Silicon Valley Bank Results Presentation Deck

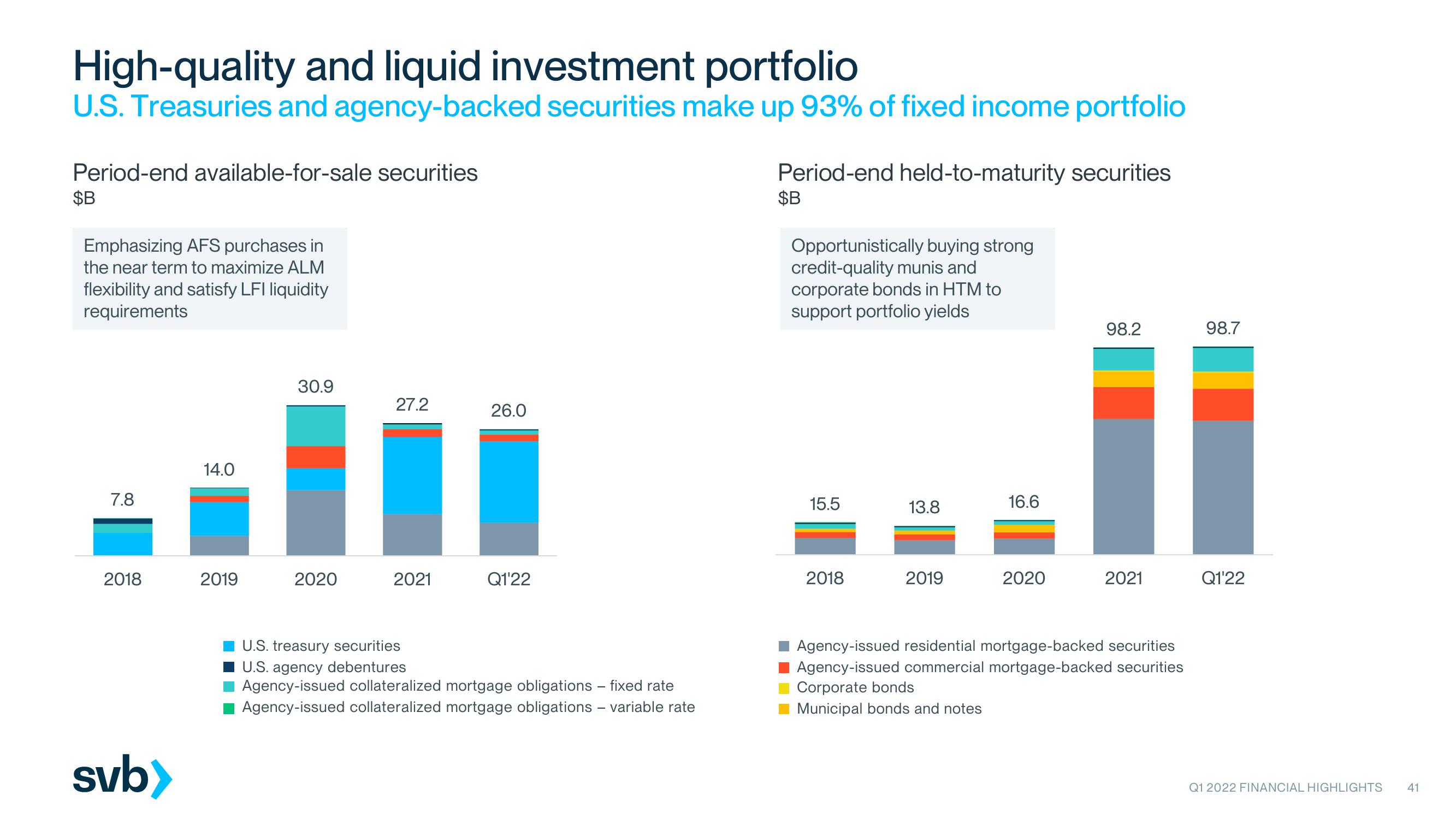

High-quality and liquid investment portfolio

U.S. Treasuries and agency-backed securities make up 93% of fixed income portfolio

Period-end available-for-sale securities

$B

Emphasizing AFS purchases in

the near term to maximize ALM

flexibility and satisfy LFI liquidity

requirements

7.8

2018

svb>

14.0

2019

30.9

2020

27.2

2021

26.0

Q1'22

U.S. treasury securities

U.S. agency debentures

Agency-issued collateralized mortgage obligations - fixed rate

Agency-issued collateralized mortgage obligations - variable rate

Period-end held-to-maturity securities

$B

Opportunistically buying strong

credit-quality munis and

corporate bonds in HTM to

support portfolio yields

15.5

2018

13.8

2019

16.6

2020

98.2

2021

Agency-issued residential mortgage-backed securities

Agency-issued commercial mortgage-backed securities

Corporate bonds

Municipal bonds and notes

98.7

Q1'22

Q1 2022 FINANCIAL HIGHLIGHTS

41View entire presentation