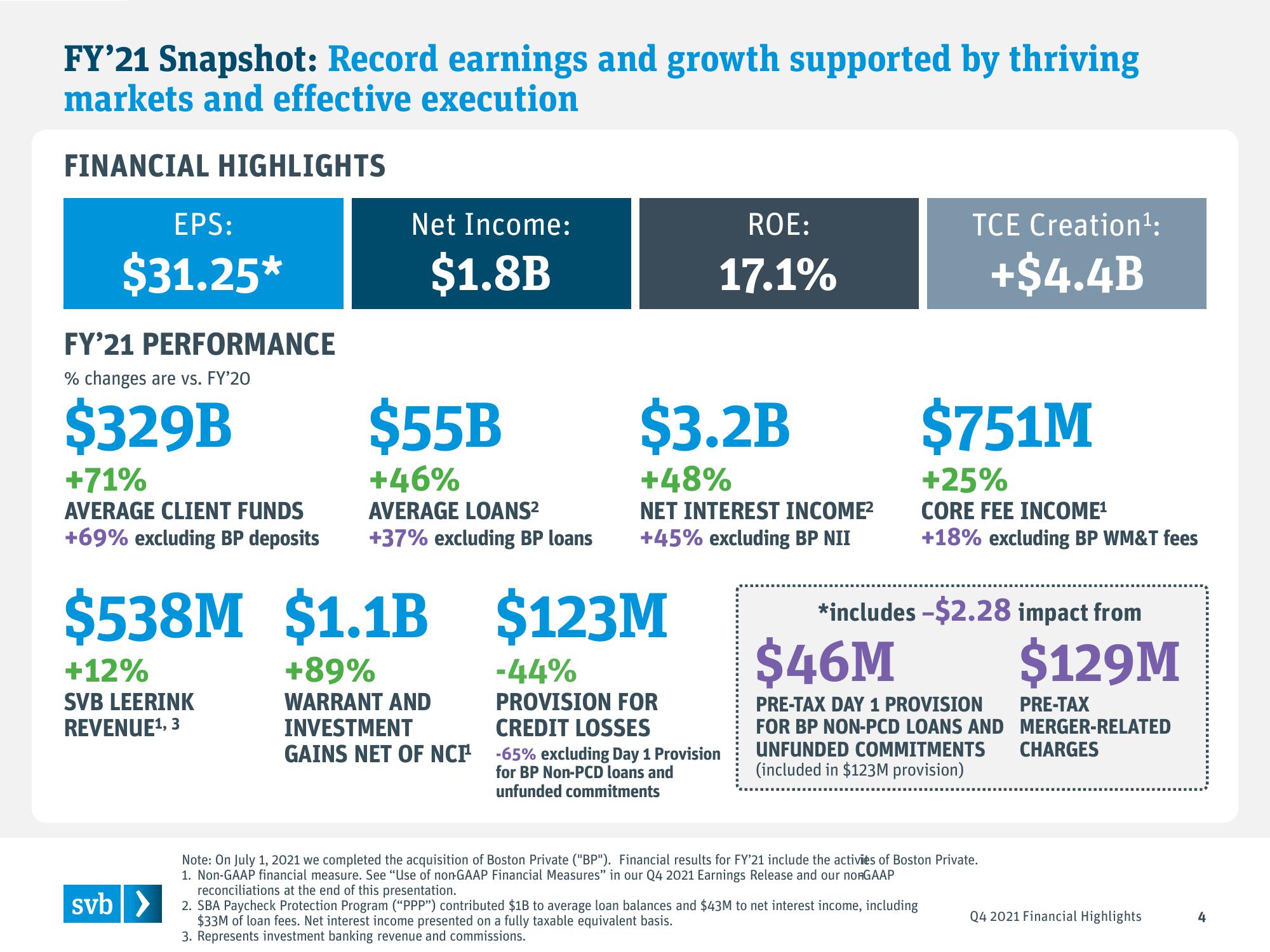

Silicon Valley Bank Results Presentation Deck

FY'21 Snapshot: Record earnings and growth supported by thriving

markets and effective execution

FINANCIAL HIGHLIGHTS

EPS:

$31.25*

FY'21 PERFORMANCE

% changes are vs. FY'20

$329B

+71%

AVERAGE CLIENT FUNDS

+69% excluding BP deposits

+12%

SVB LEERINK

REVENUE¹, 3

Net Income:

$1.8B

$538M $1.1B

+89%

WARRANT AND

INVESTMENT

GAINS NET OF NCT¹

svb>

$55B

+46%

AVERAGE LOANS²

+37% excluding BP loans

ROE:

17.1%

$3.2B

+48%

NET INTEREST INCOME²

+45% excluding BP NII

$123M

-44%

PROVISION FOR

CREDIT LOSSES

-65% excluding Day 1 Provision

for BP Non-PCD loans and

unfunded commitments

TCE Creation ¹:

+$4.4B

$751M

+25%

CORE FEE INCOME¹

+18% excluding BP WM&T fees

*includes -$2.28 impact from

$46M

PRE-TAX DAY 1 PROVISION

FOR BP NON-PCD LOANS AND

UNFUNDED COMMITMENTS

(included in $123M provision)

Note: On July 1, 2021 we completed the acquisition of Boston Private ("BP"). Financial results for FY'21 include the activies of Boston Private.

1. Non-GAAP financial measure. See "Use of non-GAAP Financial Measures" in our Q4 2021 Earnings Release and our no-GAAP

reconciliations at the end of this presentation.

2. SBA Paycheck Protection Program ("PPP") contributed $1B to average loan balances and $43M to net interest income, including

$33M of loan fees. Net interest income presented on a fully taxable equivalent basis.

3. Represents investment banking revenue and commissions.

$129M

PRE-TAX

MERGER-RELATED

CHARGES

Q4 2021 Financial Highlights

4View entire presentation