Silicon Valley Bank Results Presentation Deck

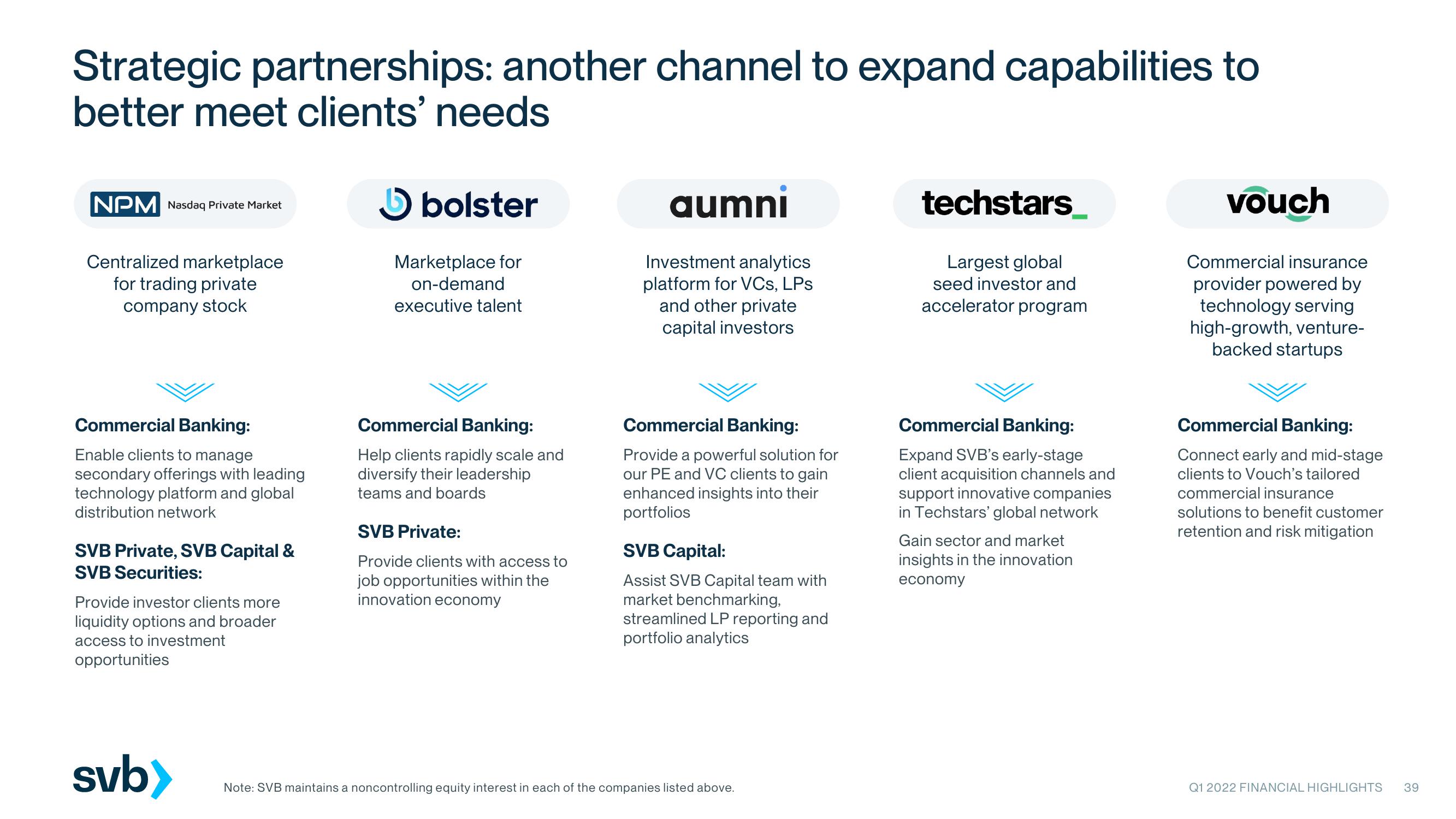

Strategic partnerships: another channel to expand capabilities to

better meet clients' needs

NPM Nasdaq Private Market

Centralized marketplace

for trading private

company stock

Commercial Banking:

Enable clients to manage

secondary offerings with leading

technology platform and global

distribution network

SVB Private, SVB Capital &

SVB Securities:

Provide investor clients more

liquidity options and broader

access to investment

opportunities

svb)

bolster

Marketplace for

on-demand

executive talent

Commercial Banking:

Help clients rapidly scale and

diversify their leadership

teams and boards

SVB Private:

Provide clients with access to

job opportunities within the

innovation economy

aumni

Investment analytics

platform for VCs, LPs

and other private

capital investors

Commercial Banking:

Provide a powerful solution for

our PE and VC clients to gain

enhanced insights into their

portfolios

SVB Capital:

Assist SVB Capital team with

market benchmarking,

streamlined LP reporting and

portfolio analytics

Note: SVB maintains a noncontrolling equity interest in each of the companies listed above.

techstars_

Largest global

seed investor and

accelerator program

Commercial Banking:

Expand SVB's early-stage

client acquisition channels and

support innovative companies

in Techstars' global network

Gain sector and market

insights in the innovation

economy

vouch

Commercial insurance

provider powered by

technology serving

high-growth, venture-

backed startups

Commercial Banking:

Connect early and mid-stage

clients to Vouch's tailored

commercial insurance

solutions to benefit customer

retention and risk mitigation

Q1 2022 FINANCIAL HIGHLIGHTS

39View entire presentation