Silicon Valley Bank Results Presentation Deck

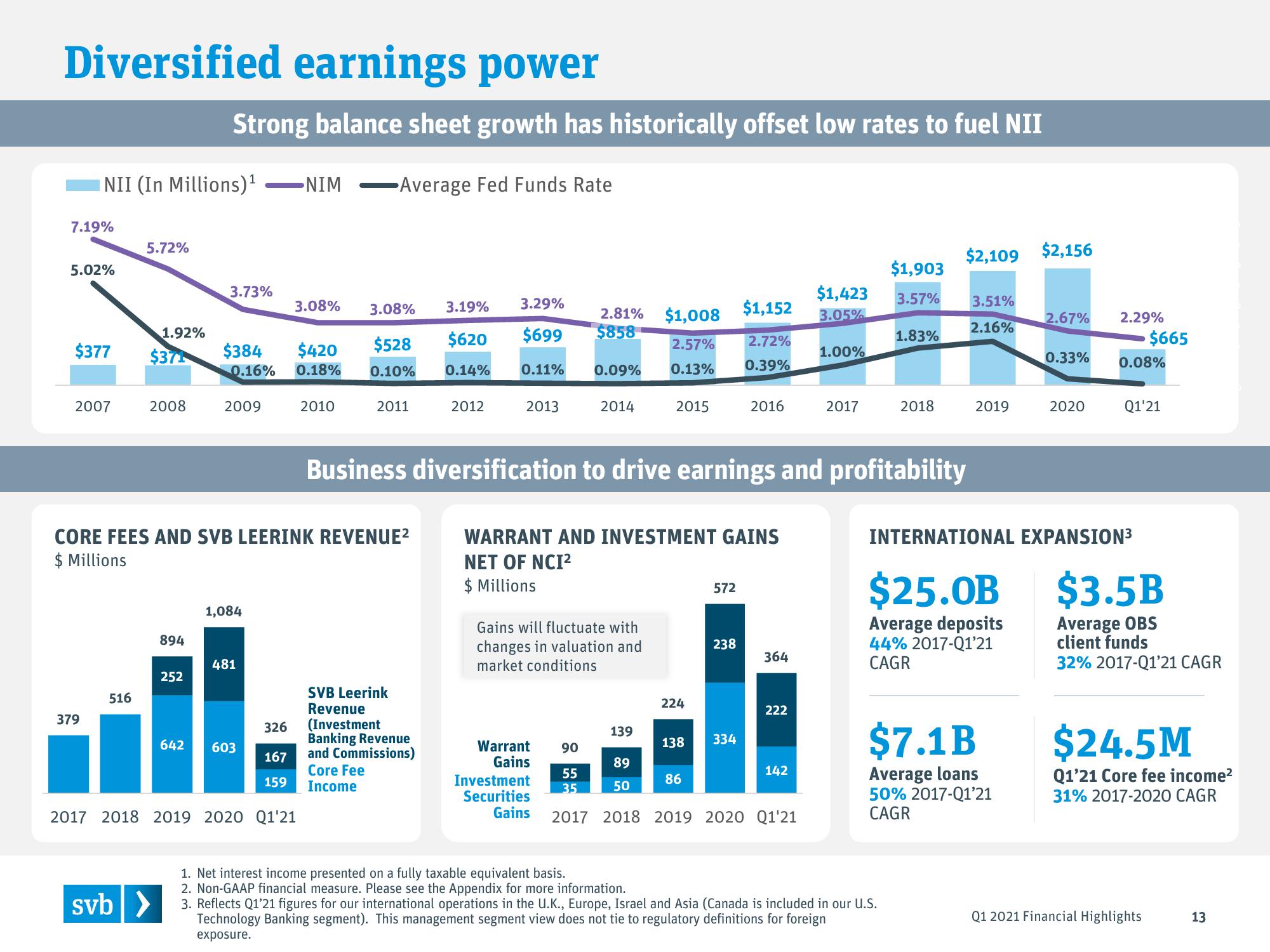

Diversified earnings power

7.19%

NII (In Millions) ¹

5.02%

$377

2007

379

5.72%

516

1.92%

$371

2008

svb >

894

Strong balance sheet growth has historically offset low rates to fuel NII

-NIM Average Fed Funds Rate

252

642

3.73%

$384

0.16%

2009

CORE FEES AND SVB LEERINK REVENUE²

$ Millions

1,084

481

603

3.08% 3.08%

$528

0.10%

326

167

159

$420

0.18%

2017 2018 2019 2020 Q1'21

2010

2011

3.19% 3.29%

$620

$699

0.14%

SVB Leerink

Revenue

(Investment

Banking Revenue

and Commissions)

Core Fee

Income

2012

0.11%

2013

2.81% $1,008

$858

Warrant

Gains

Investment

Securities

0.09%

90

55

35

2014

Gains will fluctuate with

changes in valuation and

market conditions

139

2.57%

0.13%

89

50

2015

Business diversification to drive earnings and profitability

WARRANT AND INVESTMENT GAINS

NET OF NCI²

$ Millions

224

138

86

572

238

$1,152

2.72%

0.39%

334

2016

364

222

142

$1,903

$1,423 3.57%

3.05%

Gains 2017 2018 2019 2020 Q1'21

1.00%

2017

1.83%

2018

$2,109 $2,156

1. Net interest income presented on a fully taxable equivalent basis.

2. Non-GAAP financial measure. Please see the Appendix for more information.

3. Reflects Q1'21 figures for our international operations in the U.K., Europe, Israel and Asia (Canada is included in our U.S.

Technology Banking segment). This management segment view does not tie to regulatory definitions for foreign

exposure.

3.51%

2.16%

2019

$7.1B

Average loans

50% 2017-Q1'21

CAGR

2.67% 2.29%

0.33%

2020

INTERNATIONAL EXPANSION³

$25.0B

Average deposits

44% 2017-Q1'21

CAGR

0.08%

$665

Q1'21

$3.5B

Average OBS

client funds

32% 2017-Q1'21 CAGR

$24.5M

Q1'21 Core fee income²

31% 2017-2020 CAGR

Q1 2021 Financial Highlights

13View entire presentation