Silicon Valley Bank Results Presentation Deck

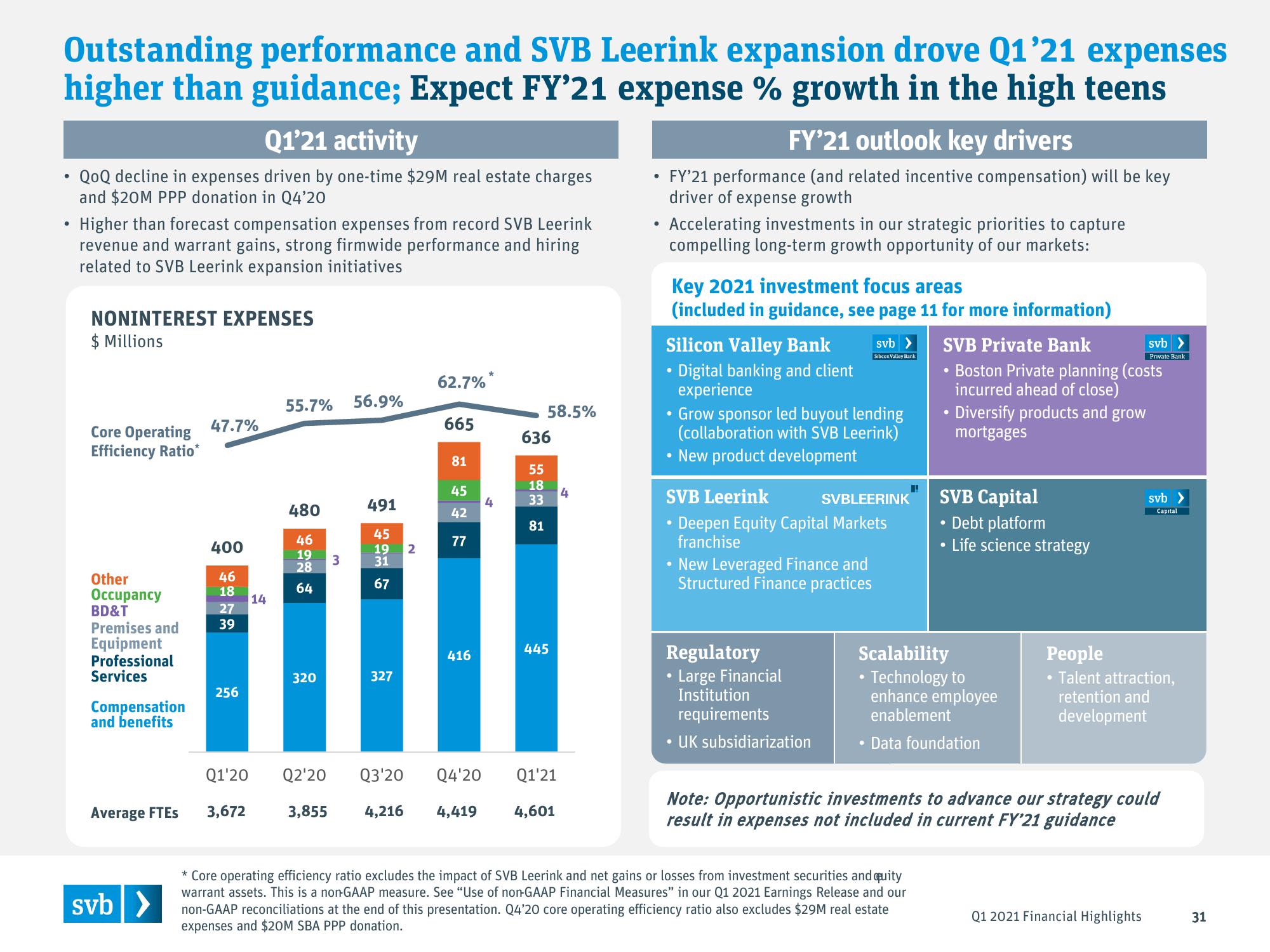

Outstanding performance and SVB Leerink expansion drove Q1'21 expenses

higher than guidance; Expect FY'21 expense % growth in the high teens

●

Q1'21 activity

QoQ decline in expenses driven by one-time $29M real estate charges

and $20M PPP donation in Q4'20

• Higher than forecast compensation expenses from record SVB Leerink

revenue and warrant gains, strong firmwide performance and hiring

related to SVB Leerink expansion initiatives

NONINTEREST EXPENSES

$ Millions

Core Operating

Efficiency Ratio*

Other

Occupancy

BD&T

Premises and

Equipment

Professional

Services

Compensation

and benefits

Average FTES

svb >

47.7%

400

46

18

27

39

256

Q1'20

3,672

14

55.7% 56.9%

480

46

19

28

64

320

Q2'20

3,855

3

491

45

19

31

67

327

2

62.7%*

665

81

45

42

77

416

4

58.5%

636

55

18

33

81

445

Q3'20 Q4'20

Q1'21

4,216 4,419 4,601

4

FY'21 outlook key drivers

• FY'21 performance (and related incentive compensation) will be key

driver of expense growth

• Accelerating investments in our strategic priorities to capture

compelling long-term growth opportunity of our markets:

Key 2021 investment focus areas

(included in guidance, see page 11 for more information)

Silicon Valley Bank

• Digital banking and client

experience

Grow sponsor led buyout lending

(collaboration with SVB Leerink)

New product development

svb

Silicon Valley Bank

SVB Leerink

Deepen Equity Capital Markets

franchise

New Leveraged Finance and

Structured Finance practices

Regulatory

Large Financial

Institution

requirements

UK subsidiarization

SVBLEERINK

SVB Private Bank

Boston Private planning (costs

incurred ahead of close)

Diversify products and grow

mortgages

●

* Core operating efficiency ratio excludes the impact of SVB Leerink and net gains or losses from investment securities and quity

warrant assets. This is a non-GAAP measure. See "Use of non-GAAP Financial Measures" in our Q1 2021 Earnings Release and our

non-GAAP reconciliations at the end of this presentation. Q4'20 core operating efficiency ratio also excludes $29M real estate

expenses and $20M SBA PPP donation.

SVB Capital

Debt platform

Life science strategy

●

Scalability

• Technology to

enhance employee

enablement

Data foundation

svb

Private Bank

svb >

Capital

People

• Talent attraction,

retention and

development

Note: Opportunistic investments to advance our strategy could

result in expenses not included in current FY'21 guidance

Q1 2021 Financial Highlights

31View entire presentation