Apollo Global Management Investor Presentation Deck

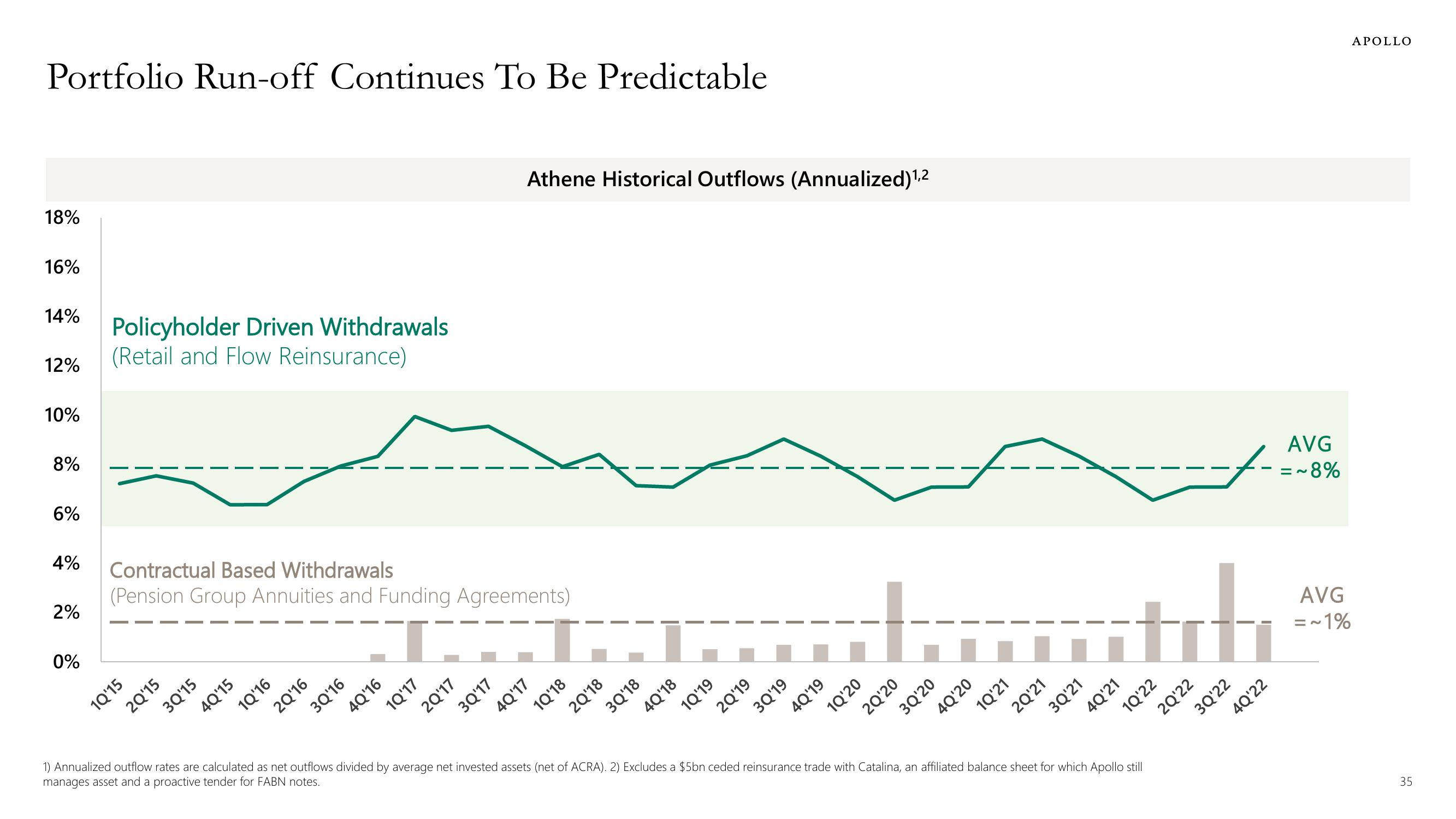

Portfolio Run-off Continues To Be Predictable

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

Policyholder Driven Withdrawals

(Retail and Flow Reinsurance)

Contractual Based Withdrawals

(Pension Group Annuities and Funding Agreements)

1Q'15

2Q'15

3Q'15

4Q'15

1Q'16

2Q¹16

3Q'16

4Q'16

1Q'17

2Q'17

Athene Historical Outflows (Annualized)¹,2

3Q'17

4Q'17

1Q'18

2Q'18

3Q'18

4Q'18

1Q'19

2Q'19

3Q'19

4Q'19

da

1Q'20

2Q'20

3Q'20

4Q'20

1Q'21

2Q¹21

3Q'21

it

4Q'21

1Q'22

1) Annualized outflow rates are calculated as net outflows divided by average net invested assets (net of ACRA). 2) Excludes a $5bn ceded reinsurance trade with Catalina, an affiliated balance sheet for which Apollo still

manages asset and a proactive tender for FABN notes.

2Q¹22

3Q'22

4Q'22

AVG

~8%

=~

AVG

=~1%

APOLLO

35View entire presentation