Silicon Valley Bank Results Presentation Deck

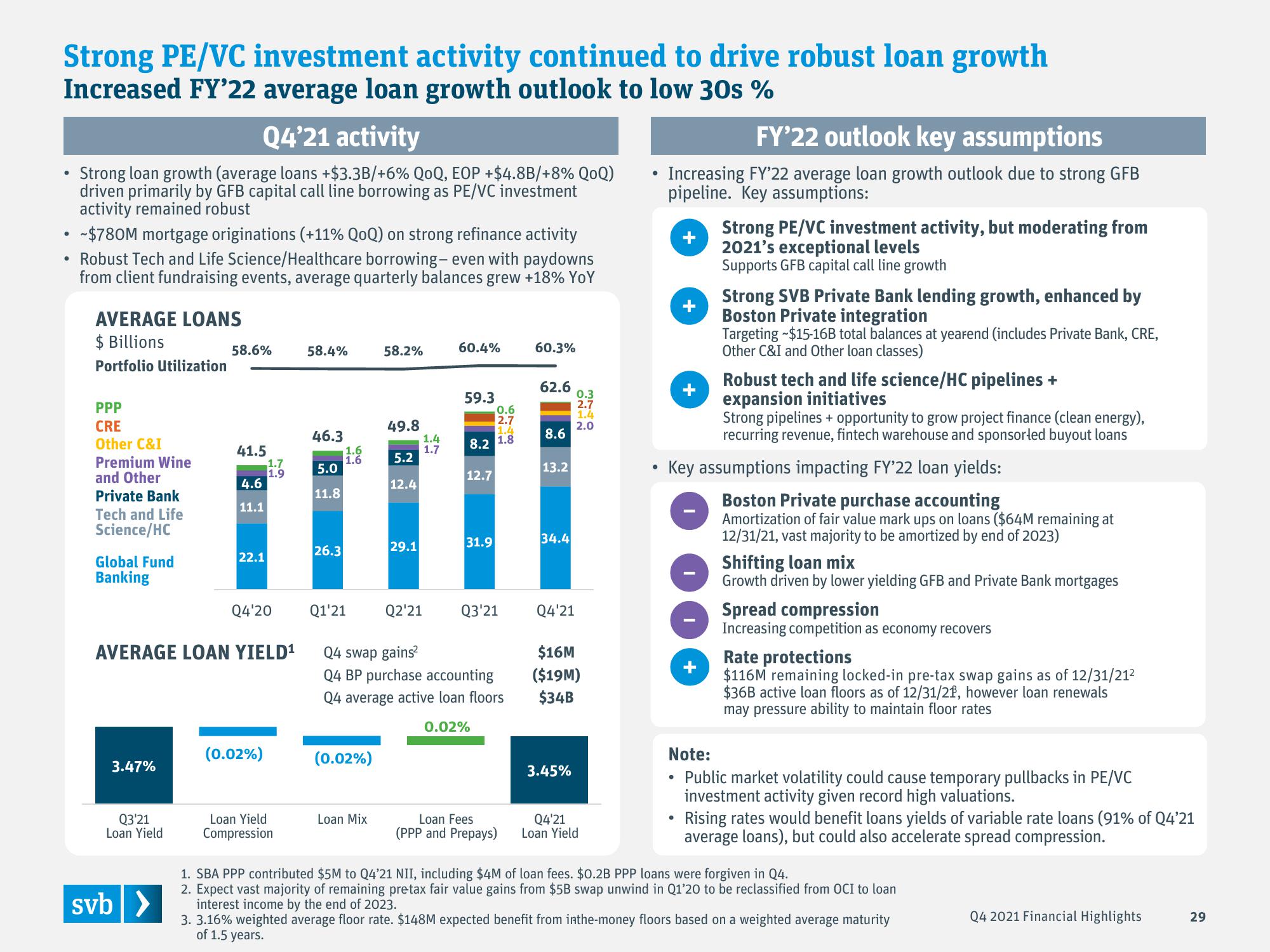

Strong PE/VC investment activity continued to drive robust loan growth

Increased FY'22 average loan growth outlook to low 30s %

Q4'21 activity

Strong loan growth (average loans +$3.3B/+6% QOQ, EOP +$4.8B/+8% QoQ)

driven primarily by GFB capital call line borrowing as PE/VC investment

activity remained robust

• ~$780M mortgage originations (+11% QoQ) on strong refinance activity

Robust Tech and Life Science/Healthcare borrowing- even with paydowns

from client fundraising events, average quarterly balances grew +18% YoY

●

AVERAGE LOANS

$ Billions

Portfolio Utilization

PPP

CRE

Other C&I

Premium Wine

and Other

Private Bank

Tech and Life

Science/HC

Global Fund

Banking

3.47%

Q3'21

Loan Yield

58.6%

svb >

41.5

4.6

11.1

22.1

AVERAGE LOAN YIELD¹

1.7

Q4'20

(0.02%)

79

1.9

Loan Yield

Compression

58.4%

46.3

5.0

11.8

26.3

1.6

1.6

Q1'21

(0.02%)

58.2%

Loan Mix

49.8

5.2

12.4

29.1

Q2'21

1.4

1.7

60.4%

59.3

8.2

12.7

31.9

0.6

2.7

1.4

1.8

Q4 swap gains²

Q4 BP purchase accounting

Q4 average active loan floors

0.02%

Q3'21

Loan Fees

(PPP and Prepays)

60.3%

62.6

8.6

13.2

34.4

Q4'21

0.3

2.7

1.4

2.0

$16M

($19M)

$34B

3.45%

Q4'21

Loan Yield

FY'22 outlook key assumptions

• Increasing FY'22 average loan growth outlook due to strong GFB

pipeline. Key assumptions:

●

+

●

●

Strong PE/VC investment activity, but moderating from

2021's exceptional levels

Supports GFB capital call line growth

+

Strong SVB Private Bank lending growth, enhanced by

Boston Private integration

Targeting -$15-16B total balances at yearend (includes Private Bank, CRE,

Other C&I and Other loan classes)

Key assumptions impacting FY'22 loan yields:

Boston Private purchase accounting

Amortization of fair value mark ups on loans ($64M remaining at

12/31/21, vast majority to be amortized by end of 2023)

Robust tech and life science/HC pipelines +

expansion initiatives

Strong pipelines + opportunity to grow project finance (clean energy),

recurring revenue, fintech warehouse and sponsorled buyout loans

Shifting loan mix

Growth driven by lower yielding GFB and Private Bank mortgages

Spread compression

Increasing competition as economy recovers

Note:

Public market volatility could cause temporary pullbacks in PE/VC

investment activity given record high valuations.

Rising rates would benefit loans yields of variable rate loans (91% of Q4'21

average loans), but could also accelerate spread compression.

Rate protections

$116M remaining locked-in pre-tax swap gains as of 12/31/21²

$36B active loan floors as of 12/31/21, however loan renewals

may pressure ability to maintain floor rates

1. SBA PPP contributed $5M to Q4'21 NII, including $4M of loan fees. $0.2B PPP loans were forgiven in Q4.

2. Expect vast majority of remaining pretax fair value gains from $5B swap unwind in Q1'20 to be reclassified from OCI to loan

interest income by the end of 2023.

3. 3.16% weighted average floor rate. $148M expected benefit from inthe-money floors based on a weighted average maturity

of 1.5 years.

Q4 2021 Financial Highlights

29View entire presentation