Silicon Valley Bank Results Presentation Deck

Building the premier investment bank dedicated to the innovation economy

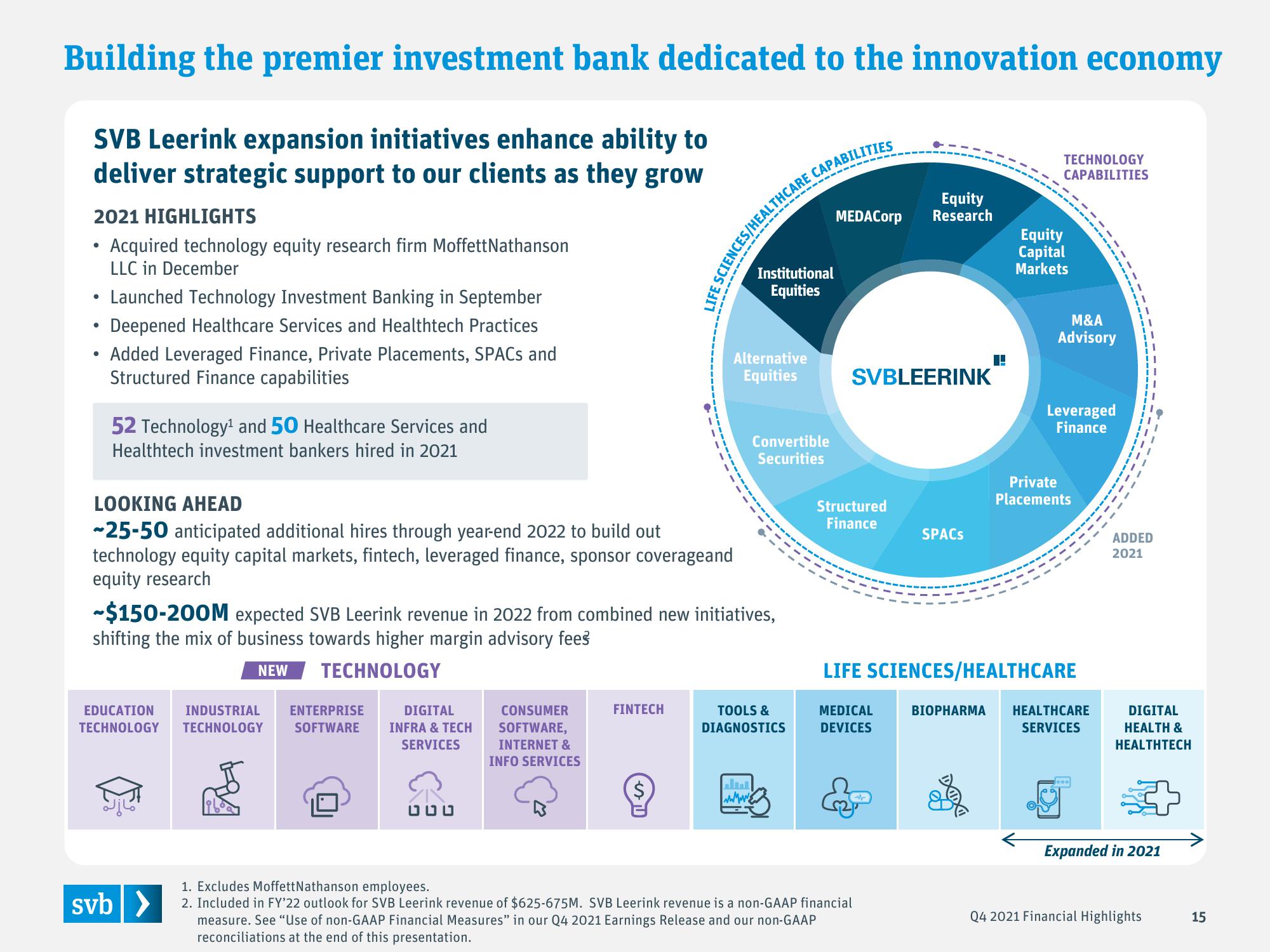

SVB Leerink expansion initiatives enhance ability to

deliver strategic support to our clients as they grow

2021 HIGHLIGHTS

Acquired technology equity research firm MoffettNathanson

LLC in December

●

●

●

●

Launched Technology Investment Banking in September

Deepened Healthcare Services and Healthtech Practices

Added Leveraged Finance, Private Placements, SPACs and

Structured Finance capabilities

52 Technology¹ and 50 Healthcare Services and

Healthtech investment bankers hired in 2021

LOOKING AHEAD

-25-50 anticipated additional hires through year-end 2022 to build out

technology equity capital markets, fintech, leveraged finance, sponsor coverageand

equity research

EDUCATION INDUSTRIAL ENTERPRISE

TECHNOLOGY TECHNOLOGY SOFTWARE

svb >

LV

~$150-200M expected SVB Leerink revenue in 2022 from combined new initiatives,

shifting the mix of business towards higher margin advisory fees

NEW

TECHNOLOGY

DIGITAL

INFRA & TECH

SERVICES

DUD

CONSUMER

SOFTWARE,

INTERNET &

INFO SERVICES

FINTECH

ENCES/HEALTHCARE CAPABILITIES

----

$

Alternative

Equities

Institutional

Equities

Convertible

Securities

u

wwwww

TOOLS &

DIAGNOSTICS

Equity

MEDACorp Research

SVBLEERINK

Structured

Finance

SPACS

1. Excludes Moffett Nathanson employees.

2. Included in FY'22 outlook for SVB Leerink revenue of $625-675M. SVB Leerink revenue is a non-GAAP financial

measure. See "Use of non-GAAP Financial Measures" in our Q4 2021 Earnings Release and our non-GAAP

reconciliations at the end of this presentation.

TECHNOLOGY

CAPABILITIES

Equity

Capital

Markets

M&A

Advisory

Leveraged

Finance

Private

Placements

LIFE SCIENCES/HEALTHCARE

MEDICAL

DEVICES

BIOPHARMA HEALTHCARE

SERVICES

ADDED

2021

DIGITAL

HEALTH &

HEALTHTECH

Expanded in 2021

Q4 2021 Financial Highlights

15View entire presentation