Silicon Valley Bank Results Presentation Deck

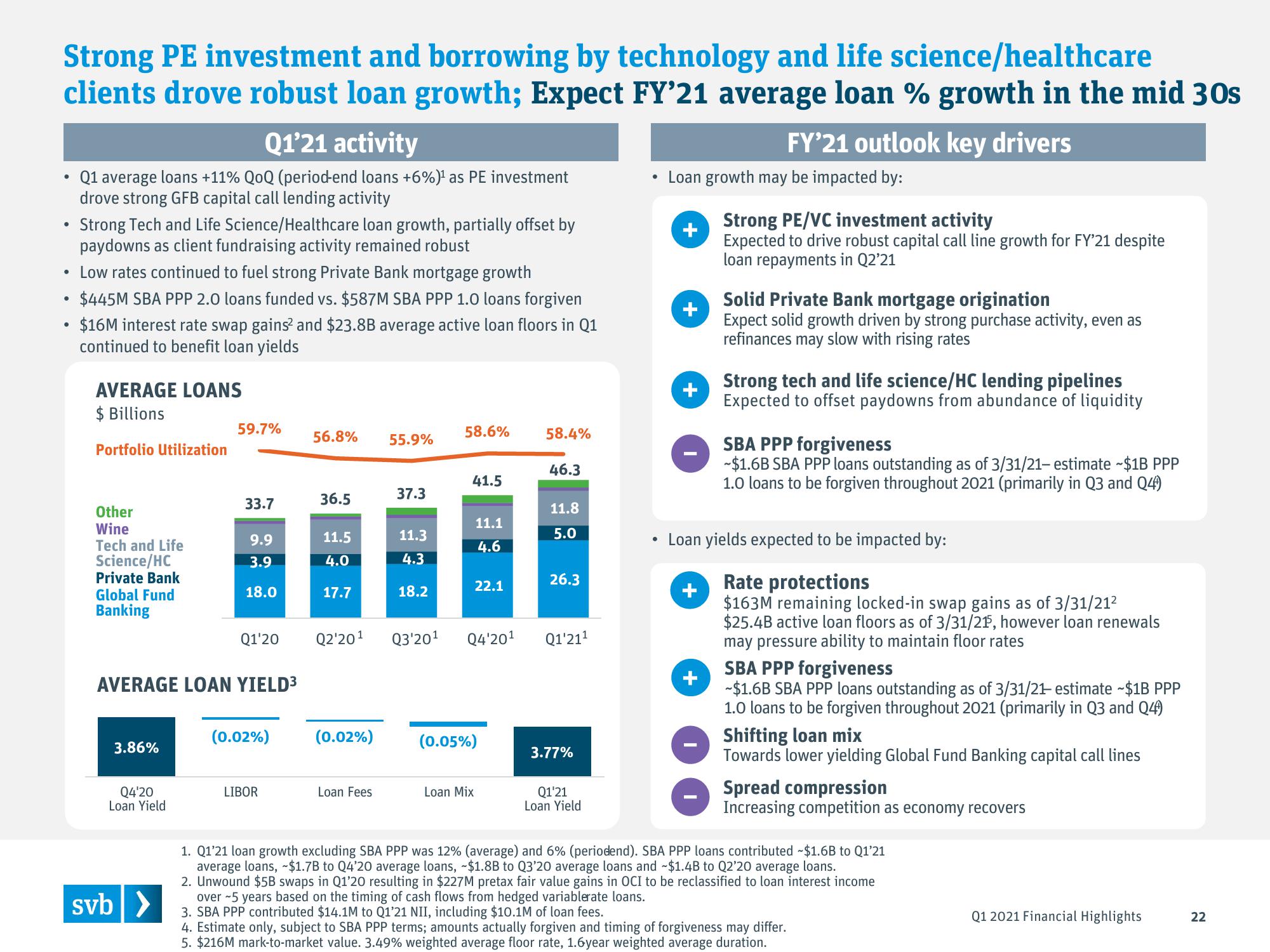

Strong PE investment and borrowing by technology and life science/healthcare

clients drove robust loan growth; Expect FY'21 average loan % growth in the mid 30s

●

●

Q1'21 activity

Q1 average loans +11% QOQ (period-end loans +6%) ¹ as PE investment

drove strong GFB capital call lending activity

Strong Tech and Life Science/Healthcare loan growth, partially offset by

paydowns as client fundraising activity remained robust

• Low rates continued to fuel strong Private Bank mortgage growth

$445M SBA PPP 2.0 loans funded vs. $587M SBA PPP 1.0 loans forgiven

$16M interest rate swap gains² and $23.8B average active loan floors in Q1

continued to benefit loan yields

AVERAGE LOANS

$ Billions

Portfolio Utilization

Other

Wine

Tech and Life

Science/HC

Private Bank

Global Fund

Banking

3.86%

Q4'20

Loan Yield

59.7%

svb>

33.7

AVERAGE LOAN YIELD³

9.9

3.9

18.0

Q1'20

(0.02%)

LIBOR

56.8%

36.5

11.5

4.0

17.7

(0.02%)

55.9%

Loan Fees

37.3

11.3

4.3

18.2

58.6%

41.5

11.1

4.6

22.1

Loan Mix

(0.05%)

58.4%

Q2'20¹ Q3'20¹ Q4'20¹ Q1'21¹

46.3

11.8

5.0

26.3

3.77%

Q1'21

Loan Yield

Loan growth may be impacted by:

+

+

+

FY'21 outlook key drivers

+

+

Strong PE/VC investment activity

Expected to drive robust capital call line growth for FY'21 despite

loan repayments in Q2'21

Solid Private Bank mortgage origination

Expect solid growth driven by strong purchase activity, even as

refinances may slow with rising rates

Strong tech and life science/HC lending pipelines

Expected to offset paydowns from abundance of liquidity

Loan yields expected to be impacted by:

Rate protections

$163M remaining locked-in swap gains as of 3/31/21²

$25.4B active loan floors as of 3/31/215, however loan renewals

may pressure ability to maintain floor rates

SBA PPP forgiveness

~$1.6B SBA PPP loans outstanding as of 3/31/21- estimate ~$1B PPP

1.0 loans to be forgiven throughout 2021 (primarily in Q3 and Q4)

SBA PPP forgiveness

~$1.6B SBA PPP loans outstanding as of 3/31/21- estimate ~$1B PPP

1.0 loans to be forgiven throughout 2021 (primarily in Q3 and Q4)

Shifting loan mix

Towards lower yielding Global Fund Banking capital call lines

Spread compression

Increasing competition as economy recovers

1. Q1'21 loan growth excluding SBA PPP was 12% (average) and 6% (periodend). SBA PPP loans contributed ~$1.6B to Q1'21

average loans, $1.7B to Q4'20 average loans, -$1.8B to Q3'20 average loans and ~$1.4B to Q2'20 average loans.

2. Unwound $5B swaps in Q1'20 resulting in $227M pretax fair value gains in OCI to be reclassified to loan interest income

over 5 years based on the timing of cash flows from hedged variablerate loans.

3. SBA PPP contributed $14.1M to Q1'21 NII, including $10.1M of loan fees.

4. Estimate only, subject to SBA PPP terms; amounts actually forgiven and timing of forgiveness may differ.

5. $216M mark-to-market value. 3.49% weighted average floor rate, 1.6year weighted average duration.

Q1 2021 Financial Highlights

22View entire presentation