Apollo Global Management Investor Presentation Deck

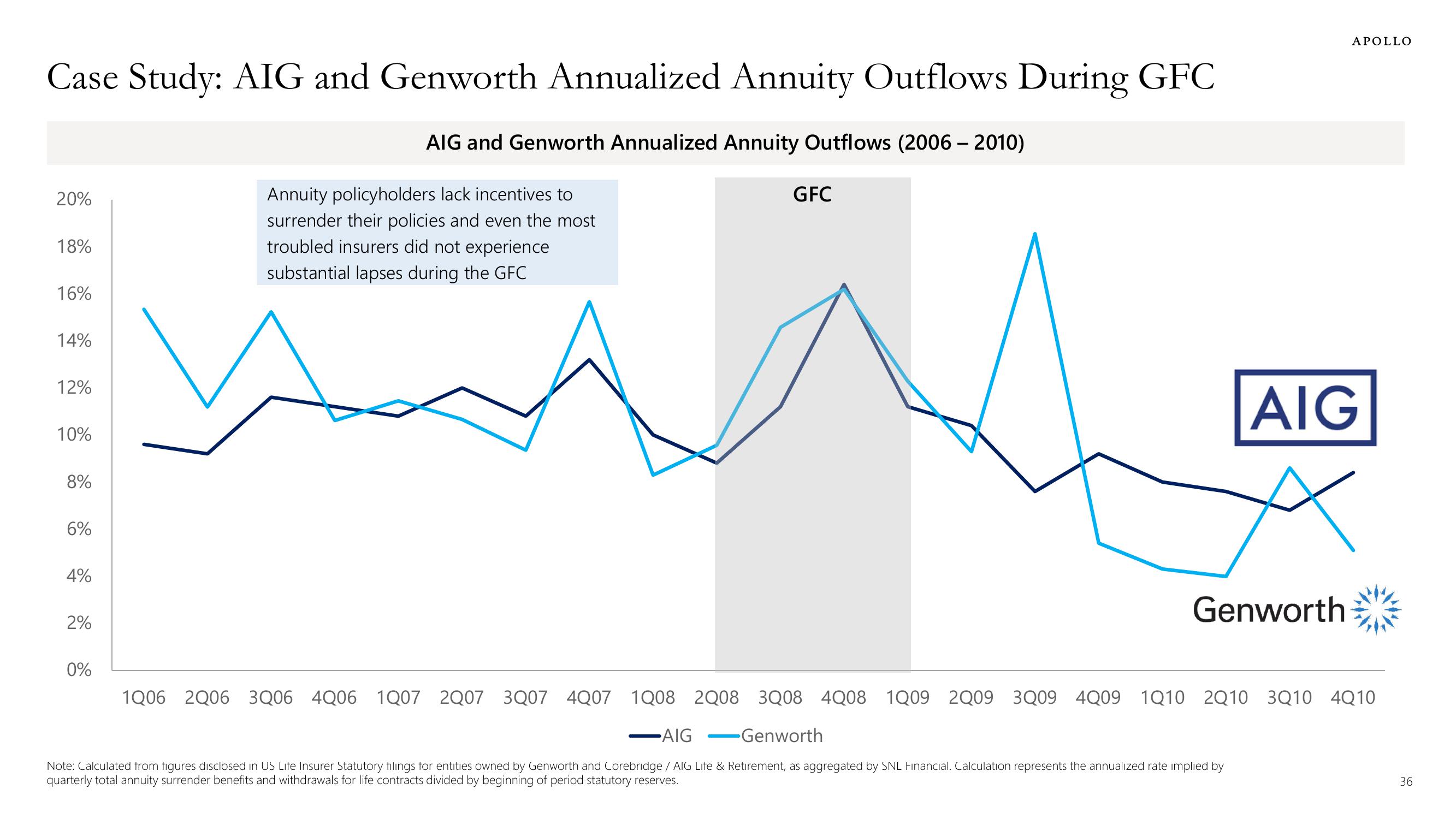

Case Study: AIG and Genworth Annualized Annuity Outflows During GFC

AIG and Genworth Annualized Annuity Outflows (2006-2010)

20%

18%

16%

14%

12%

10%

8%

6%

4%

2%

0%

Annuity policyholders lack incentives to

surrender their policies and even the most

troubled insurers did not experience

substantial lapses during the GFC

GFC

APOLLO

AIG

Genworth

1Q06 2Q06 3Q06 4Q06 1Q07 2Q07 3Q07 4Q07 1Q08 2Q08 3008 4Q08 1Q09 2Q09 3Q09 4Q09 1Q10 2Q10 3Q10 4Q10

-AIG

→Genworth

Note: Calculated from figures disclosed in US Life Insurer Statutory filings for entities owned by Genworth and Corebridge / AIG Life & Retirement, as aggregated by SNL Financial. Calculation represents the annualized rate implied by

quarterly total annuity surrender benefits and withdrawals for life contracts divided by beginning of period statutory reserves.

36View entire presentation