Silicon Valley Bank Results Presentation Deck

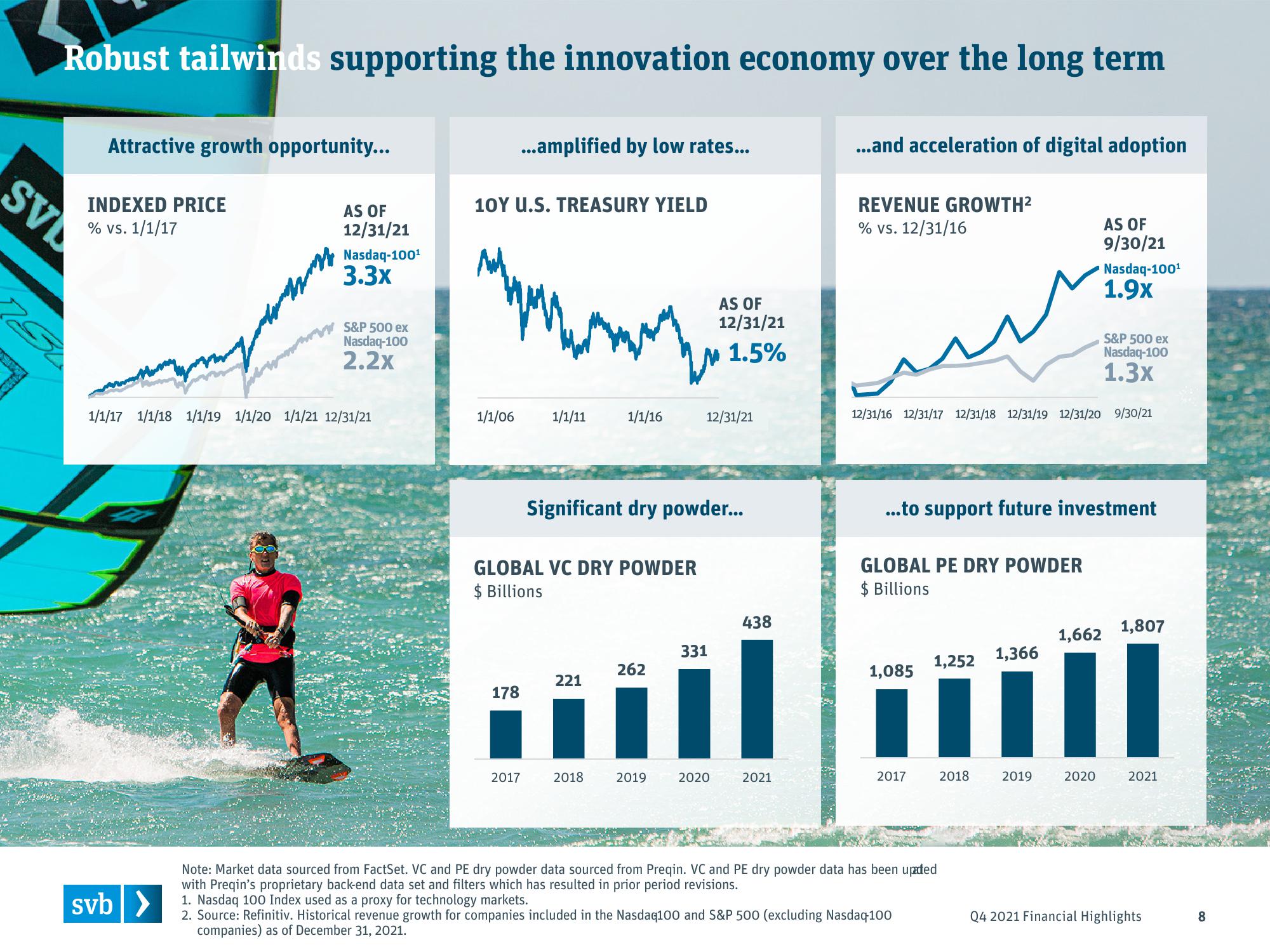

Robust tailwinds supporting the innovation economy over the long term

SV

Attractive growth opportunity...

INDEXED PRICE

% vs. 1/1/17

Un

svb >

AS OF

12/31/21

U

Nasdaq-100¹

3.3x

S&P 500 ex

Nasdaq-100

2.2x

1/1/17 1/1/18 1/1/19 1/1/20 1/1/21 12/31/21

10Y U.S. TREASURY YIELD

1/1/06

...amplified by low rates...

178

2017

1/1/11

GLOBAL VC DRY POWDER

$ Billions

1/1/16

221

Significant dry powder...

2018

262

2019

12/31/21

AS OF

12/31/21

1.5%

331

2020

438

2021

...and acceleration of digital adoption

REVENUE GROWTH²

% vs. 12/31/16

GLOBAL PE DRY POWDER

$ Billions

12/31/16 12/31/17 12/31/18 12/31/19 12/31/20 9/30/21

1,085

...to support future investment

2017

1,252 1,366

Note: Market data sourced from FactSet. VC and PE dry powder data sourced from Preqin. VC and PE dry powder data has been upated

with Preqin's proprietary back-end data set and filters which has resulted in prior period revisions.

1. Nasdaq 100 Index used as a proxy for technology markets.

2. Source: Refinitiv. Historical revenue growth for companies included in the Nasdaq100 and S&P 500 (excluding Nasdaq-100

companies) as of December 31, 2021.

2018

AS OF

9/30/21

2019

Nasdaq-100¹

1.9x

S&P 500 ex

Nasdaq-100

1.3x

2020

1,807

1,662

11

2021

Q4 2021 Financial Highlights

8View entire presentation