Silicon Valley Bank Mergers and Acquisitions Presentation Deck

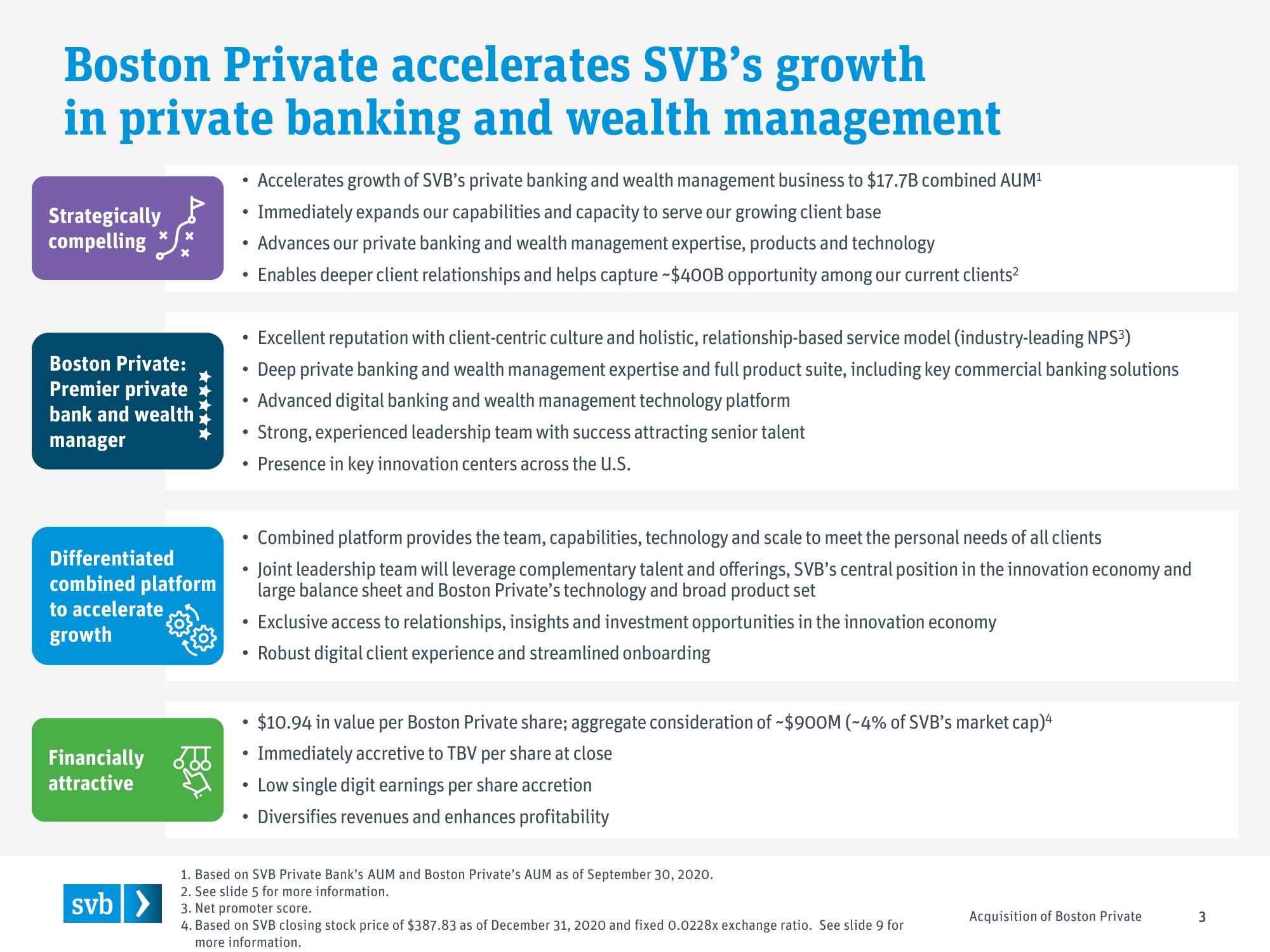

Boston Private accelerates SVB's growth

in private banking and wealth management

Strategically

compelling

Boston Private:

Premier private

bank and wealth

manager

X

Differentiated

combined platform

to accelerate

growth

Financially

attractive

svb >

●

●

●

●

●

●

●

●

●

●

●

Accelerates growth of SVB's private banking and wealth management business to $17.7B combined AUM¹

Immediately expands our capabilities and capacity to serve our growing client base

Advances our private banking and wealth management expertise, products and technology

Enables deeper client relationships and helps capture ~$400B opportunity among our current clients²

Excellent reputation with client-centric culture and holistic, relationship-based service model (industry-leading NPS³)

Deep private banking and wealth management expertise and full product suite, including key commercial banking solutions

Advanced digital banking and wealth management technology platform

Strong, experienced leadership team with success attracting senior talent

Presence in key innovation centers across the U.S.

Combined platform provides the team, capabilities, technology and scale to meet the personal needs of all clients

Joint leadership team will leverage complementary talent and offerings, SVB's central position in the innovation economy and

large balance sheet and Boston Private's technology and broad product set

Exclusive access to relationships, insights and investment opportunities in the innovation economy

Robust digital client experience and streamlined onboarding

$10.94 in value per Boston Private share; aggregate consideration of ~$900M (~4% of SVB's market cap)4

Immediately accretive to TBV per share at close

Low single digit earnings per share accretion

Diversifies revenues and enhances profitability

1. Based on SVB Private Bank's AUM and Boston Private's AUM as of September 30, 2020.

2. See slide 5 for more information.

3. Net promoter score.

4. Based on SVB closing stock price of $387.83 as of December 31, 2020 and fixed 0.0228x exchange ratio. See slide 9 for

more information.

Acquisition of Boston Private

3View entire presentation