Investor Presentation

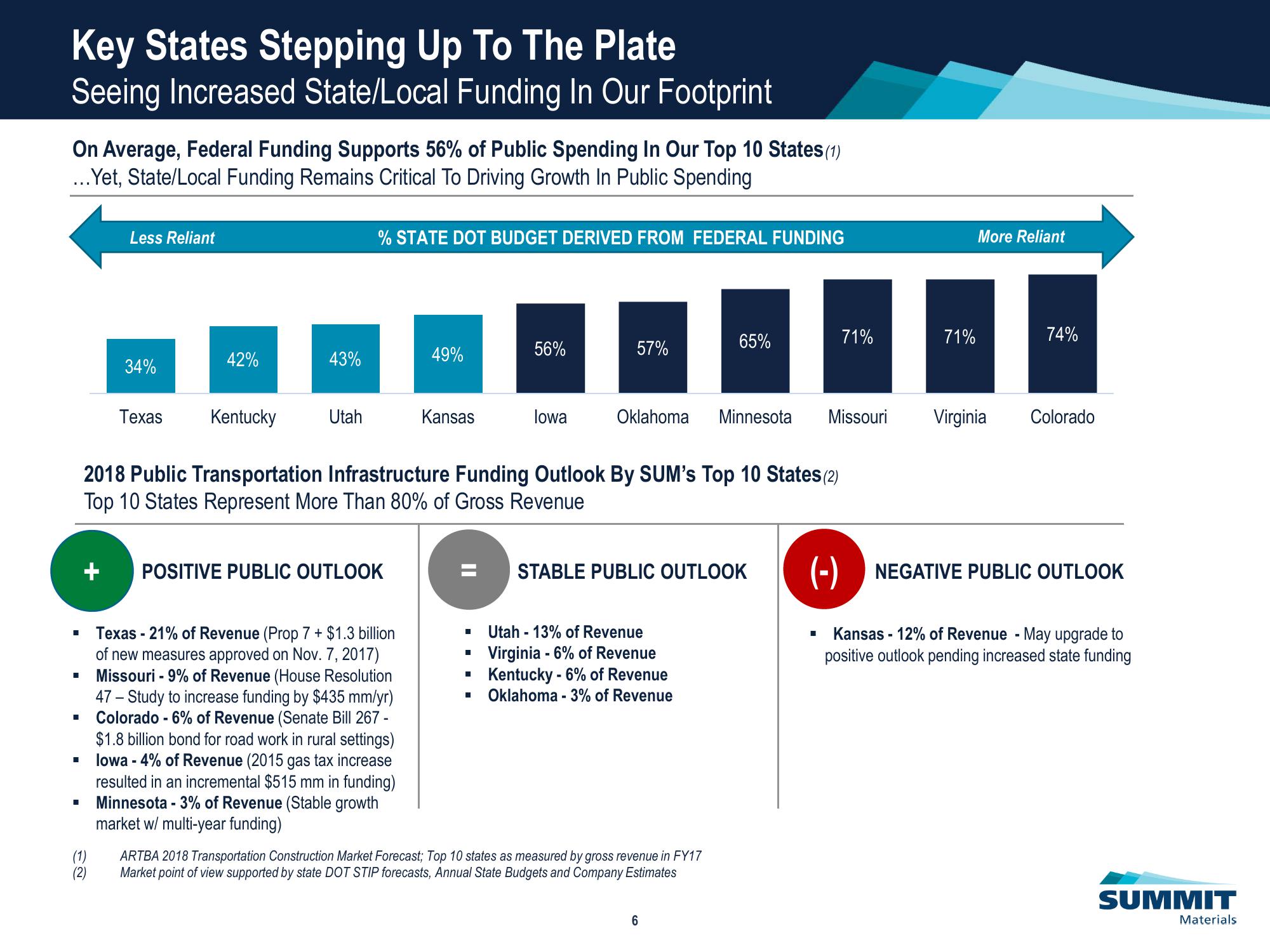

Key States Stepping Up To The Plate

Seeing Increased State/Local Funding In Our Footprint

On Average, Federal Funding Supports 56% of Public Spending In Our Top 10 States (1)

...Yet, State/Local Funding Remains Critical To Driving Growth In Public Spending

■

■

■

■

Less Reliant

(1)

(2)

34%

Texas

42%

Kentucky

43%

Utah

% STATE DOT BUDGET DERIVED FROM FEDERAL FUNDING

POSITIVE PUBLIC OUTLOOK

49%

Texas - 21% of Revenue (Prop 7 + $1.3 billion

of new measures approved on Nov. 7, 2017)

Missouri - 9% of Revenue (House Resolution

47 - Study to increase funding by $435 mm/yr)

Colorado -6% of Revenue (Senate Bill 267 -

$1.8 billion bond for road work in rural settings)

lowa - 4% of Revenue (2015 gas tax increase

resulted in an incremental $515 mm in funding)

Minnesota - 3% of Revenue (Stable growth

market w/ multi-year funding)

Kansas

56%

lowa

2018 Public Transportation Infrastructure Funding Outlook By SUM's Top 10 States (2)

Top 10 States Represent More Than 80% of Gross Revenue

H

57%

Oklahoma Minnesota Missouri

Utah - 13% of Revenue

Virginia - 6% of Revenue

Kentucky - 6% of Revenue

H Oklahoma - 3% of Revenue

65%

ARTBA 2018 Transportation Construction Market Forecast; Top 10 states as measured by gross revenue in FY17

Market point of view supported by state DOT STIP forecasts, Annual State Budgets and Company Estimates

71%

6

71%

More Reliant

Virginia

STABLE PUBLIC OUTLOOK (-) NEGATIVE PUBLIC OUTLOOK

74%

Colorado

Kansas - 12% of Revenue - May upgrade to

positive outlook pending increased state funding

SUMMIT

MaterialsView entire presentation