Silicon Valley Bank Results Presentation Deck

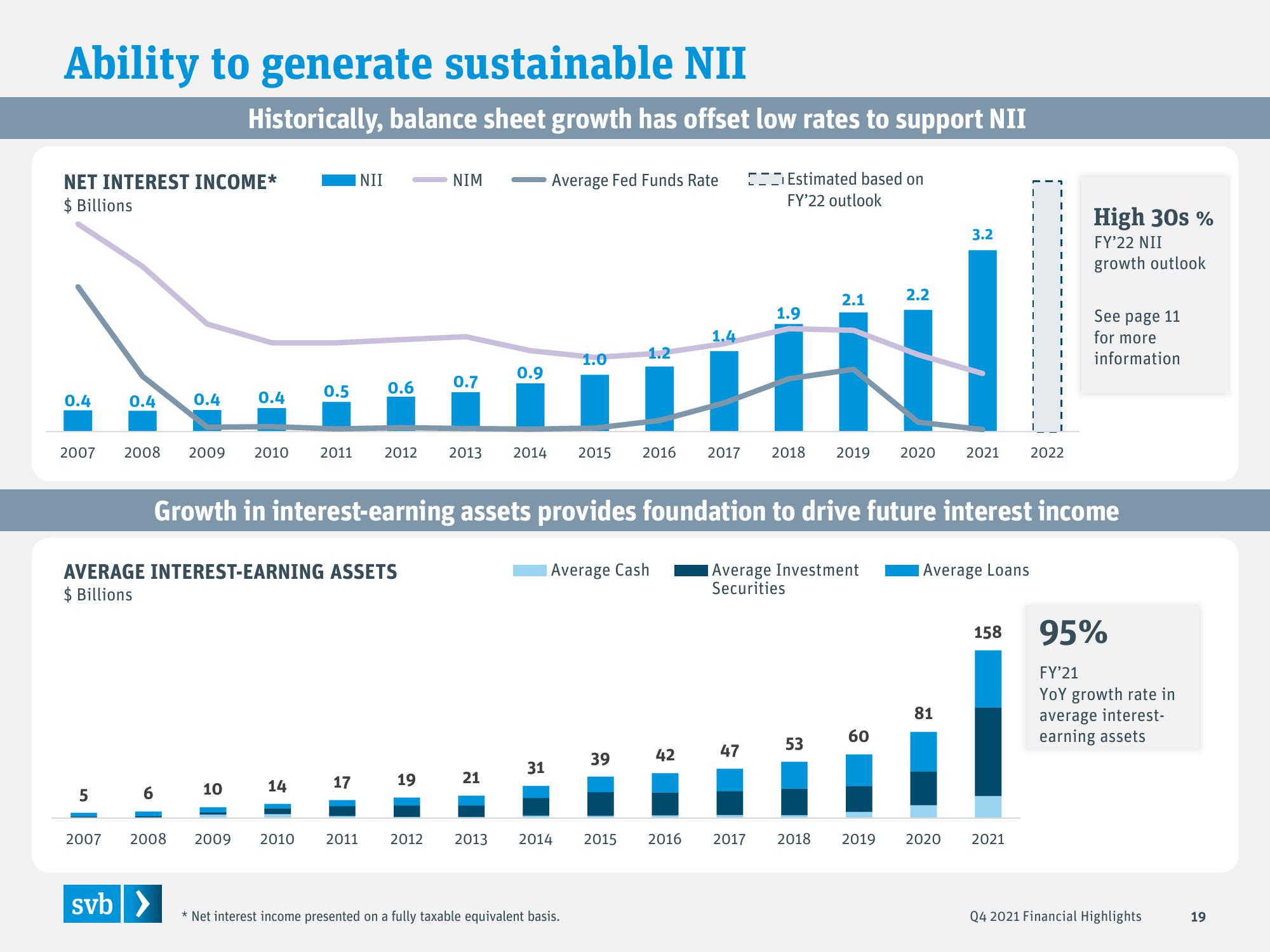

Ability to generate sustainable NII

NET INTEREST INCOME*

$ Billions

0.4

2007

0.4

5

2008

6

0.4

2007 2008

svb >

Historically, balance sheet growth has offset low rates to support NII

0.4

2009 2010

10

AVERAGE INTEREST-EARNING ASSETS

$ Billions

0.5

14

2011

2009 2010

NII

17

0.6

2011

2012

NIM

19

0.7

2013

0.9

21

2014

Average Fed Funds Rate

31

Growth in interest-earning assets provides foundation to drive future interest income

Average Investment

Securities

2012 2013 2014

1.0

* Net interest income presented on a fully taxable equivalent basis.

Average Cash

1.2

39

1.9

+

2015 2016 2017 2018 2019 2020 2021 2022

2015

42

1.4

2016

Estimated based on

FY'22 outlook

47

2.1

53

2.2

60

3.2

Average Loans

81

2017 2018 2019 2020

I

158

2021

High 30s%

FY'22 NII

growth outlook

See page 11

for more

information

95%

FY'21

YoY growth rate in

average interest-

earning assets

Q4 2021 Financial Highlights

19View entire presentation