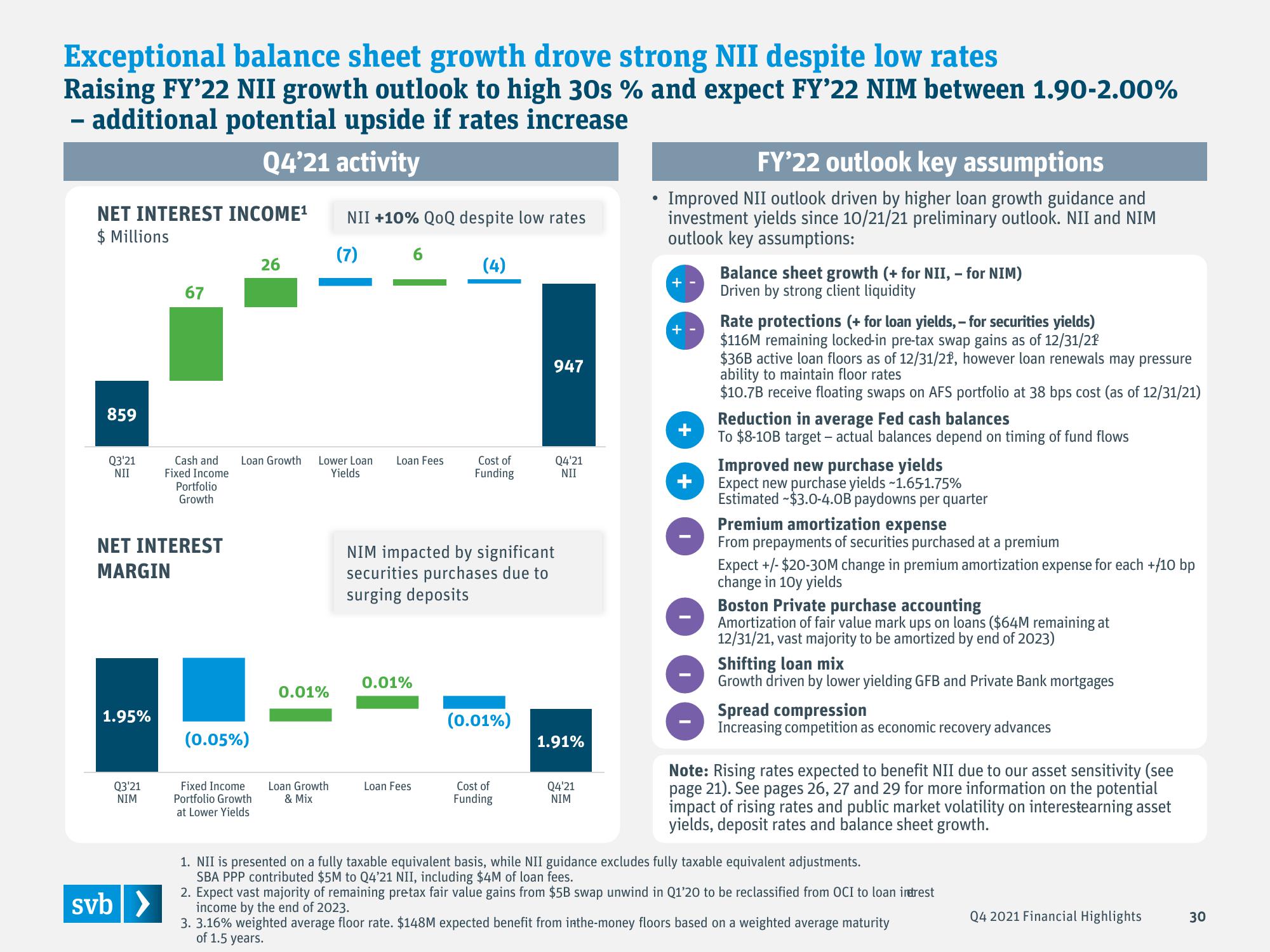

Exceptional balance sheet growth drove strong NII despite low rates

Raising FY'22 NII growth outlook to high 30s % and expect FY'22 NIM between 1.90-2.00%

– additional potential upside if rates increase

Q4'21 activity

NET INTEREST INCOME¹

$ Millions

859

Q3'21

NII

1.95%

Q3'21

NIM

67

NET INTEREST

MARGIN

svb >

Cash and

Fixed Income

Portfolio

Growth

Loan Growth

(0.05%)

26

Fixed Income

Portfolio Growth

at Lower Yields

0.01%

NII +10% QoQ despite low rates

(7)

(4)

Lower Loan Loan Fees

Yields

Loan Growth

& Mix

6

0.01%

Loan Fees

Cost of

Funding

NIM impacted by significant

securities purchases due to

surging deposits

(0.01%)

947

Cost of

Funding

Q4'21

NII

1.91%

Q4'21

NIM

FY'22 outlook key assumptions

Improved NII outlook driven by higher loan growth guidance and

investment yields since 10/21/21 preliminary outlook. NII and NIM

outlook key assumptions:

+

+

+

+

Balance sheet growth (+ for NII, - for NIM)

Driven by strong client liquidity

Rate protections (+ for loan yields,- for securities yields)

$116M remaining locked-in pre-tax swap gains as of 12/31/21

$36B active loan floors as of 12/31/21, however loan renewals may pressure

ability to maintain floor rates

$10.7B receive floating swaps on AFS portfolio at 38 bps cost (as of 12/31/21)

Reduction in average Fed cash balances

To $8-10B target - actual balances depend on timing of fund flows

Improved new purchase yields

Expect new purchase yields ~1.65-1.75%

Estimated $3.0-4.0B paydowns per quarter

Premium amortization expense

From prepayments of securities purchased at a premium

Expect +/- $20-30M change in premium amortization expense for each +/10 bp

change in 10y yields

Boston Private purchase accounting

Amortization of fair value mark ups on loans ($64M remaining at

12/31/21, vast majority to be amortized by end of 2023)

Shifting loan mix

Growth driven by lower yielding GFB and Private Bank mortgages

Spread compression

Increasing competition as economic recovery advances

Note: Rising rates expected to benefit NII due to our asset sensitivity (see

page 21). See pages 26, 27 and 29 for more information on the potential

impact of rising rates and public market volatility on interestearning asset

yields, deposit rates and balance sheet growth.

1. NII is presented on a fully taxable equivalent basis, while NII guidance excludes fully taxable equivalent adjustments.

SBA PPP contributed $5M to Q4'21 NII, including $4M of loan fees.

2. Expect vast majority of remaining pretax fair value gains from $5B swap unwind in Q1'20 to be reclassified from OCI to loan intrest

income by the end of 2023.

3. 3.16% weighted average floor rate. $148M expected benefit from inthe-money floors based on a weighted average maturity

of 1.5 years.

Q4 2021 Financial Highlights

30View entire presentation