Silicon Valley Bank Results Presentation Deck

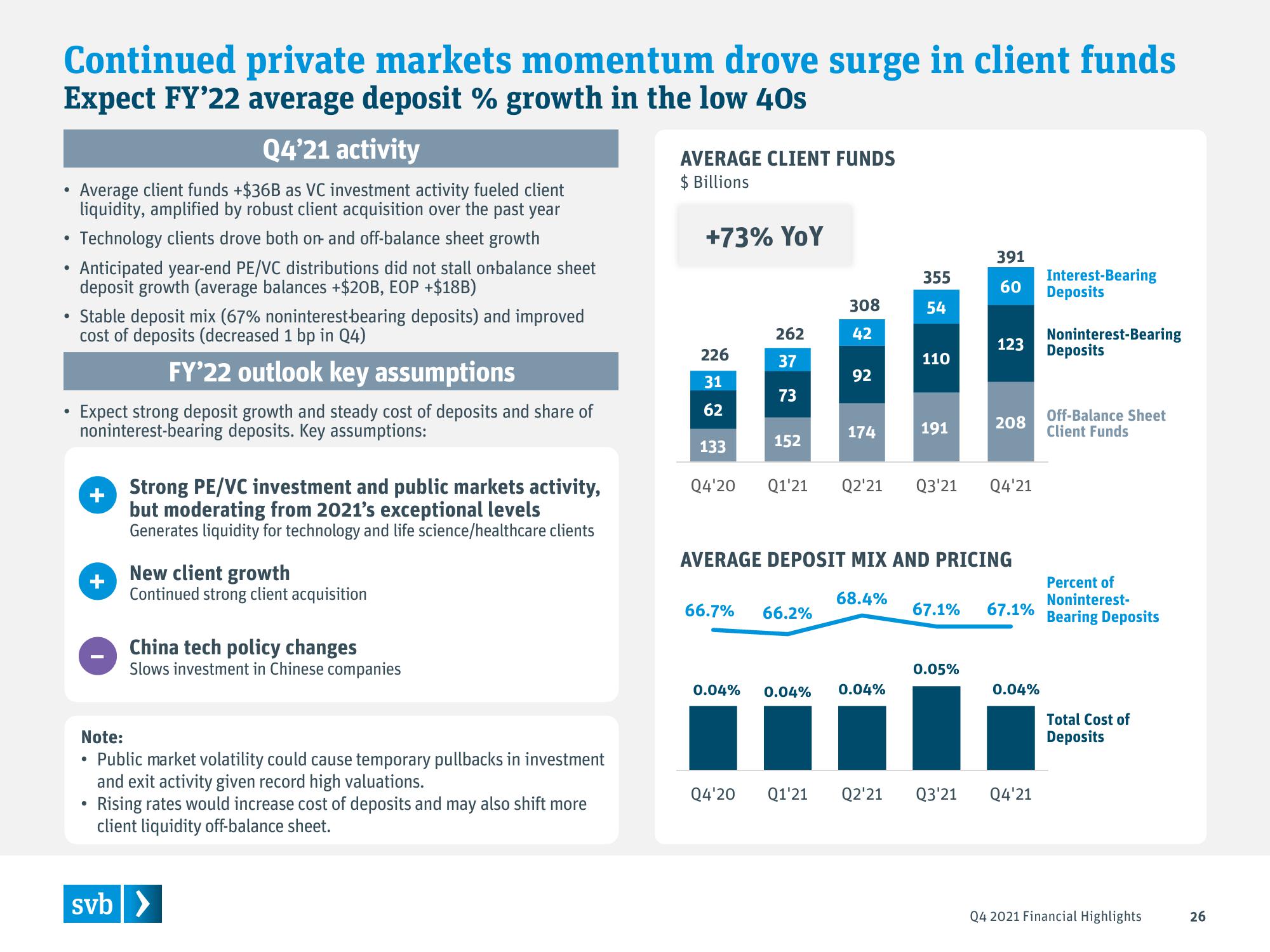

Continued private markets momentum drove surge in client funds

Expect FY'22 average deposit % growth in the low 40s

●

●

●

●

Q4'21 activity

Average client funds +$36B as VC investment activity fueled client

liquidity, amplified by robust client acquisition over the past year

Technology clients drove both on and off-balance sheet growth

Anticipated year-end PE/VC distributions did not stall onbalance sheet

deposit growth (average balances +$20B, EOP +$18B)

Stable deposit mix (67% noninterest-bearing deposits) and improved

cost of deposits (decreased 1 bp in Q4)

FY'22 outlook key assumptions

Expect strong deposit growth and steady cost of deposits and share of

noninterest-bearing deposits. Key assumptions:

+Strong PE/VC investment and public markets activity,

but moderating from 2021's exceptional levels

Generates liquidity for technology and life science/healthcare clients

+

New client growth

Continued strong client acquisition

China tech policy changes

Slows investment in Chinese companies

Note:

Public market volatility could cause temporary pullbacks in investment

and exit activity given record high valuations.

• Rising rates would increase cost of deposits and may also shift more

client liquidity off-balance sheet.

svb >

AVERAGE CLIENT FUNDS

$Billions

+73% YoY

226

31

62

133

262

37

73

152

308

42

66.7% 66.2%

92

174

Q4'20 Q1'21

Q4'20 Q1'21 Q2'21 Q3'21

68.4%

0.04% 0.04% 0.04%

355

54

110

Q2¹21

191

AVERAGE DEPOSIT MIX AND PRICING

67.1%

0.05%

391

60

Q3'21

123

208

Q4'21

0.04%

Interest-Bearing

Deposits

Q4'21

Noninterest-Bearing

Deposits

Percent of

Noninterest-

67.1% Bearing Deposits

Off-Balance Sheet

Client Funds

Total Cost of

Deposits

Q4 2021 Financial Highlights

26View entire presentation