Silicon Valley Bank Results Presentation Deck

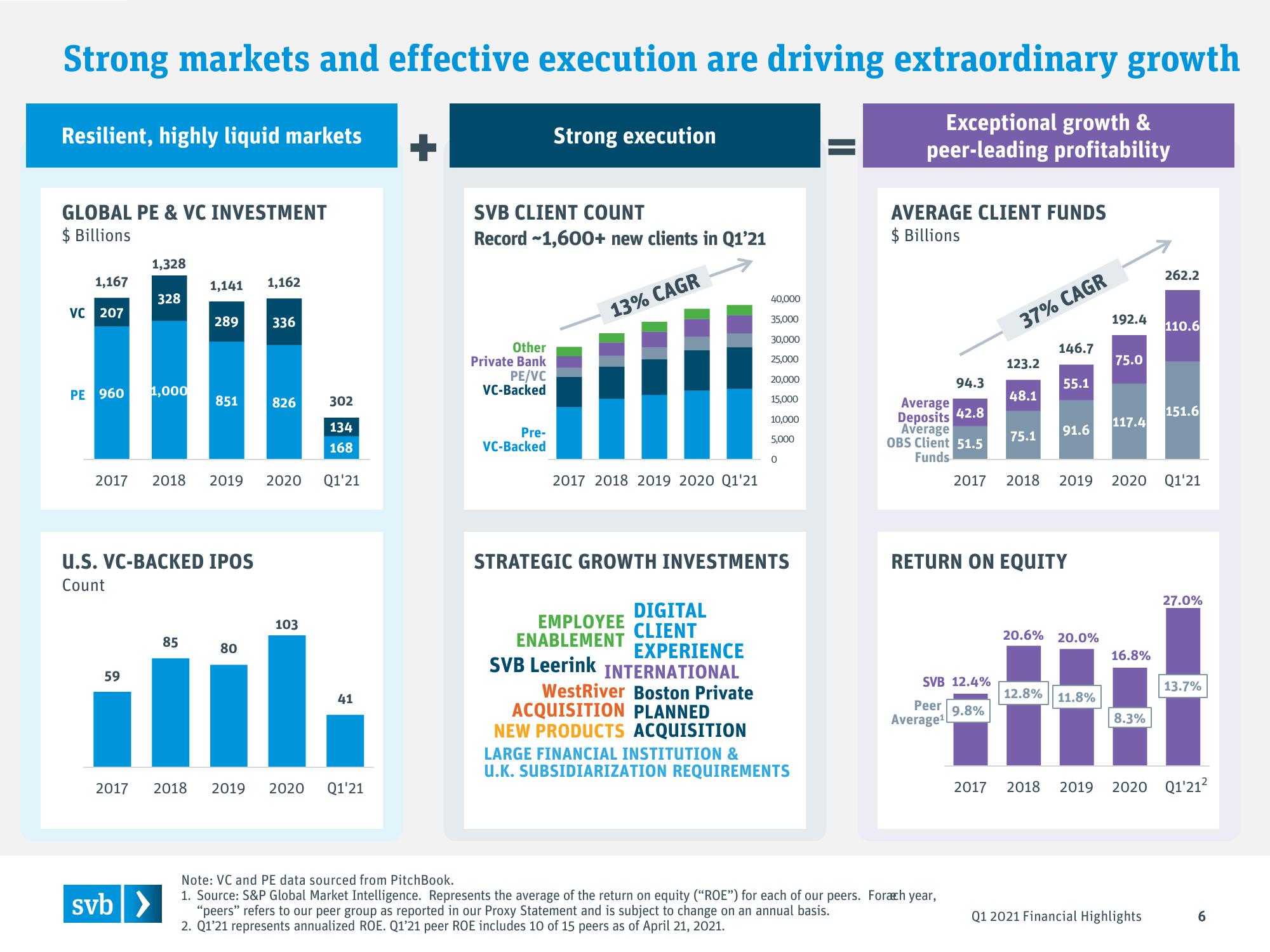

Strong markets and effective execution are driving extraordinary growth

Exceptional growth &

peer-leading profitability

Resilient, highly liquid markets

GLOBAL PE & VC INVESTMENT

$ Billions

1,167

VC 207

1,328

PE 960 1,000

59

328

2017

1,141

U.S. VC-BACKED IPOS

Count

svb >

289

85

851

2017 2018 2019 2020 Q1'21

1,162

80

336

826

302

134

168

103

41

2018 2019 2020 Q1'21

SVB CLIENT COUNT

Record -1,600+ new clients in Q1'21

Other

Private Bank

PE/VC

VC-Backed

Strong execution

Pre-

VC-Backed

13% CAGR

2017 2018 2019 2020 Q1'21

EMPLOYEE

ENABLEMENT

STRATEGIC GROWTH INVESTMENTS

SVB Leerink

40,000

35,000

30,000

25,000

20,000

15,000

10,000

5,000

DIGITAL

CLIENT

0

EXPERIENCE

INTERNATIONAL

WestRiver Boston Private

ACQUISITION PLANNED

NEW PRODUCTS ACQUISITION

LARGE FINANCIAL INSTITUTION &

U.K. SUBSIDIARIZATION REQUIREMENTS

AVERAGE CLIENT FUNDS

$ Billions

94.3

Average

Deposits 42.8

Average

OBS Client 51.5

Funds

SVB 12.4%

Peer

Average¹

Note: VC and PE data sourced from PitchBook.

1. Source: S&P Global Market Intelligence. Represents the average of the return on equity ("ROE") for each of our peers. Forach year,

"peers" refers to our peer group as reported in our Proxy Statement and is subject to change on an annual basis.

2. Q1'21 represents annualized ROE. Q1'21 peer ROE includes 10 of 15 peers as of April 21, 2021.

37% CAGR

9.8%

123.2

2017

48.1

75.1

RETURN ON EQUITY

146.7

2017 2018 2019

55.1

91.6

20.6% 20.0%

12.8% 11.8%

192.4

75.0

117.4

16.8%

8.3%

262.2

2020 Q1'21

110.6

Q1 2021 Financial Highlights

151.6

27.0%

13.7%

2018 2019 2020 Q1'21²

6View entire presentation